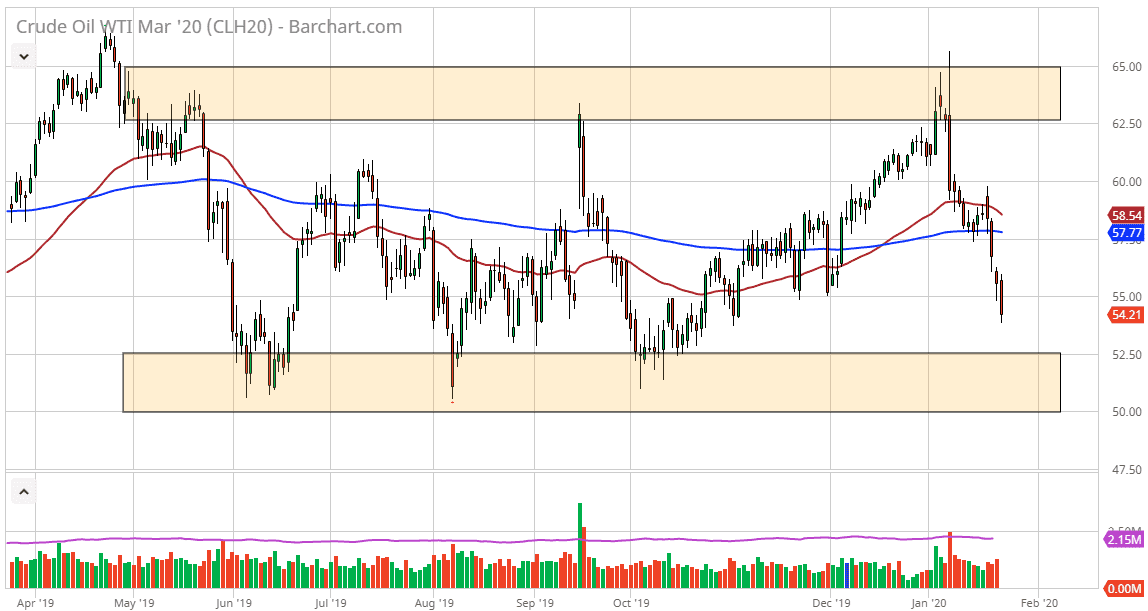

The West Texas Intermediate Crude Oil market broke down rather significantly during the trading session on Friday, slicing through the $55 level. It also slice through the bottom of the hammer from the previous session, and that of course is a very negative sign. The market breaking down through that level opens up the door to the $52.50 level, which is the gateway to an even lower level in the form of $50 even. I do believe that eventually we go down into that range between $52.50 and $50, but it’s going to take a bit of further momentum.

I believe that the market is going to turn around somewhere near the $52.50 level, and I will use a daily close on the chart to decide when it’s time to start buying. If we do in fact have that happen, it will be time to start buying as it would be a continuation of the overall consolidation that the market has been in for months. Although we are at extraordinarily low levels, the reality is that we are still well within the range of trading that we have been in, so therefore I do not have any concerns about some type of massive meltdown.

Crude oil continues to suffer due to an oversupply issue, but there does come a point where currency markets have their say as well. If the US dollar gets hit, that could send the market back up to the upside as well, as sometimes Forex markets have a major influence. That being said though, the reality is that we have been in this range for months, and even though we have fallen as hard as we have, we are a bit overextended so it would make sense that it’s going to be difficult to break through the support level of this range. If we do, it opens up the door to the $45 level, but I think it’s more likely that we find plenty of support to turn around and reach towards the 200 day EMA in the middle of the range, and then possibly even the top of the range closer to the $62.50 level if certain things line up. In the short term, I’m focusing more or less on whether or not we get enough support to cause a bit of a bounce. This will be observed on a day by day basis and I will let you know what I find.