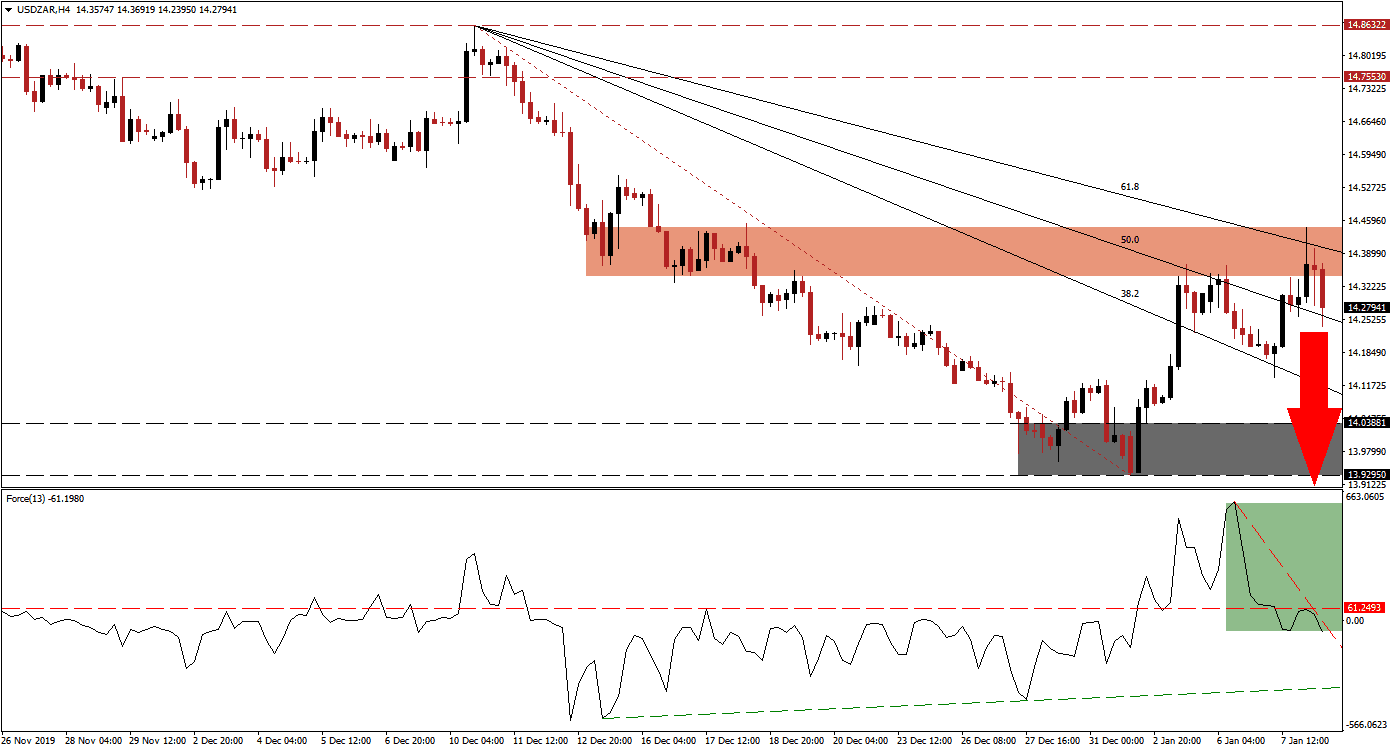

US Dollar weakness is not priced into financial markets but may emerge as a dominant trend in 2020. A helpless US Federal Reserve, impeachment proceedings plus elections are three fundamental headwinds for the world’s top reserve currency. An administration favoring tariffs and sanctions in a slowing global economic environment adds to structural issues, accelerating the move away from the US Dollar at the top of the global reserve system. The USD/ZAR was rejected by its short-term resistance zone, and a fresh breakdown sequence is anticipated to lead to fresh lows in this currency pair.

The Force Index, a next-generation technical indicator, advanced to a fresh high before bullish momentum rapidly faded. This led to a breakdown in the Force Index below its horizontal support level, turning it into resistance. A descending resistance level materialized, adding to downside pressures, as marked by the green rectangle. This technical indicator additionally moved into negative territory, placing bears in charge of the USD/ZAR. The Force Index is expected to close the gap to its shallow ascending support level.

A failed breakout attempt in the USD/ZAR above its short-term resistance zone, located between 14.34314 and 14.44509, as marked by the red rectangle, added to the expansion in bearish momentum. The descending 61.8 Fibonacci Retracement Fan Resistance Level is enforcing the short-term resistance zone and maintaining the long-term bearish chart formation. The South African economy is showing signs of optimism with car exports surging, but Eskom issues continue to keep price action in check. You can learn more about the Fibonacci Retracement Fan here.

Price action is likely to move back into its support zone located between 13.92950 and 14.03881, as marked by the grey rectangle. The Fibonacci Retracement Fan should guide this currency pair farther to the downside and lead to a breakdown in the USD/ZAR below its support zone. Forex traders are advised to monitor the intra-day low of 14.13270, the low which pushed price action into its failed breakout attempt. A breakdown below this level is expected to result in the addition of new net short positions. The next support zone is located between 13.58367 and 13.70433.

USD/ZAR Technical Trading Set-Up - Breakdown Extension Scenario

Short Entry @ 14.27500

Take Profit @ 13.58500

Stop Loss @ 14.50000

Downside Potential: 6,900 pips

Upside Risk: 2,250 pips

Risk/Reward Ratio: 3.07

A sustained breakout in the Force Index above its descending resistance level, followed by a push above the 0 center-line, is anticipated to result in a second breakout attempt in the USD/ZAR. Given the dominant bearish fundamental outlook in this currency pair, any advance should be taken advantage of with short positions. The next long-term resistance zone awaits price action between 14.75530 and 14.86322.

USD/ZAR Technical Trading Set-Up - Limited Breakout Scenario

Long Entry @ 14.57500

Take Profit @ 14.81500

Stop Loss @ 14.47500

Upside Potential: 2,400 pips

Downside Risk: 1,000 pips

Risk/Reward Ratio: 2.40