The spread of the Corona virus in China and the official announcement of the six deaths so far have frightened global markets, and global stock indicators collapsed amid expectations of more rapid spread of the virus. This is in addition to the pessimistic expectations from the International Monetary Fund towards global economic growth, which supported investors risk evasion until the situation is contained, and since the Japanese yen is a safe haven, it is natural that the USD/JPY fell to the 109.76 level, and abandoned the 110.00 psychological resistance, which supports the strength The recent bullish momentum.

The Bank of Japan kept the monetary policy stimulus as is, but boosted its growth outlook, citing government economic measures. The bank's monetary policy board voted to stick to the negative interest rate of -0.1 percent, unchanged, as had been expected. It also maintained the 10-year yield target for Japanese government bonds at around zero percent.

Moreover, the bank will purchase JGBs in a flexible way, increasing the amount due at an annual pace of about 80 trillion yen. The Bank of Japan raised its forecast for economic growth for the fiscal year 2020 with the support of financial incentives offered by the bank.

And in the Davos economic summit, US President Donald Trump said he led a "stunning shift" of the US economy and urged the world to invest in America, but he has a lot to say on climate change issues that are at the center of the gathering of business and political leaders in the Swiss Alps. Responding to the press for the historic accountability trial aimed at isolating him, Trump replied, "It's a shame." And Trump reminded those present that when he spoke here in 2018, "I told you that we are craving for a great American return." "Today I am proud to announce that the United States is in the midst of an economic boom, the world has never seen anything like it before," he added.

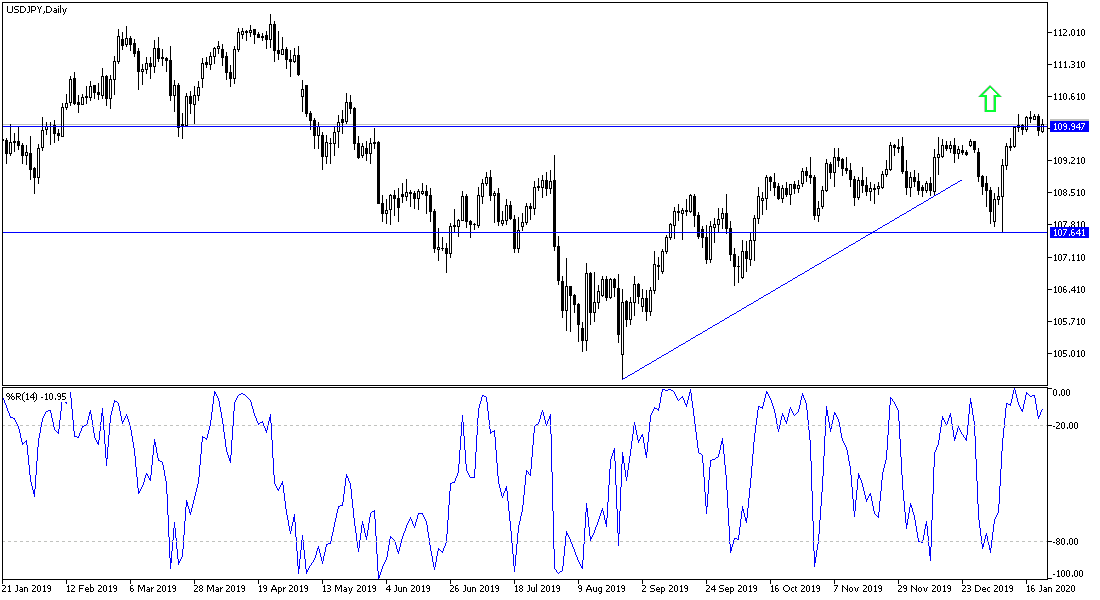

According to the technical analysis of the pair: The price of USD/JPY still has the ability to stick to the path of the bullish correction, and that gains of the Japanese yen may be temporary with renewed fears in the markets of the consequences of the Chinese virus. The 110.00 psychological resistance remains the key to the strength of this trend. On the daily chart, we have not found a break of the bullish reversal so far. Purchases may return if the pair moves towards 109.00 support, if the global geopolitical tensions increase again. The return of investor risk appetite may support the pair's gains towards the 110.45 and 111.20 resistance levels, respectively.

There are no significant economic data releases from Japan today. From the United States, existing home sales data will be announced.