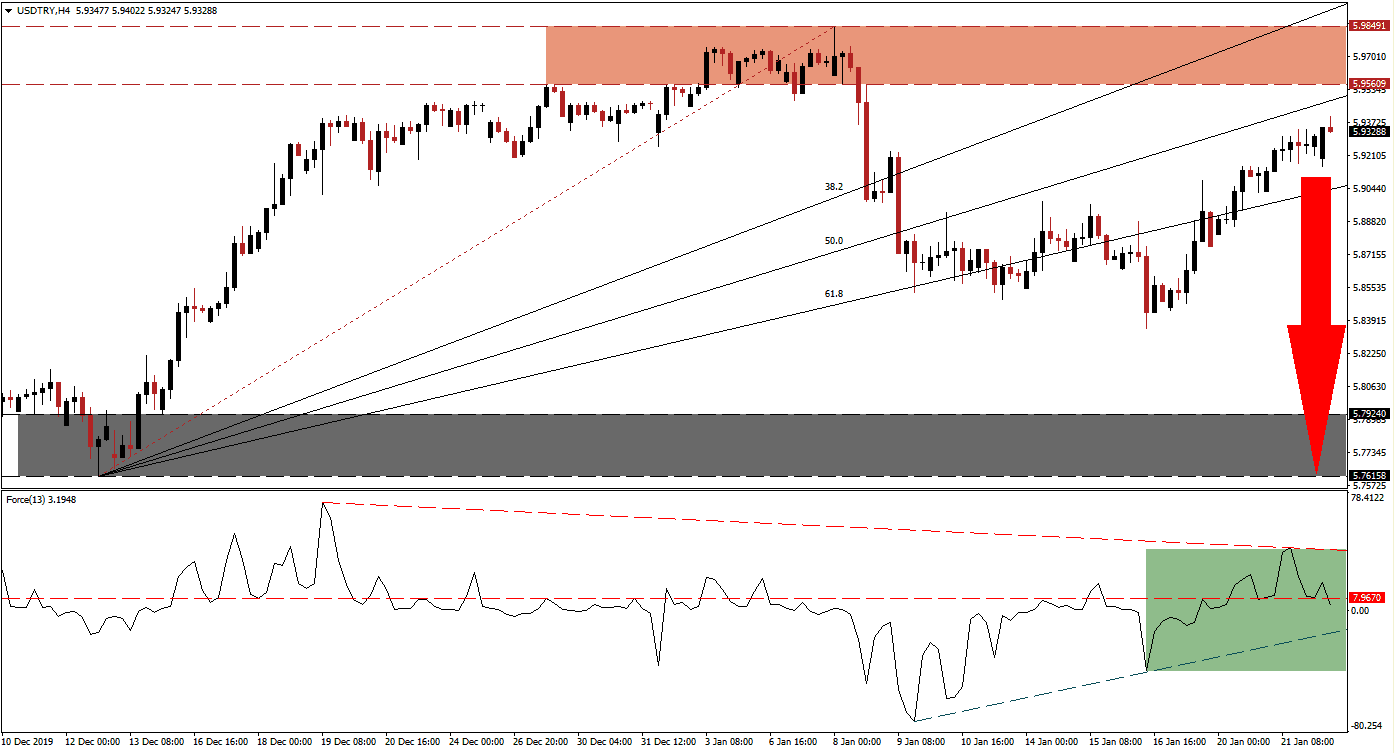

Increasing the bright outlook for the Turkish economy in 2020, amid a slowing global one, is the ongoing support of the government to exporters. The Export Credit Bank of Turkey announced that it will reduce interest rates on Turkish Lira loans to small and medium-sized companies active in the high-tech sector to 7.95%. According to the Turkish Exporters’ Assembly, the aim for 2020 is $190 billion in exports. Following the advance in the USD/TRY, a breakdown below its ascending 61.8 Fibonacci Retracement Fan Support Level is expected to initiate a corrective phase.

The Force Index, a next-generation technical indicator, indicates the loss in bullish momentum after it failed to extend to the upside. A descending resistance level formed and is adding to downside pressures. The Force Index pushed below its horizontal support level, which converted it into resistance, as marked by the green rectangle. This technical indicator is now anticipated to move into negative conditions, followed by a breakdown below its ascending support level. Bears will then be in control of the USD/TRY, preceding a corrective phase.

Adding to bearish developments in this currency pair is the lower high from where a sell-off is favored. It is situated below its resistance zone located between 5.95609 and 5.98491, as marked by the red rectangle, at an intra-day high of 5.94022. While the USD/TRY may attempt to reach the bottom range of this zone, the build-up in bearish pressures is unlikely to allow for a move higher. The 50.0 Fibonacci Retracement Fan Resistance Level is approaching the resistance zone, increasing breakdown pressures. You can learn more about a breakdown here.

This currency pair is likely to be exposed to a profit-taking sell-off, following a breakdown below its 61.8 Fibonacci Retracement Fan Support Level. The USD/TRY will face a minor support level provided by its intra-day low of 5.83495, the low of the previous corrective phase. Given the long-term bullish outlook for the Turkish Lira, an extension of the pending sell-off into its support zone is possible. This zone awaits price action between 5.76158 and 5.79240, as marked by the grey rectangle.

USD/TRY Technical Trading Set-Up - Profit-Taking Scenario

Short Entry @ 5.93250

Take Profit @ 5.76250

Stop Loss @ 5.98750

Downside Potential: 1,700 pips

Upside Risk: 550 pips

Risk/Reward Ratio: 3.09

A breakout in the Force Index above its descending resistance level is anticipated to push the USD/TRY higher. Any breakout attempt above its resistance zone is likely to remain a short-term development, which should be viewed as an excellent short-selling opportunity. The upside potential is limited to its next resistance zone, located between 6.10696 and 6.14675. The dominant bullish fundamental scenario for the Turkish Lira is favored to prevent a further upside move.

USD/TRY Technical Trading Set-Up - Limited Breakout Scenario

Long Entry @ 6.02250

Take Profit @ 6.14750

Stop Loss @ 5.96250

Upside Potential: 1,250 pips

Downside Risk: 600 pips

Risk/Reward Ratio: 2.08