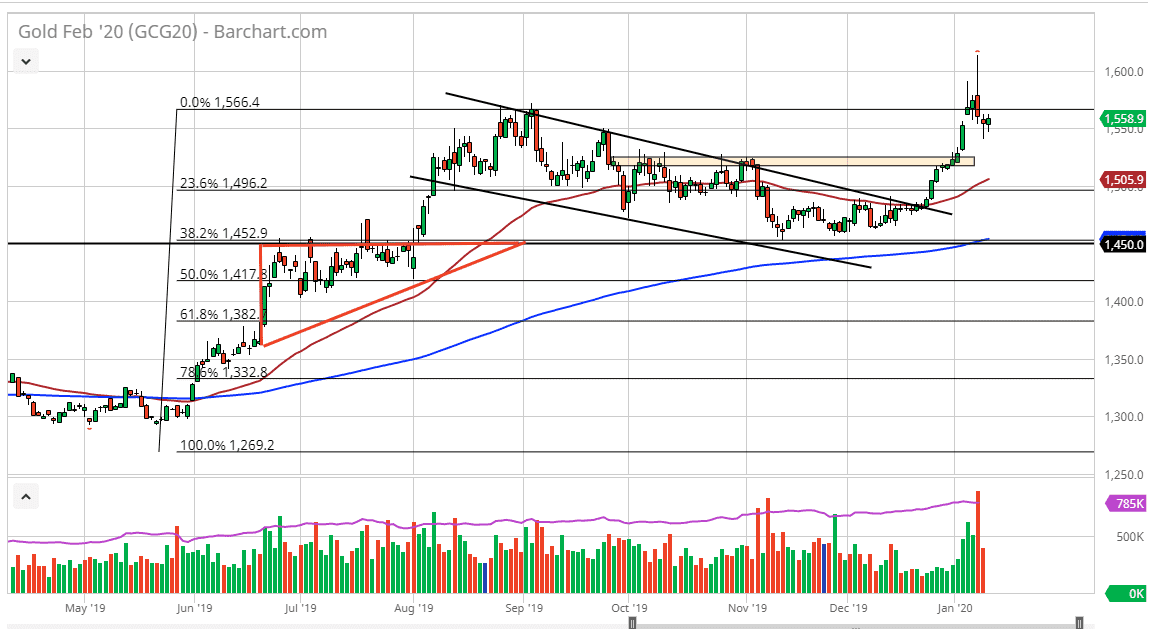

Gold markets initially pulled back during the trading session on Friday, but then turned around to show the $1550 level to be supportive. This is the scene of a gap from the beginning of the week, and at this point you should also pay attention to the fact that we broke down a bit during the day on Thursday only to turn around and form a supportive looking candlestick. However, the weekly chart ended up forming a massive shooting star so I think at this point there are a couple of areas that we should be paying attention to when it comes to trading gold.

If we were to break down below the bottom of the hammer from the Thursday session, this could lead to a significant pullback towards the $1525 level, possibly even the $1500 level. However, if we were to turn around and break above the highs from the panic spike on Wednesday, that could send this market much higher. All things being equal though, I think what we are probably going to see is a lot of back and forth action, but with more likelihood of a pullback coming due to exhaustion.

All of that being said, it’s likely that the headlines will continue to cause some issues, and if we do get a major amount of negativity out there, it could send the gold markets higher. That being said, there is also the possibility of some type of Middle East headline, or something to that effect that could have people very scared also. The market should also have support underneath at the 50 day EMA as it is currently higher, so I look at pullbacks as an opportunity to pick up gold “on the cheap.” I don’t really have an interest in shorting this market although I can see where we could break down over the next couple of days. Yes, you can make money doing that but since it would be against the overall trend, I think it’s much easier to simply pick up this market at lower levels and take advantage of signs of support. This is an always the easiest thing to do, so await you will want to do is build up a position slowly, and then start adding to it as it works out in your favor. The market will continue to be going higher based upon the central banks around the world and not just the headlines so I do like gold longer term.