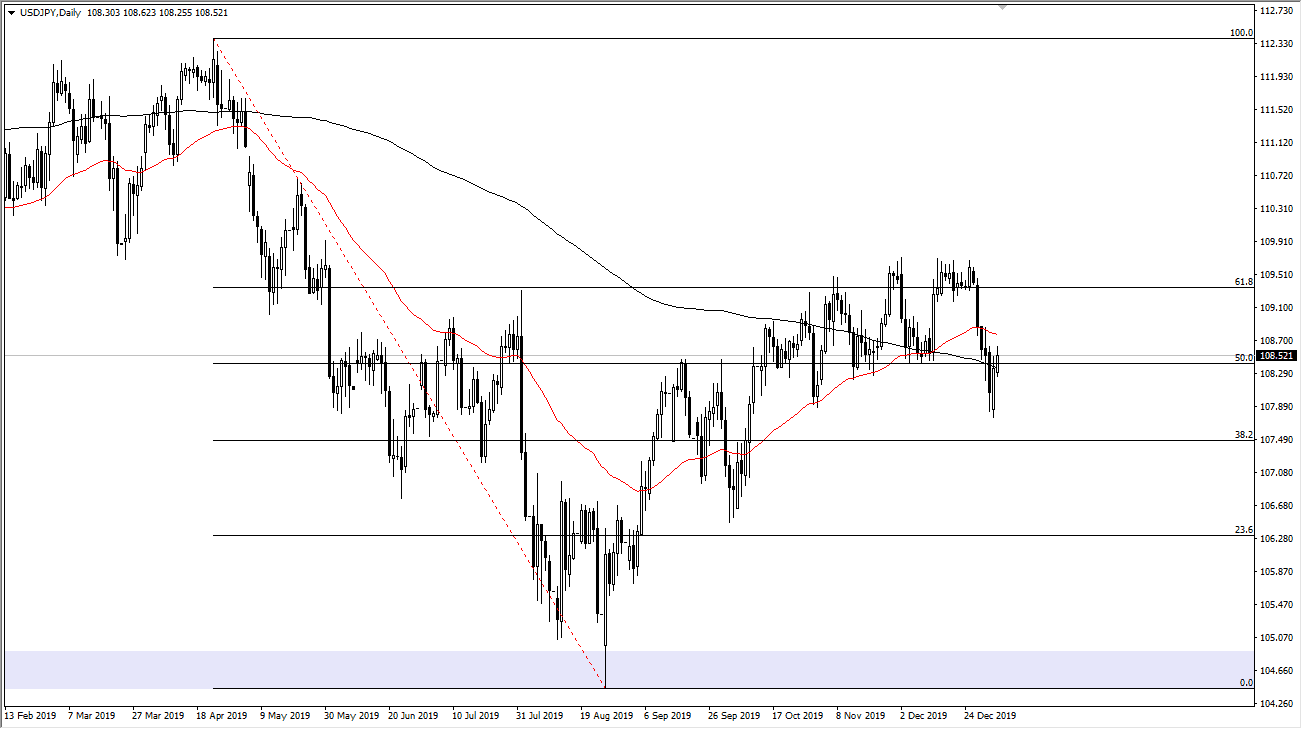

The US dollar has rallied a bit during the trading session on Tuesday, breaking above the 200 day EMA but hasn’t exactly exploded to the upside. The market will pay attention to this 200 day EMA, which is an obvious longer-term technical signal. The ¥108.50 level is an area that has been important more than once so the fact that we started to break above there is a very bullish sign. The next major barrier is going to be the 50 day EMA, which is colored in red on the chart. If we can break above that level, then it’s likely that we will go looking into where we had recently seen the highs print at the ¥109.70 level.

Keep in mind that this pair is highly sensitive to risk appetite, and at this point there are plenty of things out there that could cause major issues. The Japanese yen is typically used as a safety currency, so if we get more negative headlines out there it’s likely that the pair will rollover. However, if things calmed down it’s very likely that we will go to the upside. This could send the market looking towards that crucial ¥109.60 level, which is the gateway to much higher pricing. If we can break above that level is very likely that the market will then go to the ¥111 level where there is a bit of a gap. If we can break above there, then the market is likely to go to the ¥112.50 level. Ultimately, this is a market that has pulled back nicely, but there’s a lot of noise out there right now that will continue to make this a very difficult market in general.

If we break down below the bottom of the candlestick from the Monday session, it’s possible that we could go to the ¥106.50 level. That is an area where we have seen a lot of support, and therefore it would make a nice target. I think that the US dollar will continue to get kicked around back and forth against the Japanese yen and therefore it’s likely that the pair will be very difficult to trade, and I wouldn’t put too much into the market right away. Ultimately, this is a market that I do think goes higher, but we need a sense of calm in the markets before it can really take off to the upside.