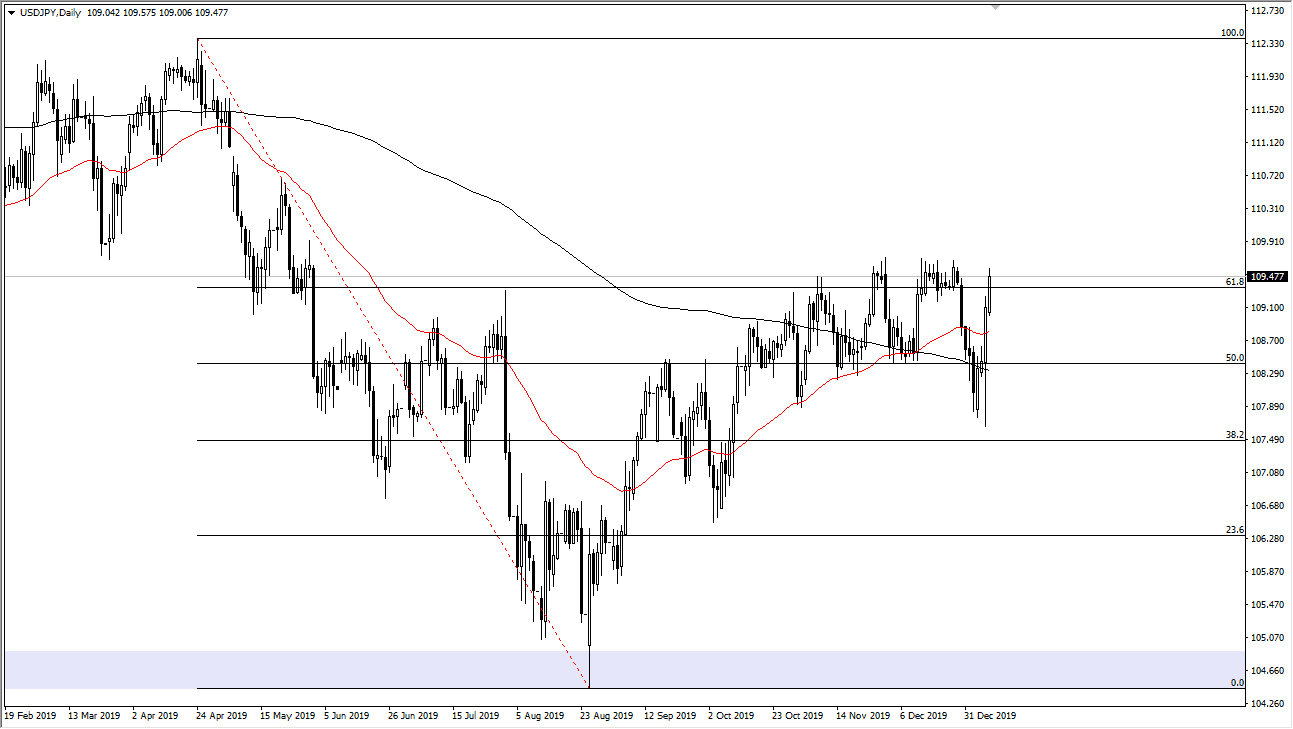

The US dollar has rallied a bit during the trading session on Friday as we get the jobs figure. We are currently near the ¥109.60 level, an area that will continue to cause a bit of resistance as it has in the past. This is an area that has been very stubborn and with the jobs number coming out of America during the session, it will probably cause a bit of volatility. That being said, if we can break above the ¥109.60 level, the market may be free to go and attack the ¥110 level. That’s an area that should keep the market somewhat down, but if we were to break above there it’s likely that the market could go to the ¥111 level, possibly even the ¥112.50 level after that. Remember, this is a pair that is highly sensitive to the jobs figure anyway, and the fact that we are hanging out at a major resistance level suggests that we are going to get some type of resolution.

If we do pull back from here, the market is very likely to go looking towards the ¥108.50 level, and then possibly the ¥108 level after that. Looking at this chart, it’s obvious that the market will continue to try to bang to the upside unless of course we get some type of horrific news or shock in the market. The 200 day EMA has offered support as it is shown on the chart by the black line.

We have seen a complete turnaround in risk appetite, as the Iranians have stepped away from picking up the shooting war and now it looks as if tensions are starting to come back down. Looking at this chart, it’s been quite a turnaround and it does suggest that the market will continue to favor the upside but needs some type of catalyst to continue to go higher. We are a bit overextended over the last 48 hours, so a pullback would make a bit of sense. I’m not looking for some type of break down, just simply an opportunity to pick up this market “on the cheap” and pick up a little bit of value. Remember, the Japanese yen is a safety currency, so having said that it’s likely that the market will react accordingly, and therefore this is a marketplace that I will be looking to at 8:30 AM New York time, as its reaction will tell you everything you need to know about what the markets think about the Non-Farm Payroll figures.