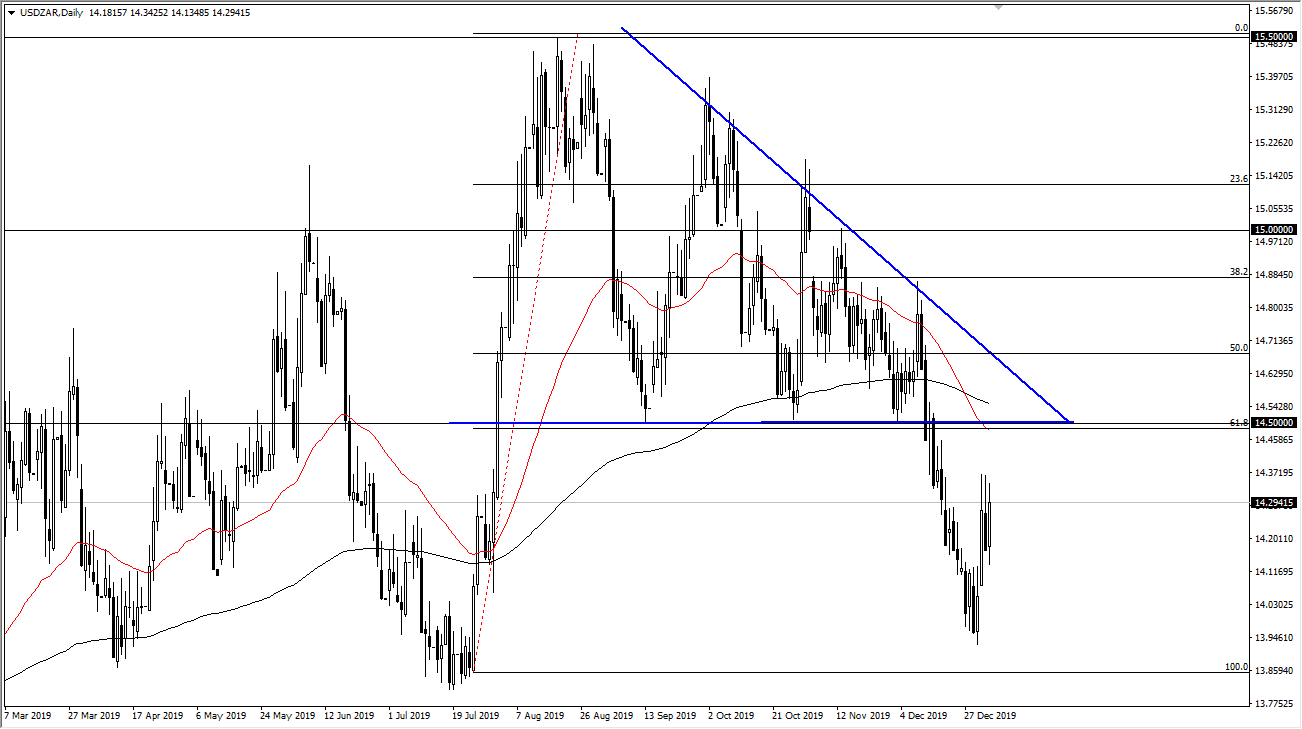

The US dollar has rallied significantly during the trading session on Tuesday against the South African Rand, as we tried to break out above the 14.30 Rand level. The 14.50 Rand level is above and was the previous support level that should now offer resistance. After all, there is a certain amount of “market memory” that comes into play. This is when buyers become sellers later, and vice versa. In other words, you may have heard it explained as “the floor becomes the ceiling and vice versa.”

Looking at this chart, we have broken down rather significantly, but we’ve seen a bit of a bounce from here that shows signs of life. Nonetheless, this is a market that still is decidedly negative, and we had broken below the 200 day EMA with such vigor that I think we will continue to see markets go much lower. The 50 day EMA has broken below the 200 day EMA as well, forming the longer-term “death cross” that catches a lot of attention.

The South African government has been dealing with extreme amounts of debt, but it does seem as if there is movement in that direction and that should help the South African Rand going forward. Furthermore, if commodity markets continue to strengthen, that should in theory offer a bit of strength to the South African economy as well.

Conversely, if we were to break out above the moving averages, then it would kill the downtrend and I think we could go looking towards the 15 Rand level. That would involve a break above the 14.50 Rand level obviously, so it would probably catch a lot of short sellers on the wrong side of the trade. Keep in mind that this pair breaking down is bullish, at least for risk appetite. The South African Rand is the easiest way to play emerging market economies in Africa, and of course take advantage of the gold and diamond exports, not to mention all the other hard materials to come out of South Africa. All things being equal, this bounce has shown signs of recovery, but it should be thought of more as a “dead cat bounce.” Ultimately, this is a market that will continue to see a lot of sellers above so simply waiting for signs of exhaustion will probably be the way to go going forward. To the downside, the 13.85 Rand level could be a bit of a target.