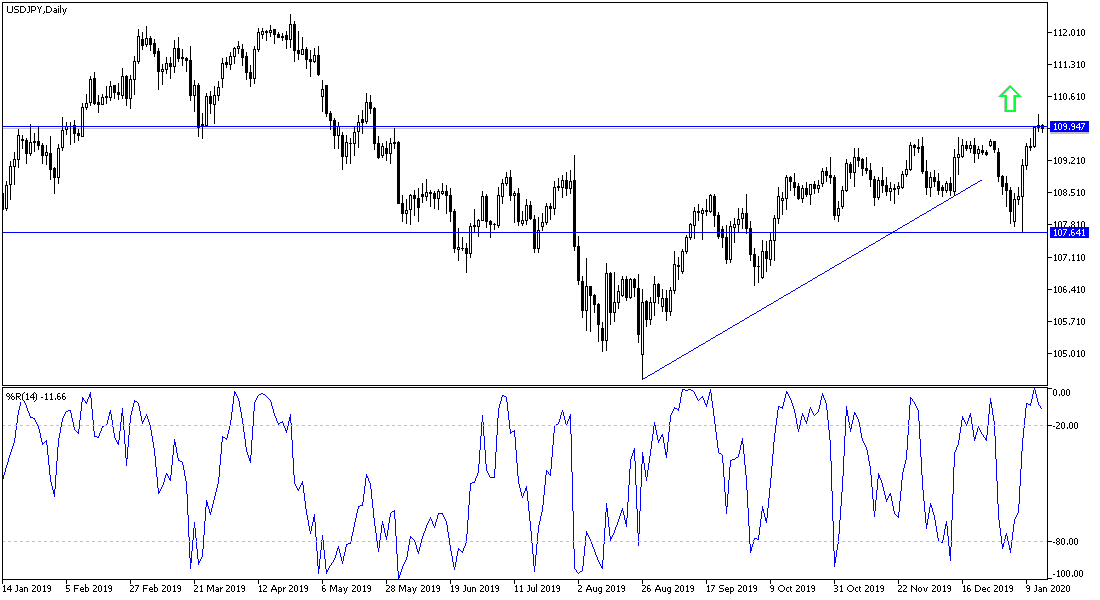

For five trading sessions in a row, as shown on the daily chart of the USD/JPY pair, an upward corrective performance pair was crowned by stability above the 110.00 psychological resistance, with gains reaching the 110.21 resistance, its highest in seven months. Gains are waiting for the formal signing today on the Phase 1 trade agreement between the United States of America and China, in a special ceremony to be held at the White House. The details of that deal will be announced immediately upon signing, and the next stages will be also announced towards ending the tariff war between the two largest economies in the world, which was a strong reason for the global economy to fold to the brink of recession.

The pair was less affected by the announcement of lower than expected US inflation results. As US consumer prices rose 0.2% in December, according to the Labor Department's statistics office, markets were expecting a 0.3% increase. The loss was sufficient to fluctuate the performance of the dollar despite the fact that the annual inflation rate is still above 2.1% to 2.3%, in line with expectations. Core inflation - which excludes volatile food and energy elements- rose 0.1%, below expectations for 0.2%, even though the annual rate remains steady at 2.3%. Core prices are seen as a more reliable measure of inflation trends in the country.

Markets are concerned with inflation because it is the outlook for price growth that determines the interest rate policy, which affects capital flows as well as short-term speculative activity on the dollar. High inflation usually tends to increase interest rates and an often stronger currency.

Today's deal will avoid a new round of tariffs between the two sides, and is expected to commit them to removing a small portion of the tariffs already imposed on exports from both sides, which help the United States and global economies regain their strength. Both have been affected by the trade war, but the US growth engine has remained in better shape than its overseas counterparts, and the awaited deal is expected to weaken expectations for further rate cuts by the Federal Reserve.

The Federal Reserve cut interest rates three times in 2019, and investors are still betting that the 2020 cut is almost certain.

According to the technical analysis of the pair: Holding on to the 110.00 psychological resistance will consolidate the strength of the bullish correction of this pair, and is awaiting the reaction from the announcement of the details of the deal between the United States of America and China later in the day, which if it was supportive of the current optimism, the pair may witness further gains. The closest support levels for the pair are currently at 110.55, 111.20 and 112.00, respectively.

As for the economic calendar data today: There will be statements by the Bank of Japan Governor, Kuroda, at the beginning of today's session, after which attention will be paid to the announcement of the PPI, the Empire State Industrial Index and the U.S oil stocks data.