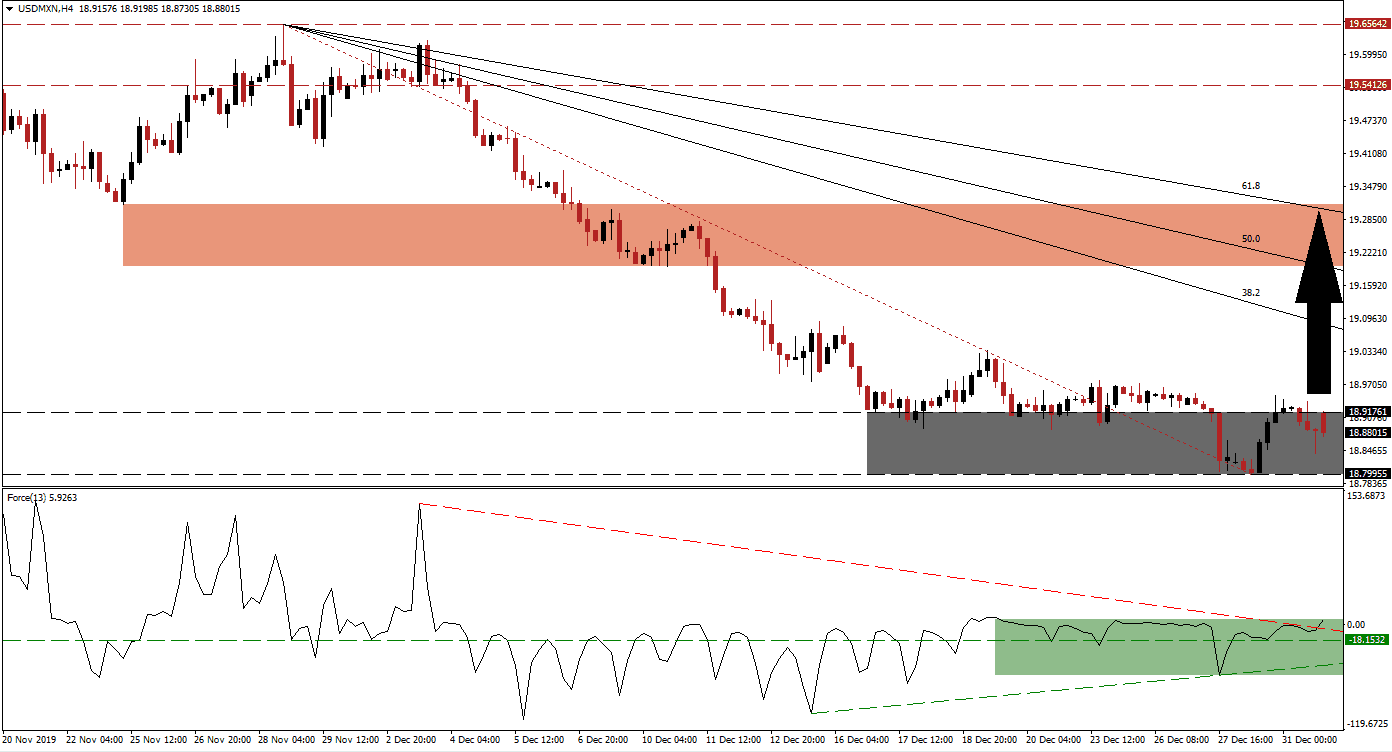

Economic reports out of the US have been disappointing, and the US Dollar is under growing selling pressure across the board. Given the extreme oversold conditions in the majority of US Dollar currency pairs, a minor recovery is anticipated. The USD/MXN entered a sideways trend after recording a lower low, causing an adjustment to its support zone. Bullish momentum started to recover, and a breakout in this currency pair is pending. This will be a counter-trend advance inside of the long-term bearish chart formation. You can learn more about a breakout here.

The Force Index, a next-generation technical indicator, indicates the rise in bullish momentum as price action drifted sideways. The Force Index recorded a lower high as the USD/MXN extended its move to the downside. A positive divergence materialized as a result, and the ascending support level pushed it above its horizontal resistance level, converting it into support. This technical indicator extended its advance and eclipsed its descending resistance level, as marked by the green rectangle. The Force Index also moved into positive conditions, placing bulls in charge of this currency pair.

Price action additionally moved above its Fibonacci Retracement Fan trendline, another bullish development. The USD/MXN is favored to move out of its support zone located between 18.79955 and 18.91761, as marked by the grey rectangle. A short-covering rally is expected to close the gap between this currency pair and its descending 38.2 Fibonacci Retracement Fan Resistance Level. More upside momentum is anticipated after price action eclipses its intra-day high of 19.03660, the peak before a lower low was created. You can learn more about the Fibonacci Retracement Fan here.

Given the dominant bearish fundamental outlook in the USD/MXN, forex traders are advised to consider a breakout as a solid short-selling opportunity. The upside potential in this currency pair remains limited to its short-term resistance zone located between 19.19660 and 19.31354, as marked by the red rectangle. The 61.8 Fibonacci Retracement Fan Resistance Level is enforcing this zone, and an extension of the downtrend is favored. This is likely to lead to a fresh breakdown in this currency pair.

USD/MXN Technical Trading Set-Up - Short-Covering Rally Scenario

Long Entry @ 18.92000

Take Profit @ 19.27000

Stop Loss @ 18.82000

Upside Potential: 3,500 pips

Downside Risk: 1,000 pips

Risk/Reward Ratio: 3.50

In case of a breakdown in the Force Index below its ascending support level, the USD/MXN is expected to push to the downside. A minor recovery before a fresh breakdown remains the dominant trading scenario, due to the technical picture. It will also ensure the longevity of the sell-off. The next support zone awaits this currency pair between 18.40210 and 18.52616. More downside is likely, but a new catalyst would be required.

USD/MXN Technical Trading Set-Up - Breakdown Scenario

Short Entry @ 18.75000

Take Profit @ 18.40250

Stop Loss @ 18.87000

Downside Potential: 3,475 pips

Upside Risk: 20 pips

Risk/Reward Ratio: 2.90