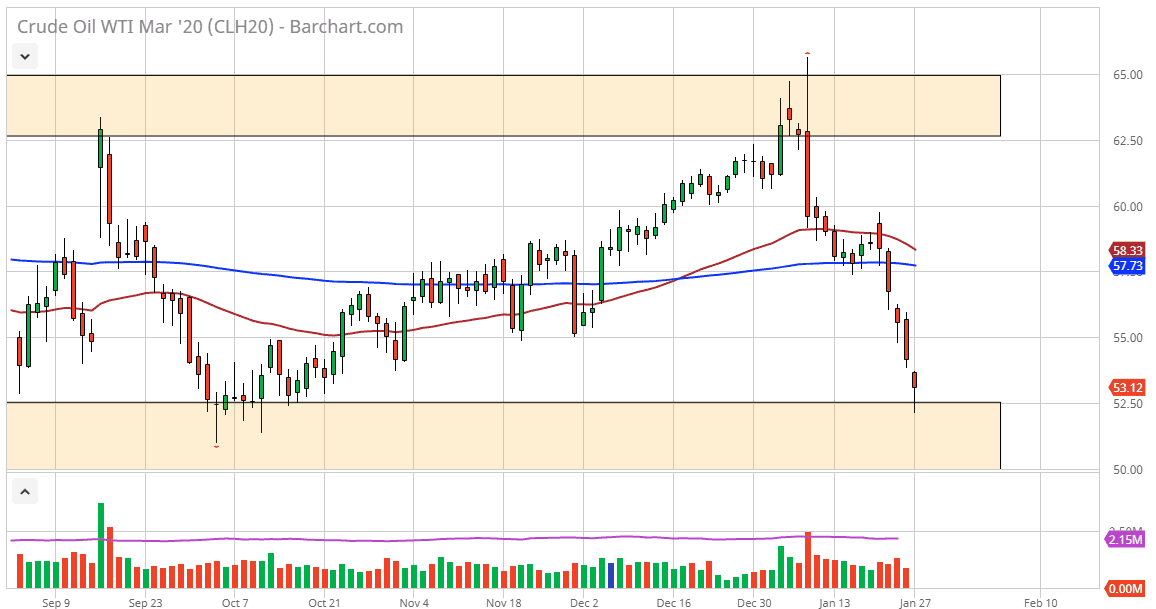

While the West Texas Intermediate Crude Oil market has been an absolute disaster over the last couple of weeks, we are starting to run into signs of exhaustion as far as sellers are concerned. This doesn’t mean that is going to be easy to buy this market, but if it does in fact break above the highs from the Monday session, it could go looking towards the $55 level for a bit of a bounce. This makes quite a bit of sense because we have crashed directly into the beginning of serious support based upon the recent consolidation area. Overall, this is a market that has been trading in a range between $50 and $65 for quite some time.

Granted, there has been a massive selloff due to the lack of demand potential coming out of China, as several parts of the country are on lockdown when it comes to the coronavirus. However, OPEC is now starting to talk about cutting further, and quite frankly the market has perhaps exhausted the selling in the short term. That being said, it is certainly going to be an area of trouble when it comes to this market, so I would not be excited to go along, or I should say at the very least I would be cautious about putting too much money into this. You are certainly taking a somewhat risky trade if you are going long here, but there is a major support level underneath so if there’s any place we are going to see a bit of a turnaround, it’s going to be in the next few days.

If the market did break down below the $50 level, then we could go looking towards the $45 level next. That would be a major breach of support when it comes to this market and could unwind a lot of the buyers. That being said though, it’s obvious that we are oversold at this point by just about any metric you use, and I do anticipate that there are going to be a certain percentage of value hunters out there willing to step in and pick this market up, or at the very least having short sellers jump out and collecting profits. Furthermore, Saudi Arabia is very likely to step in and try to manipulate the price relatively soon as well. I would not be aggressive here, but we clearly looking at an area that could bring in a bounce.