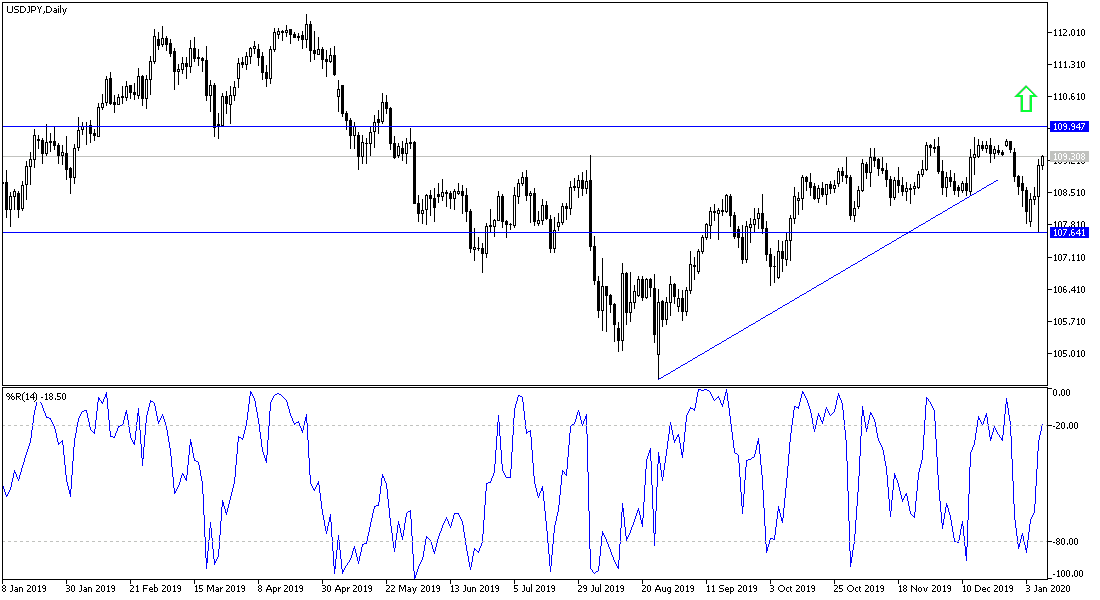

President Trump’s speech after the Iranian attack on US bases in Iraq, eased a lot of the financial markets fears, and investors returned to taking risk, and gave up, even if temporary, on safe heavens, which allowed the USD/JPY to achieve an upward correction, pushing it towards the 109.24 resistance, after it dropped to the 107.65 support, the lowest level in 3 months, in a reaction the Iranian missile attacks on American troops.

President Trump threatened Iran initially of a military response to any attack on American interests, but his actual reaction to the missile attacks that took place last night, was more subdued. Trump revealed in a speech to the nation on Wednesday that his administration will impose additional economic sanctions on Iran after the attacks.

New sanctions are likely to have negative affect on the Iranian economy that is suffering already, however, they look much more severe than Trump’s previous threat of “Hitting them stronger than they have even seen before!” It seems that Trump’s decision to abandon the military response to the Iranian attack stems from the fact that the said attack didn’t result in any American or Iraqi casualties.

USD performance varied against other major currencies after Labor data in the US private sector jumped more than expected in December. The ADP survey indicated that the private sector employment in December saw an increase of around 202000, after gaining by a revised 124000 news jobs in November. Economists were expecting a 160000 new jobs comparing to 67000 new jobs announced originally for the previous month.

Tomorrow, the U.S NFP Report will be released, economists expect an increase of U.S employment by 168000 in December, after 266000 news jobs added in November. Unemployment rate is expected to remain at 3.5%.

According to technical analysis of the pair: The USD/JPY giving up on stability below 108.00 psychological support would weaken the bearish correction, and if it moved towards 110.00 resistance, the bullish trend might strengthen again. The move towards either level will depend on the Middle East developments and the details of the Phase 1 trade deal between the U.S and China.

As for the economic calendar data: From China, Inflation, Consumer Price Index and Producer Price Index data will be released. From the U.S, unemployed claims will be released.