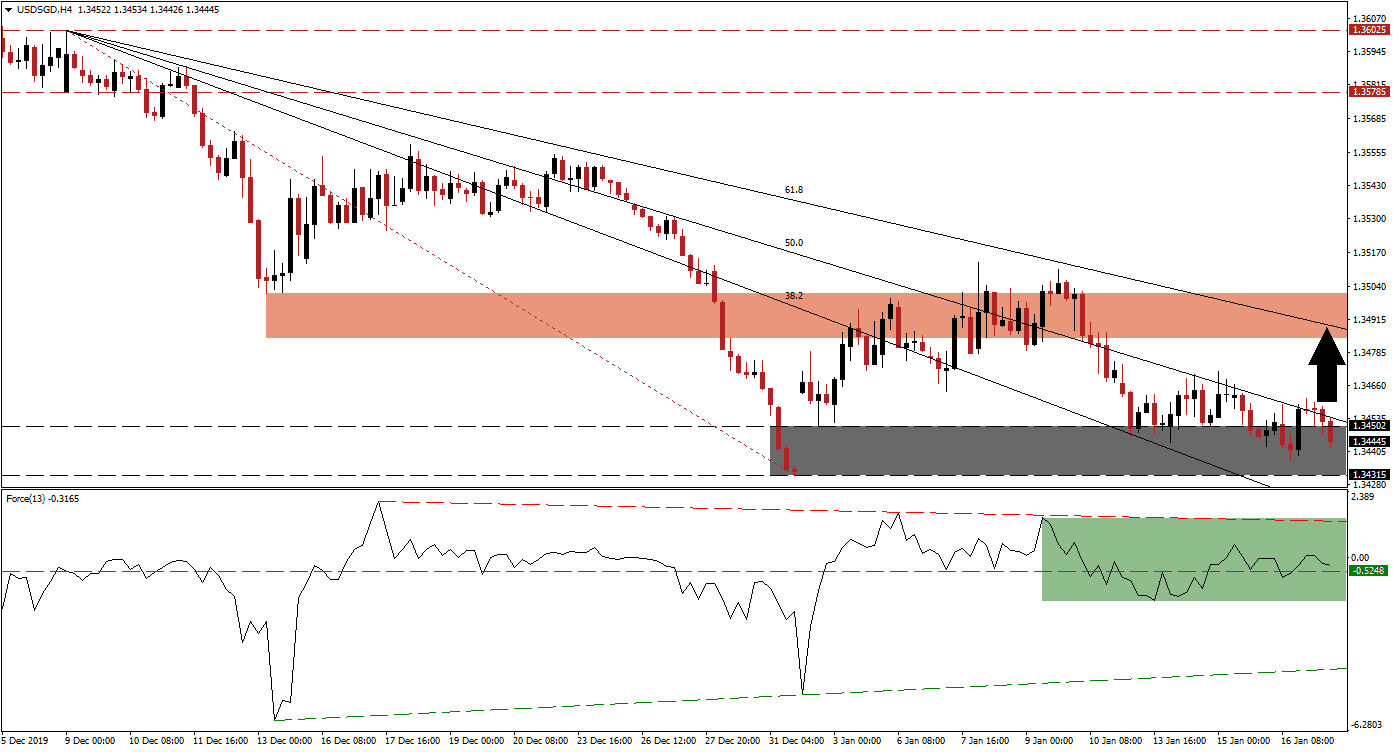

While the long-term outlook for this currency pair remains bearish, it is likely to be interrupted by smaller counter-trend moves. They are a necessity for a healthy trend and ensure the longevity of it. US economic data continues to disappoint, with a few surprises, adding to fundamental pressures. Today’s trade data out of Singapore surprised to the upside with a surprise increase in non-oil exports, boosting the trade surplus in December. Despite the positive development, bullish momentum in the USD/SGD remained muted, with price action inside its support zone.

The Force Index, a next-generation technical indicator, maintains its current bullish stance and suggests this currency pair is vulnerable to a minor advance. After the Force Index converted its horizontal resistance level into support, as marked by the green rectangle, breakout pressures have increased. Bears have temporarily regained control of the USD/SGD after this technical indicator dipped into negative territory, but a bounce off of its horizontal support level is favored to push it into its descending resistance level. This is expected to guide price action to the upside.

This currency pair is anticipated to push out of its support zone located between 1.34315 and 1.34502, as marked by the grey rectangle. It will additionally elevate price action above its descending 50.0 Fibonacci Retracement Fan Resistance Level, which is on the verge of entering the top range of this support zone. A minor advance in the USD/SGD will close a price gap to the upside, which formed as a result of a previous breakout above its support zone. This breakout was rejected by the 61.8 Fibonacci Retracement Fan Resistance Level. You can learn more about a price gap here.

After a breakout in the USD/SGD above its 50.0 Fibonacci Retracement Fan Resistance Level, a short-covering rally is favored to elevate this currency pair into its short-term resistance zone. This zone is located between 1.34839 and 1.35013, as marked by the red rectangle. Forex traders should expect an end to the counter-trend move after price action will reach its 61.8 Fibonacci Retracement Fan Resistance Level, which is passing through the resistance zone. This level has previously rejected an advance and is anticipated to do so again, maintaining the long-term bearish trend. You can learn more about a breakout here.

USD/SGD Technical Trading Set-Up - Limited Breakout Scenario

Long Entry @ 1.34450

Take Profit @ 1.34900

Stop Loss @ 1.34300

Upside Potential: 45 pips

Downside Risk: 15 pips

Risk/Reward Ratio: 3.00

Should the Force Index move below the 0 center-line and accelerate into its ascending support level, the USD/SGD is likely to complete a breakdown and extend its sell-off. The 38.2 Fibonacci Retracement Fan Support Level may guide this currency pair farther to the downside. The next support zone awaits this currency pair between 1.32944 and 1.33206, from where a breakdown extension will require a new catalyst.

USD/SGD Technical Trading Set-Up - Breakdown Scenario

Short Entry @ 1.34100

Take Profit @ 1.33000

Stop Loss @ 1.34500

Downside Potential: 110 pips

Upside Risk: 40 pips

Risk/Reward Ratio: 2.75