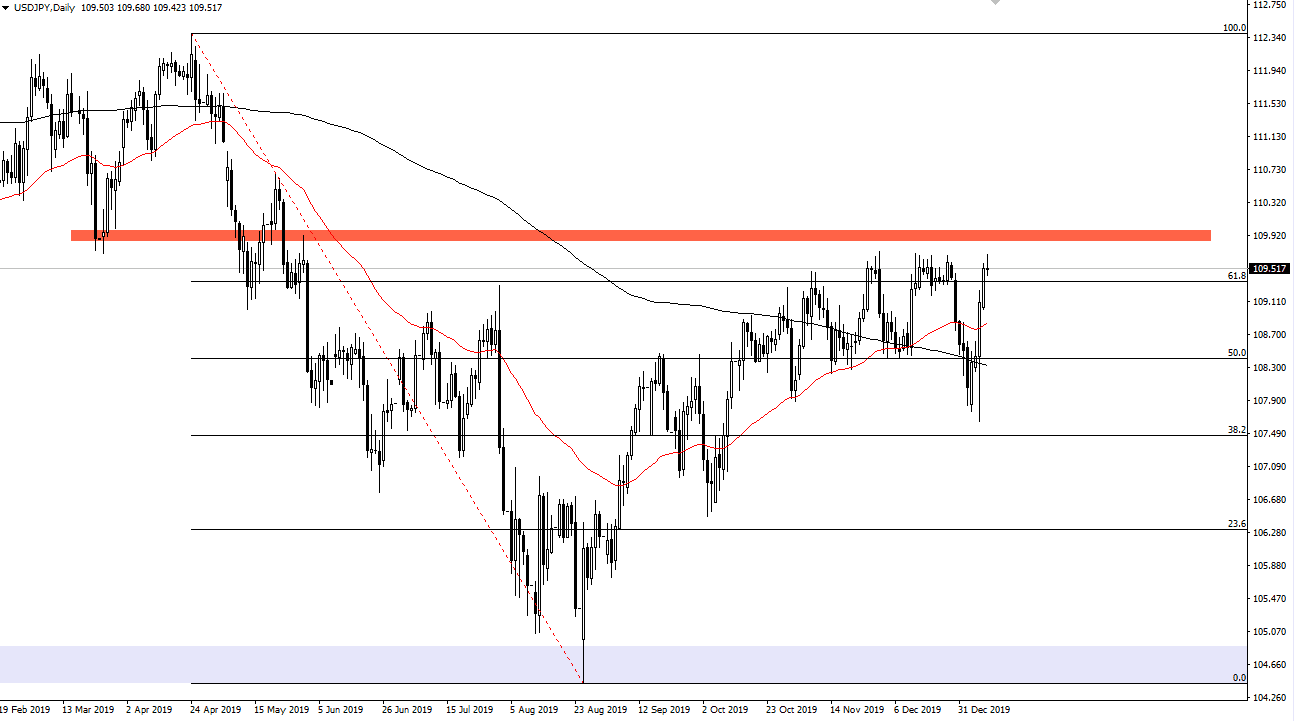

The US dollar has rallied slightly during the trading session on Friday, but the jobs report out the United States was a bit lower than anticipated. This of course has a bit of a negative effect on the greenback, and the fact that we have seen so much in the way of a pushback suggests that the area will continue to hold as resistance. The ¥109.50 level of course is an area that has been resistive more than once, and the fact that we have exploded to the upside the way we have of the last couple of days suggests that momentum simply cannot hang on in this general vicinity.

Furthermore, I don’t know that the markets are ready to explode to the upside as far as risk appetite is concerned, and that most certainly will be a major factor when it comes to this pair. The USD/JPY pair is very sensitive to risk appetite as the Japanese yen is a “safety currency”, and that is something that should be kept in the back of your mind. By showing signs of exhaustion, it suggests that perhaps we will pull back, and I think that makes quite a bit of sense. I don’t necessarily believe that we are going to break down, but I also recognize that we have gone too far in too short of a timeframe. Because of this, I believe that the market will probably aim for the 50 day EMA initially, and then perhaps the 200 day EMA. I would be a bit surprised if we break down below the 200 day EMA though, as we are most decidedly bullish in general.

Looking at the chart though, if we were to break above the ¥110 level, I believe that the market will probably go looking towards the ¥111 level, and then eventually the ¥112.50 level. With that in mind, it would be a significant break out and a major “risk on” type of move. I don’t think we are ready for that, but I do think eventually that’s probably how this plays out as we have been so tenacious when it comes to trying to break through the area above. Volume will pick up this coming week, as everybody will be back from the holidays finally. Ultimately, this is a market that is one that I like buying on dips more than anything else.