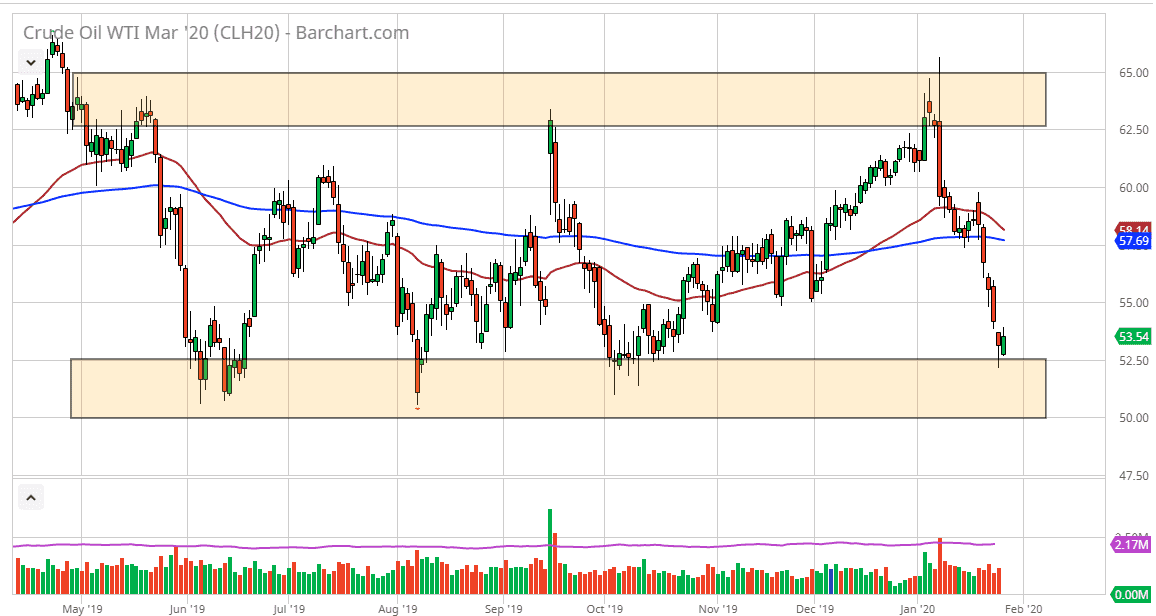

The West Texas Intermediate Crude Oil market initially gapped lower to kick off the trading session on Tuesday but found enough support at the $52.50 level to recover as the market had been at the very bottom of a larger consolidation area. Looking at this chart, you can see that there has been supported between the $50 level and the $52.50 level for quite some time and it looks as if we are in fact trying to find some type of bounce from this area as we had crashed directly into it. Furthermore, the speed in which the market fell into this area suggests that it will be difficult to simply slice through it. Even if we were to break down below the $50 level, it will more than likely be a longer-term process because at this point one would have to wonder what the rush would be.

Looking at this chart, a bounce towards the $55 level looks very possible, as the market has gotten overdone at this point. Furthermore, there is chatter about OPEC looking to cut production yet again, and then of course could drive the price higher also. Furthermore, if we can break above the $55 level, the market could then go to the $57.50 level. At this point, it would be difficult to break above that level.

One thing is for sure, this is a short-term opportunity at best, and at this point longer-term we still have to look towards the downside unless of course there is some type of major change when it comes to the supply/demand situation. Pay attention to the FOMC statement later in the day on Wednesday, because that will obviously have an influence on the US dollar which is a bit of a knock on effect over here. If the US dollar search the strength and that might drive down the value of crude oil as it is priced in that currency. Looking at the chart, it’s oversold so that is the first reason why think that the support will hold. Furthermore, it has held before so all things being equal you have to assume that the range holds until it doesn’t. By the time we get through the Wednesday session, we could have a bit more clarity when it comes to the direction of both the greenback and of course the crude oil market itself.