The price of USD/JPY is trying to maintain the 110.00 psychological resistance, which supports the strength of the bullish trend. Recently, gains stopped around the 110.28 resistance, the highest level in seven months, and declined slightly to the 109.88 level at the time of writing. The US dollar is still the strongest in light of the improvement in the American economic performance compared to other global economies.

In the morning, the Japanese central bank kept the stimulus of monetary policy as is, but boosted its growth outlook, citing the government's economic measures. Accordingly, the Bank of Japan’s Policy Board voted by 7-2 to maintain the negative interest rate at -0.1 percent on current accounts held by financial institutions at the central bank, in decisions that were widely expected by the markets. The board of directors has also maintained the 10-year yield target of Japanese government bonds at around zero percent.

Moreover, the bank will purchase JGBs in a flexible way, increasing the amount due at an annual pace of about 80 trillion yen. The Bank of Japan raised its growth forecast for fiscal year 2020, citing effects of fiscal stimulus.

The good performance of the US economy weakens expectations for the possibility of a US interest rate cut by the Federal Reserve led by Jerome Powell soon. The bank may stick to its policy for a longer period as long as the US economy is in good shape.

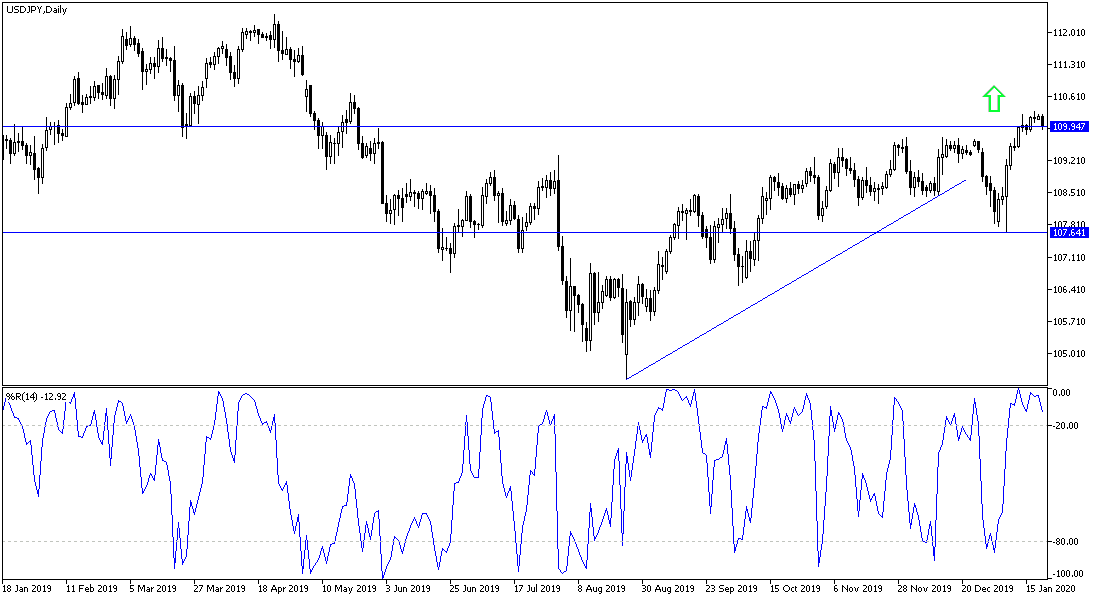

According to the technical analysis of the pair: On the daily chart, the price is still moving inside an ascending channel supported by the 110.00 psychological resistance. At the same time, some technical indicators showed the pair reaching the overbought areas, and the pair did not get catalysts to complete the upward pace, as it may be exposed to corrections might push it towards support levels of 109.75 and 109.00, and I still prefer buying the pair from every low level. The continued strength of the US dollar and more investor risk appetite will support the bulls' move towards 110.45, 111.20 and 112.00 resistance levels, respectively.

After the announcement of the monetary policy of the Central Bank of Japan, and the update of its economic forecasts and the statements of its Governor Kuroda, the economic calendar for the second consecutive day will have no important American economic data.