Since December 2019, the US Dollar has been under increasing selling pressure. President Trump has argued for a weaker currency, and economic data was bearish enough to warrant portfolio adjustments. The strong advance in the US currency showed early signs of collapsing after the US Federal Reserve was forced to inject capital into the repo market in September. Given the strong sell-off, a minor reversal was expected. The start of 2020 saw a price gap to the upside in the USD/SGD, taking it to the top range of its support zone. Reports of the killing of a top Iranian general by a US airstrike in Iraq allowed this currency pair to push higher.

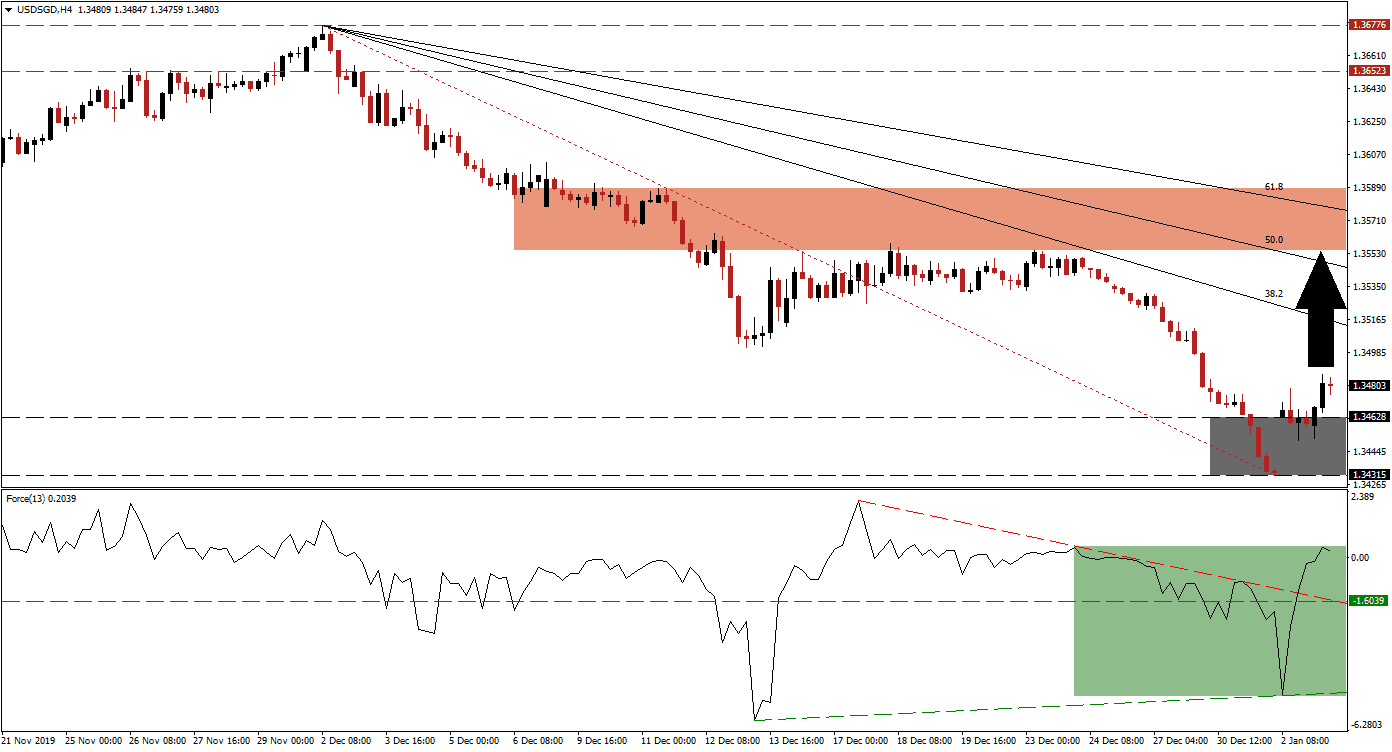

The Force Index, a next-generation technical indicator, confirms the spike in bullish momentum after it recorded a higher low. This formed a positive divergence and provided an early indicator of a pending price action reversal. The Force Index bounced off of its ascending support level, and a double breakout followed. This technical indicator converted its horizontal resistance level into support, eclipsed its descending resistance level, and moved into positive conditions. Bulls are now in charge of the USD/SGD, and an extension of the breakout is anticipated. You can learn more about the Force Index here.

After price action completed a breakout above its support zone located between 1.34315 and 1.34628, as marked by the grey rectangle, a short-covering rally is likely to close the gap to its descending 38.2 Fibonacci Retracement Fan Resistance Level. Forex traders are advised to monitor the intra-day low of 1.35013, the low of a previously reversed breakdown. A move in the USD/SGD above this level may result in the addition of new net long positions. You can learn more about the Fibonacci Retracement Fan here.

Due to the long-term bearish fundamental outlook for this currency pair, the upside potential remains limited to the bottom range of its short-term resistance zone. The USD/SGD was rejected three times by this zone, located between 1.35547 and 1.35887, as marked by the red rectangle. The 61.8 Fibonacci Retracement Fan Resistance Level is passing through this resistance zone and expected to enforce the long-term downtrend with a new breakdown sequence.

USD/SGD Technical Trading Set-Up - Short-Covering Scenario

Long Entry @ 1.34800

Take Profit @ 1.35550

Stop Loss @ 1.34550

Upside Potential: 75 pips

Downside Risk: 25 pips

Risk/Reward Ratio: 3.00

A breakdown in the Force Index below its descending resistance level is favored to lead the USD/SGD into a breakdown of its own. While bullish momentum expanded, it barely elevated the Force Index above the 0 center-line, and the price action recovery is vulnerable to collapse. The next support zone awaits this currency pair between 1.32933 and 1.33206, from where more downside is likely to materialize.

USD/SGD Technical Trading Set-Up - Breakdown Scenario

Short Entry @ 1.34200

Take Profit @ 1.33000

Stop Loss @ 1.34750

Downside Potential: 120 pips

Upside Risk: 45 pips

Risk/Reward Ratio: 2.67