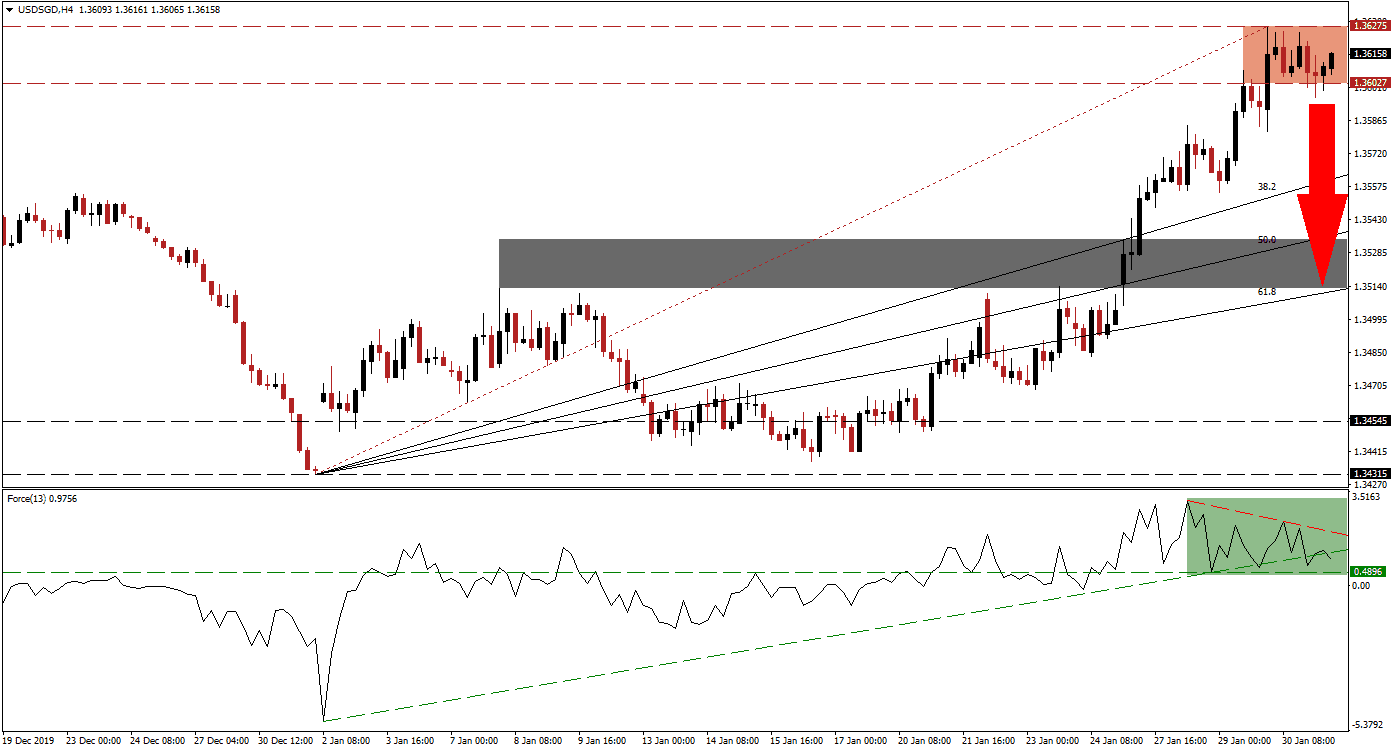

Bank lending in Singapore remained stable in December, but fourth-quarter business expectations slumped. This reflects the ongoing global economic slowdown, battered on multiple fronts, with the deadly coronavirus posing the latest mispriced threat. Central banks around the globe announced a combined 131 interest rate cuts, with little to no impact on structural economic issues. The USD/SGD spiked into its resistance zone, as the death toll from the virus is on the rise, but bullish momentum is fading. You can learn more about a resistance zone here.

The Force Index, a next-generation technical indicator, offers the first sign that the uptrend is exhausted and vulnerable to a breakdown sequence. While this currency pair extended its advance into its resistance zone, the Force Index contracted, and a negative divergence formed. It led to a breakdown below its ascending support level, turning it into resistance, as marked by the green rectangle. The rise in bearish pressures is expected to pressure this technical indicator below its horizontal support level, into negative conditions, from where bears will take control of the USD/SGD.

Another bearish development materialized inside of its resistance zone located between 1.36027 and 1.36275, as marked by the red rectangle, with the move in price action below its Fibonacci Retracement Fan trendline. A breakdown in the USD/SGD is favored to ignite a profit-taking sell-off, which will close the gap between this currency pair and its ascending 38.2 Fibonacci Retracement Fan Support Level. US economic data showed private consumption in the fourth quarter revised sharply lower, while inflationary pressures eased further, adding to downside pressure in the US Dollar.

Forex traders are advised to monitor the intra-day low of 1.35818, the low of the candlestick, which marks the top range of the Fibonacci Retracement Fan sequence. A breakdown below this level is anticipated to invite the next wave of nest short positions. The USD/SGD is positioned to correct into its short-term support zone located between 1.35131 and 1.35346, as marked by the grey rectangle, enforced by its 61.8 Fibonacci Retracement Fan Support Level. A breakdown extension is likely but will require a fresh fundamental catalyst. You can learn more about a breakdown here.

USD/SGD Technical Trading Set-Up - Breakdown Scenario

Short Entry @ 1.36150

Take Profit @ 1.35150

Stop Loss @ 1.36450

Downside Potential: 100 pips

Upside Risk: 30 pips

Risk/Reward Ratio: 3.33

In the event of a breakout in the Force Index above its descending resistance level, the USD/SGD may attempt to push farther to the upside. Due to the dominant bearish fundamental outlook, supported by the emerging technical picture, any breakout attempt appears to be limited to its next resistance zone between 1.36776 and 1.37189. This should be considered and excellent short-selling opportunity.

USD/SGD Technical Trading Set-Up - Limited Breakout Scenario

Long Entry @ 1.36650

Take Profit @ 1.37150

Stop Loss @ 1.36450

Upside Potential: 50 pips

Downside Risk: 20 pips

Risk/Reward Ratio: 2.50