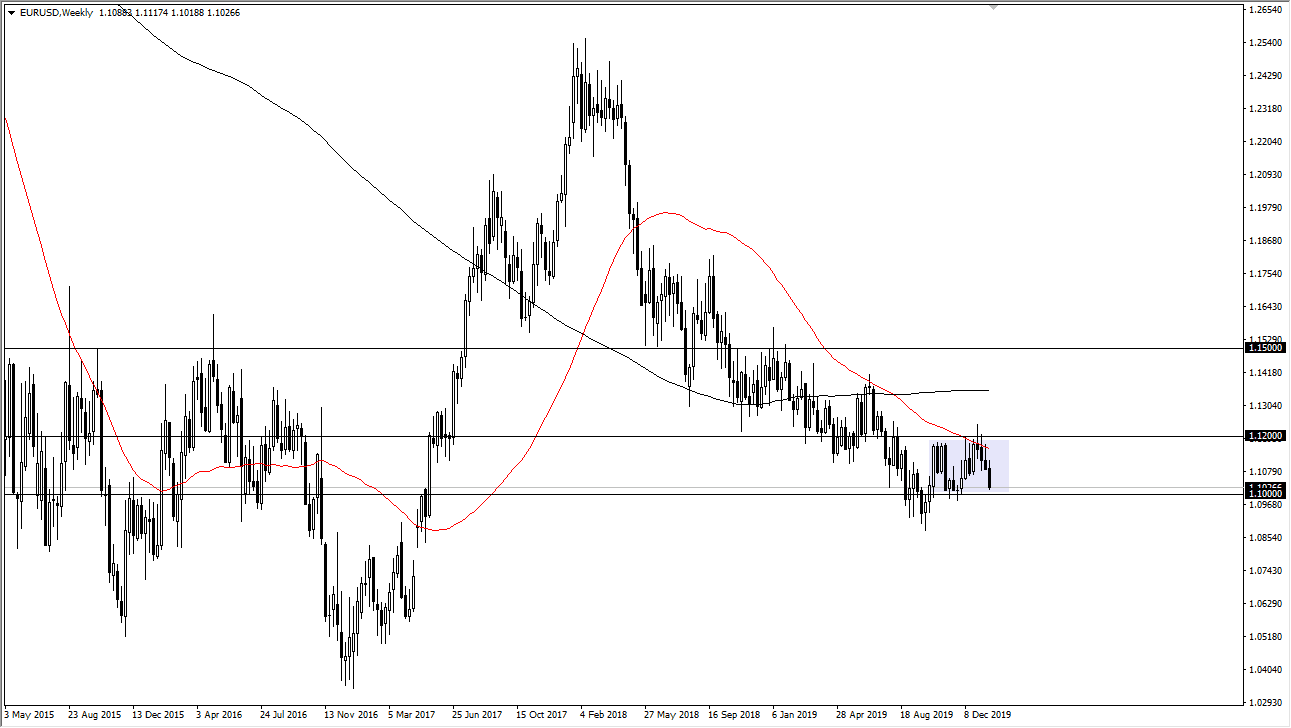

EUR/USD

The Euro initially tried to rally during the week, but then broke down towards the 1.10 level. This was especially driven home as Christine Largarde has suggested that the ECB is ready to keep its monetary policy extraordinarily accommodative. If that’s the case, we are very likely to continue seeing Euro weakness. For this week, I believe that we probably get a short-term bounce, but sellers should return to the market to test the 1.10 level. If we simply slice through that level, then the 1.09 level and then the 1.0750 level would be targets.

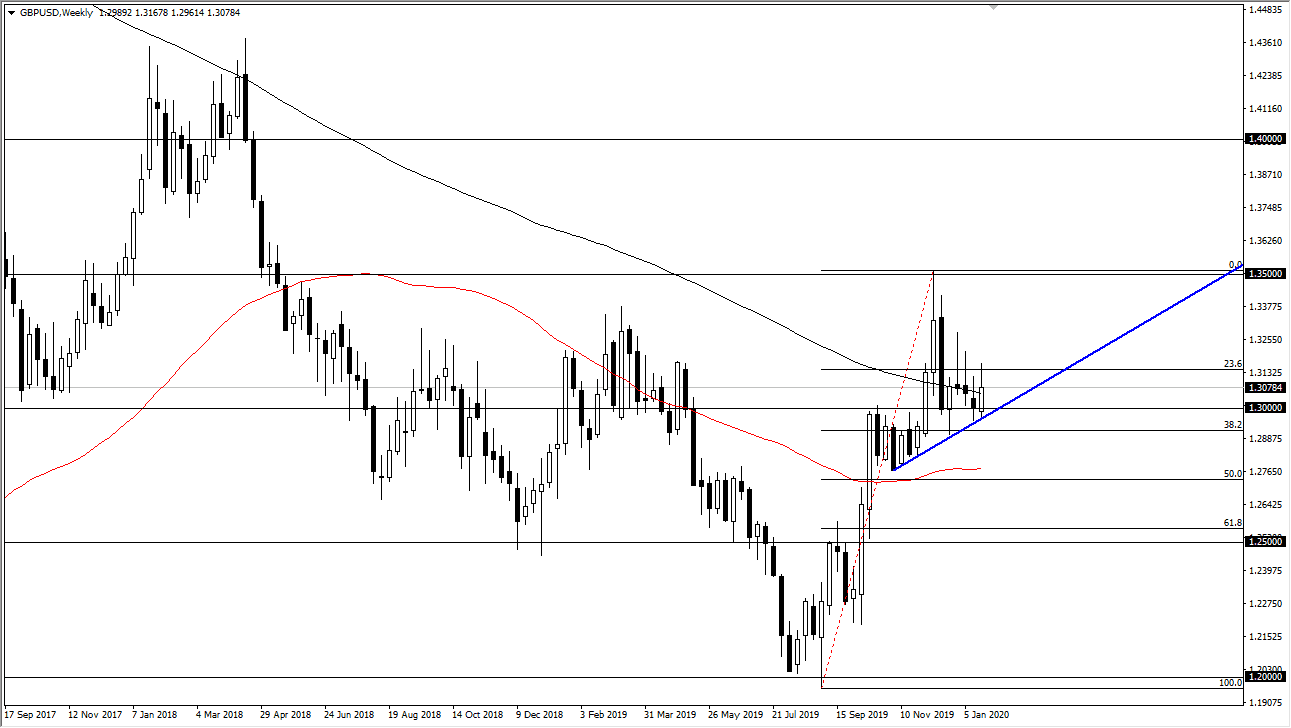

GBP/USD

The British pound has continued to be stubbornly resilient against the greenback, as we have climbed a massive uptrend line. We had formed a couple of shooting stars on the chart until this week, which has been broken into that region. At this point, I think that we can continue to see buyers on dips, and I believe that the uptrend line and the 1.30 level will offer a buying opportunities. If those levels get violated to the downside, then the market is very likely to go looking towards 1.28 handle. Keep in mind that the British are under the microscope due to Brexit and the possibility of a Bank of England interest-rate cut, but as the numbers have gotten better including PMI and employment figures, perhaps making sure that the interest rate cut isn’t necessary.

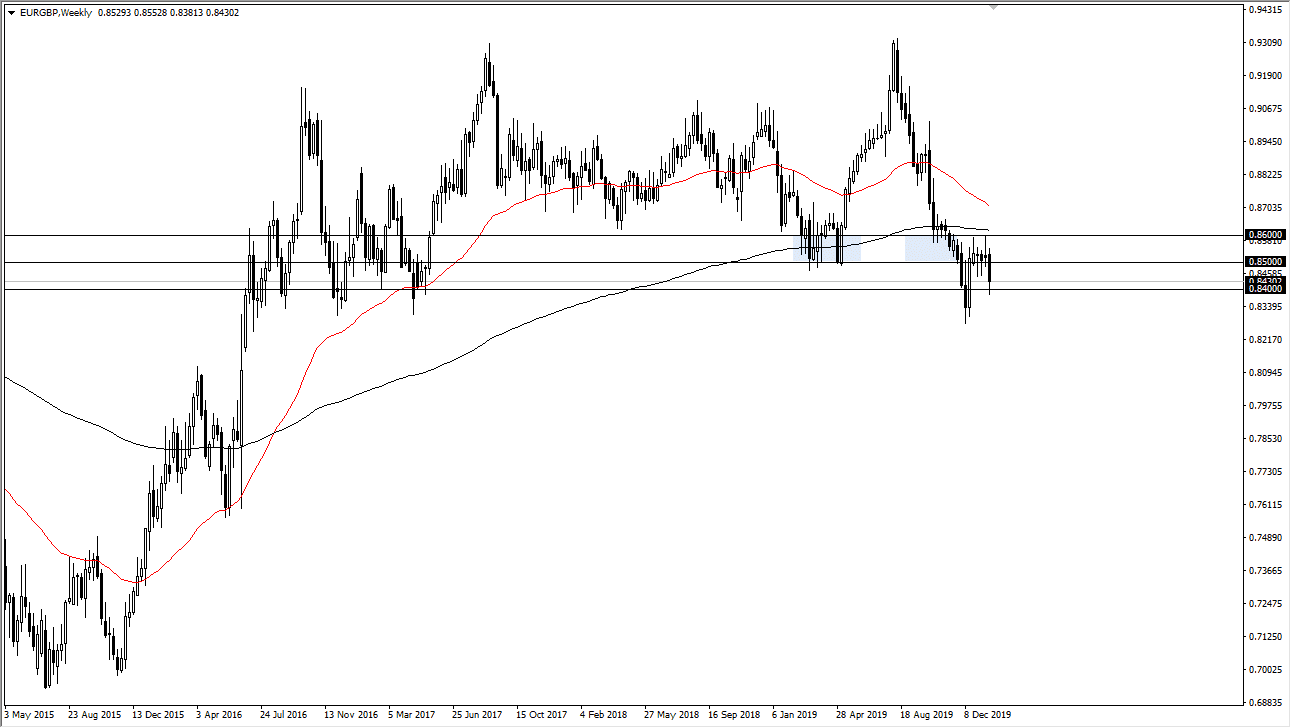

EUR/GBP

the Euro has hit the 0.84 level against the British pound, but at this point when I look at the Friday candlestick it’s obvious that there is a bit of a hammer and we may get a short-term bounce. That bounce those should run into trouble at the 0.85 level, and I think sellers will reenter the market in that general vicinity. However, if we were to break down below the bottom the hammer from the Friday session, it’s very likely that the market then goes down to the 0.83 handle.

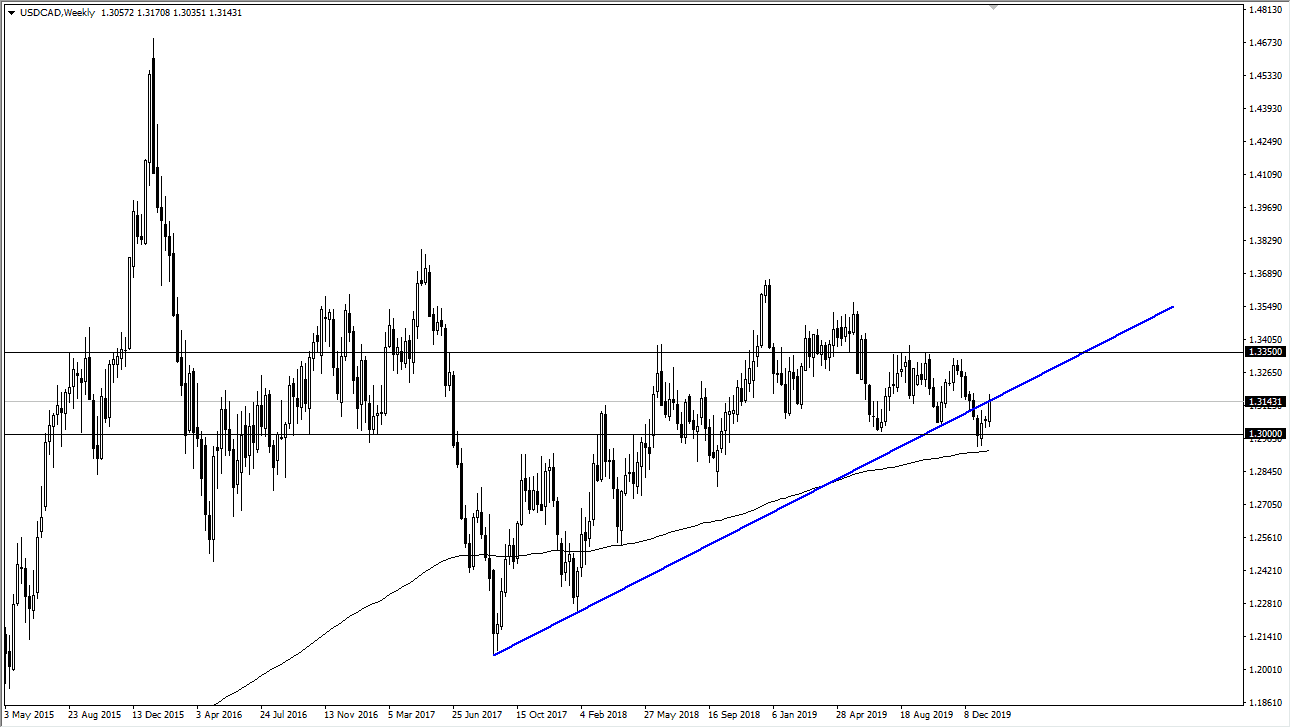

USD/CAD

The US dollar has rallied against the Canadian dollar during the week but has also seen the uptrend line offer resistance. It will be interesting to see how this plays out, but if we were to break down below the 1.31 handle, I think that the market goes looking towards 1.30 level. We have bounced from the 200 week EMA recently, so that of course is something to pay attention to as well. Alternately, if we break above the highs of the week then this pair goes looking towards the 1.3250 level above.