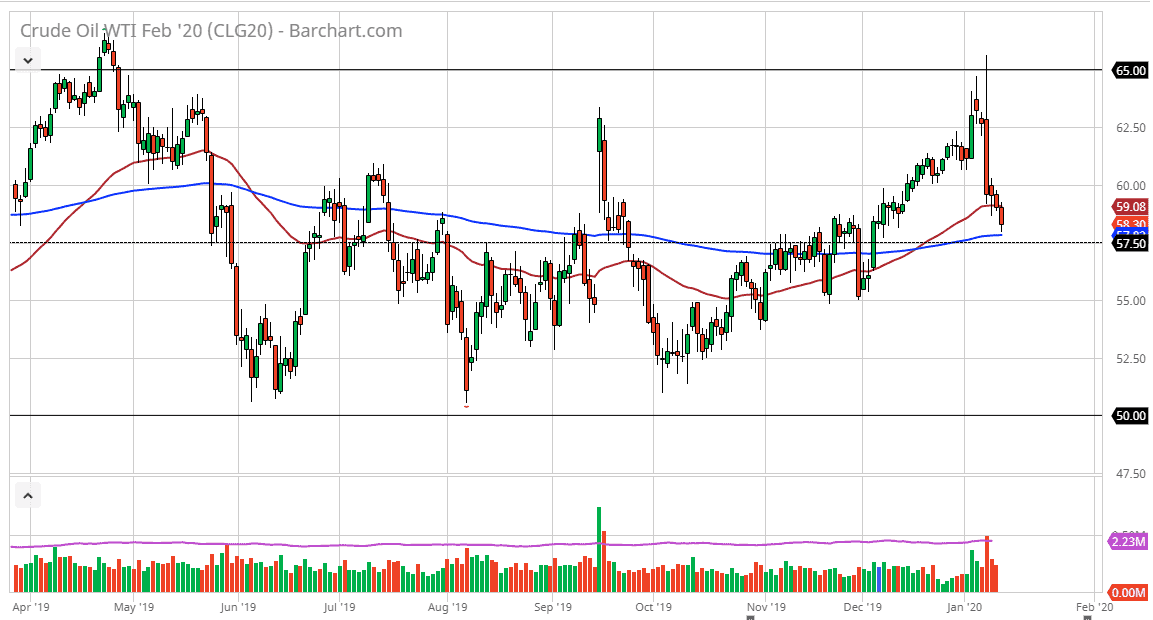

When I state that the West Texas Intermediate Crude Oil market is at “fair value”, what I mean by that statement is that we are directly in the middle of the overall trading range that the market has been in. We look at the chart from an extended point of view, it’s easy to see that the $65 level has been resistance while the $50 level has been supported. Within that range we have seen a lot of trading over the last couple of years, but quite frankly it looks to me like the markets are going to stay in this area. That makes a lot of sense, because $15 is of course a relatively large trading range.

As markets tested the $67.50 level, that was the middle of the range and therefore in theory should be “fair value”, at least from a technical analysis standpoint. Adding more fuel to the fire so to speak is the fact that the 200 day EMA currently sits right at that level, so we will need to make some type of significant decision relatively soon. Because of this, the next couple of trading sessions will probably be crucial when it comes to where we go next and will certainly catch my attention. I believe at this point we are likely to see a move below the $57 level kick off a drop down to the $55 level, possibly even the $52.50 level before value hunters will almost certainly come back. On the other hand, we could turn around and take out the top of the candlestick from Monday, which I believe would signify that the market is ready to rally and find support here, looking to break above the $60 level and then eventually reach towards $62.50.

All that being said, keep in mind that although there are a lot of tensions between the Americans and the Iranians, the reality is that demand for crude oil just isn’t there. If that’s the case, OPEC cuts and tensions in the Middle East are only going to have so much of an effect on crude oil markets, because quite frankly the Americans are self-sufficient, so therefore the West Texas Intermediate Crude Oil market will be a bit insulated from geopolitical issues. If you need proof, just look at the last couple of days as tensions have faded between the Americans and the Iranians, the market has dropped significantly.