We have always waited a long time for USD/JPY to breach through the 110.00 psychological resistance to confirm the reversal of the pair’s general trend upward, which happened during today’s trading session, where the pair tested the highest resistance level of 110.21 for more than seven months. This comes with increasing investor risk appetite amid optimism that the Phase 1 trade agreement between the United States of America and China, which will be officially signed tomorrow, may end the tariff war between them, which led to a slowdown in global economic growth to the point of recession. The two parties to the global trade war show goodwill before signing the adoption of steps that reduce the severity of their dispute.

The Trump administration abandoned its designation of China as a currency manipulator before signing the agreement. Which included among its provisions a section aimed at preventing China from manipulating its currency to gain commercial advantages. The measure announced yesterday comes five months after the Trump administration described China as a currency manipulator - the first time any country has been labeled with that description since 1994 during the Clinton administration.

In this context, Treasury Secretary Stephen Mnuchen stated that the administration has abandoned the designation of China as a currency manipulator due to the obligations stipulated in the Phase 1 trade agreement that President Donald Trump will sign with China on Wednesday at a special ceremony in the White House. "China has made enforceable commitments to refrain from devaluation, while enhancing transparency and accountability," Manuchin added in a statement accompanying the currency report.

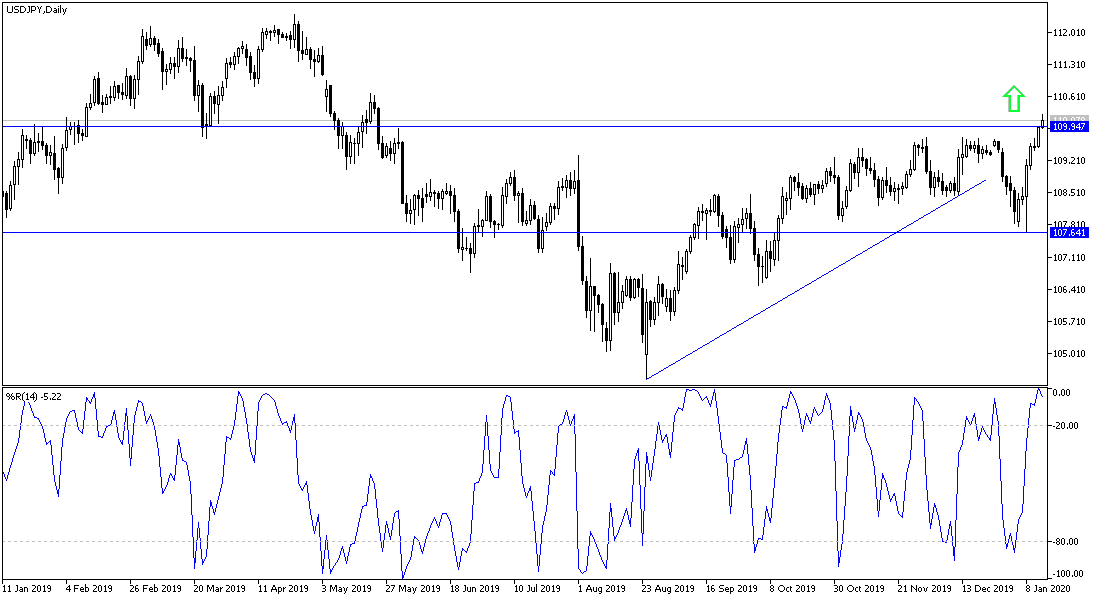

According to the technical analysis of the pair: As we mentioned in the previous technical analyzes, the USD/JPY stability above the 110.00 psychological resistance will support the reversal of the general trend upward as indicated by the daily chart. At the present time, the closest resistance levels for the pair are at 110.4, 111.20 and 112.00, respectively. This optimism may face weaker-than-expected figures for US inflation, whose elements will be announced starting from today with the announcement of the US CPI, and tomorrow's producer prices, ending with the announcement of retail sales figures. Weak inflation affects the Fed's desire to stick to its current policy because it will support expectations of easing monetary policy to push inflation higher.

On the downside, the closest support levels for the pair are currently at 109.85, 109.00 and 108.65, and I still prefer buying the pair from each downside level.