The rapid spread of the deadly Corona virus in China at a very sensitive time forced the Chinese authorities to speed up taking the necessary measures to contain the situation. The Chinese economy is suffering the consequences of the trade war with the United States, and only days after agreeing to a truce between them, the country is exposed to the virus. In a rapid development of events, China closed a city of more than 11 million people on Thursday in an unprecedented attempt to contain a new deadly viral disease that led to hundreds of infections, and spread to other cities and countries on travel flights for the new lunar year. Usually crowded streets, shopping malls, restaurants and other public places in Wuhan were eerily empty. This situation is suitable for the Japanese yen as a safe heaven. The price of the USD/JPY fell to the 109.50 support level at the time of writing, breaking below the 110.00 psychological resistance, which supports the strength of the bullish correction.

On the economic level. Japan posted a deficit for the second year in a row last year, as its exports were hit by slowing demand in China amid a tariff war with the United States. Government data today showed that Japan's exports fell 5.6% in 2019, to 76.9 trillion yen ($701.6 billion), while imports fell 5.0% to 78.6 trillion yen ($710 billion). This resulted in a deficit of 1.6 trillion yen ($14 billion).

From the United States of America, there is a lack of US economic releases this week. Yesterday the National Association of Realtors announced that existing home sales rose last month to a seasonal annual rate of 5.54 million. For all of 2019, 5.34 million homes were sold - matching the level of 2018. High mortgage rates hurt sales in the first half of last year, while lower interest rates boosted purchases in the second half. In December, sales increased in the Northeast, South and West. But sales have fallen in the Midwest, which is generally an affordable market.

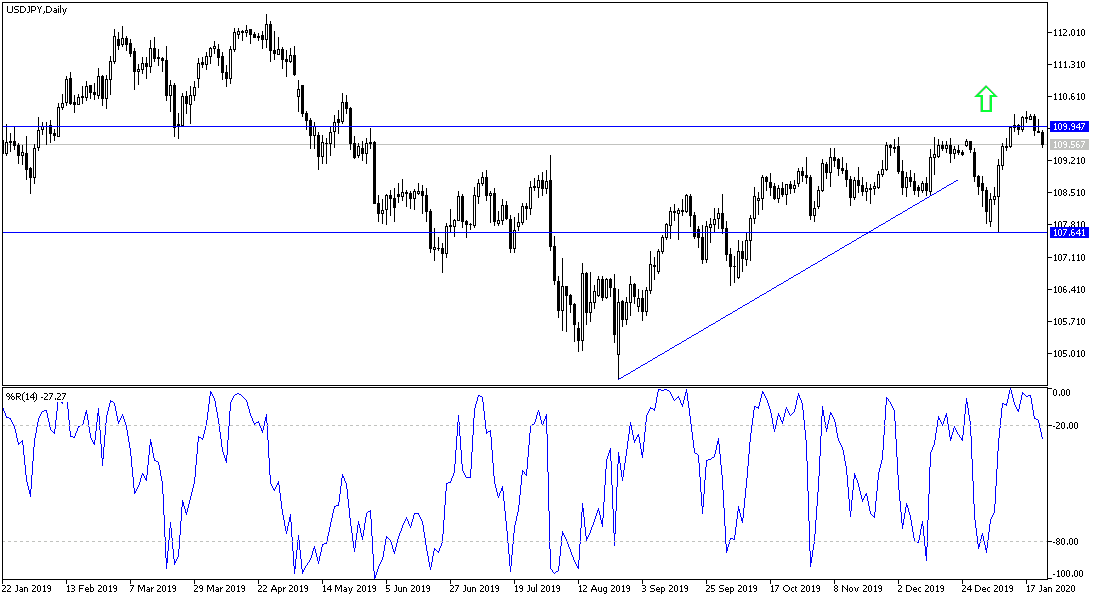

According to the technical analysis of the pair: There is no change in my technical view of USD/JPY, the 110.00 psychological resistance is still the key to the strength of the bullish correction and the bulls' confidence may be shaken if the pair moves below the 109.00 support, and this may be a natural matter in light of the situation in China, which increases concerns in the global financial markets, and therefore, traders flock to the Japanese yen as a safe haven in such times. I still prefer buying the pair from every downtrend.

After the announcement of the trade balance figures from Japan, the pair will react to the announcement of the weekly US jobless claims and the extent of the investors' risk appetite.