The World Health Organization (WHO) is holding an emergency meeting to discuss and track the path of the global outbreak of, and its global impact. If the meeting emerges labeling the Coruna virus as a global epidemic that must be fought by all countries of the world, the safe havens may return to harvest new record gains, which may support more losses to the price of the USD/JPY pair. The Japanese yen is one of the most important safe havens. The pair retreated to the 108.72 support in the beginning of this week’s trading before trying to rebound around 109.26 in light of the stability that prevailed in the global markets recently.

The US dollar did not react much to the Federal Reserve's announcement of its monetary policy, as the bank kept the US interest rate around 1.75% unchanged, as expected. The Fed indicated that recent economic data indicates that the labor market remains strong and that economic activity has increased at a moderate rate. The bank described household spending as rising "at a moderate pace" compared to last month's description of spending as rising "at a strong pace."

Regarding leaving interest rates unchanged, the Fed said it viewed that the current monetary policy stance as appropriate to support the continued growth of economic activity, strong labor market conditions and the return of inflation to the 2 percent target.

The Fed painted a mostly bright picture of the US economy in its statement after the latest policy meeting. However, they also warned that they would “monitor” the global economy, which might be slowed by the Chinese Corona Virus - a threat mentioned by Bank Governor Jerome Powell at the start of his press conference. Global stock and bond markets deteriorated last week due to concerns over the consequences of the virus.

Last year, the US central bank cut interest rates three times after raising it four times in 2018. Powell and other Federal Reserve officials attribute those interest rate cuts to revitalizing the housing market, which had faltered early last year, and offset some obstacles from President Donald Trump's trade wars with China.

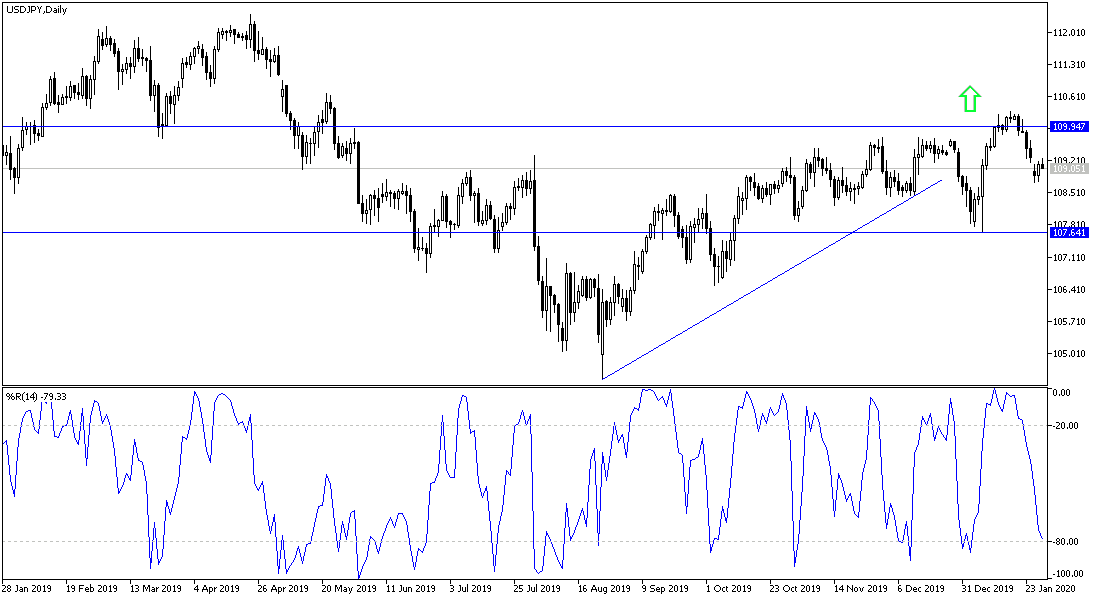

According to the technical analysis of the pair: USD/JPY is still unable to return to the area of the 110.00 psychological resistance, which supports the bullish correction. It will remain under downward pressure for a while until the final announcement of the elimination of the deadly Corona virus, which threatens global economic growth. Increasing global anxiety and tension means more gains for the Japanese yen as an ideal safe haven for investors in times of uncertainty, and thus the pair has moved towards support levels of 108.70, 108.00 and 107.35, respectively. The pair will react today to the announcement of the US economic growth rate at the end of 2019.