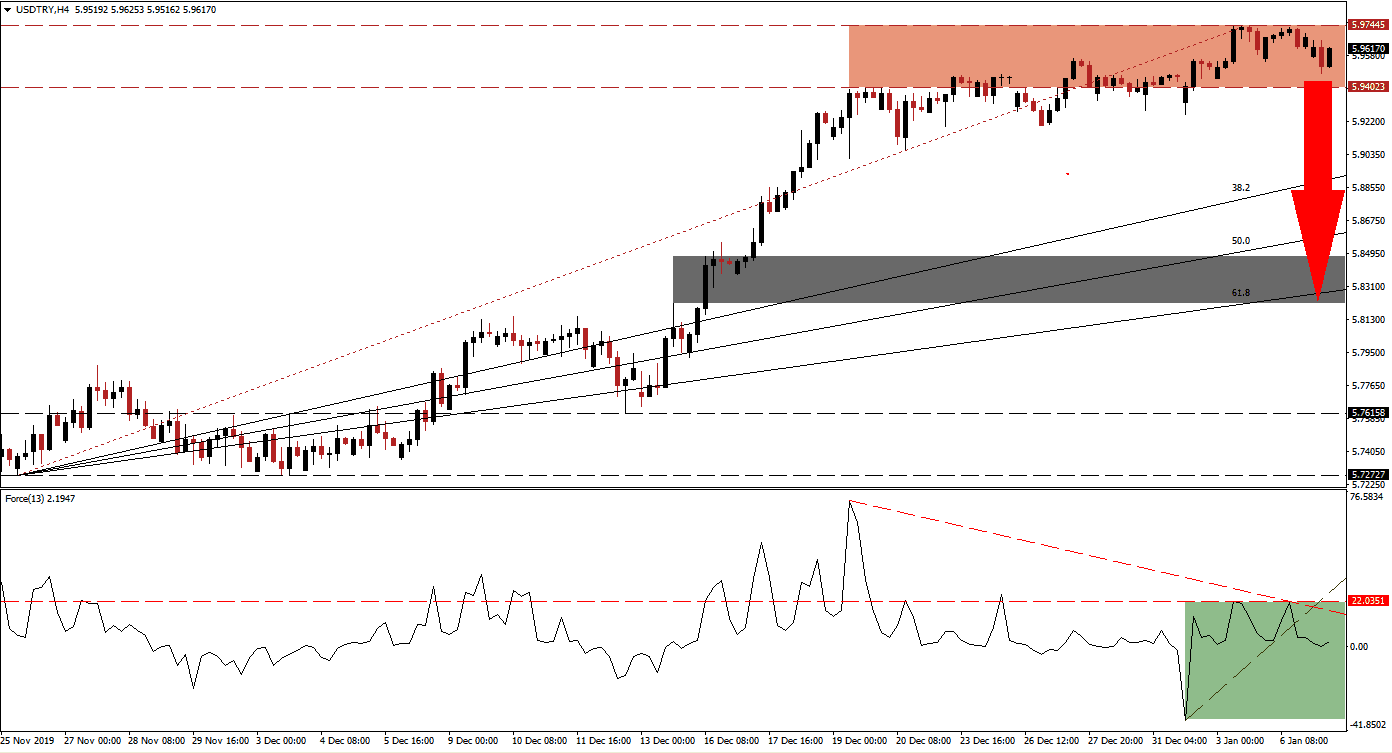

Following a strong rally, after this currency pair completed a breakout above its support zone, the upside is exhausted. The USD/TRY is anticipated to face a corrective phase with a breakdown below its resistance zone. US economic data has shown a much-weaker economy than what is currently priced into the markets. While the Turkish economy continues to be exposed by corporate debt levels denominated in foreign currencies, it has shown signs of stabilization. You can read more about a resistance zone here.

The Force Index, a next-generation technical indicator, was rejected twice by its horizontal resistance level and confirmed that the upside potential for this currency pair is exhausted. Its descending resistance level is adding bearish pressures, and the Force Index pushed below its steep ascending support level, as marked by the green rectangle. This technical indicator is now expected to descend into negative territory, placing bears in charge of the USD/TRY, and leading price action into a breakdown.

Another bearish development materialized after the USD/TRY moved below its Fibonacci Retracement Fan trendline. This occurred inside of its resistance zone located between 5.94023 and 5.97445, as marked by the red rectangle. A breakdown below this zone is favored to initiate a profit-taking sell-off. Forex traders are advised to monitor the intra-day low of 5.92550, the low of a previous move below its resistance zone. Should this currency pair descend past this mark, fresh net sell orders are anticipated to fuel the sell-off. You can read more about the Fibonacci Retracement Fan here.

Price action is likely to close the gap to its ascending 38.2 Fibonacci Retracement Fan Support Level as a result of the pending breakdown. More downside is possible, with today’s US ISM Non-Manufacturing Index and factory orders likely to deliver more bearish facts. The USD/TRY is cleared to extend down into its next short-term support zone located between 5.82177 and 5.84741, as marked by the grey rectangle. This zone is enforced by the 61.8 Fibonacci Retracement Fan Support Level, from where a breakdown will require a new catalyst.

USD/TRY Technical Trading Set-Up - Breakdown Scenario

Short Entry @ 5.96150

Take Profit @ 5.82200

Stop Loss @ 6.00150

Downside Potential: 1,395 pips

Upside Risk: 400 pips

Risk/Reward Ratio: 3.49

Should the Force Index push through its descending resistance level, the USD/TRY is anticipated to attempt a breakout. Given the long-term bullish fundamental outlook for this currency pair, the upside is limited to its next resistance zone. Forex traders are advised to view this as a solid short-selling opportunity. The next resistance zone is located between 6.09490 and 6.14675.

USD/TRY Technical Trading Set-Up - Limited Breakout Scenario

Long Entry @ 6.02500

Take Profit @ 6.12000

Stop Loss @ 5.98500

Upside Potential: 950 pips

Downside Risk: 400 pips

Risk/Reward Ratio: 2.38