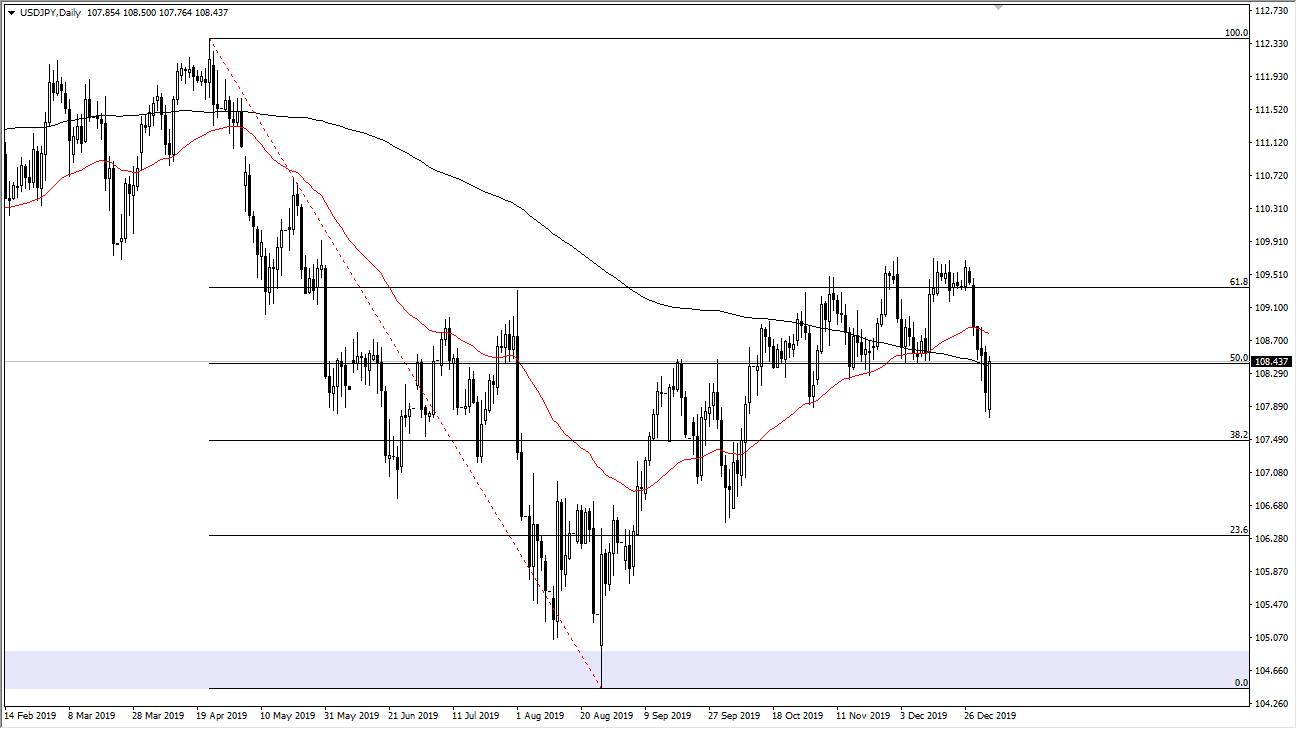

The US dollar has gapped lower to kick off the week on Monday against the Japanese yen but then turned around to show plenty of strength. At this point, the market is starting to show that it is trying to recapture the 200 day EMA, so it is very possible that longer-term buyers will get involved and push to the upside. Ultimately, this is a market that is very sensitive to risk appetite, so keep that in mind. With the recent tensions increasing in the Middle East, it suggests that there could be a run towards the Japanese yen. That being said though, the market could turn around as it suggests right now, showing signs of life again.

If the markets do calm down and we don’t get some type of major “risk off” type of situation, this pair very well could go back towards the ¥109.60 level. That was the top of the overall consolidation area that we had been in, so it’s very likely that the market will go looking towards that area by default. If we were to break above there, then the market is likely to go looking towards the ¥111 level, possibly even the ¥112.50 level if we do get the breakout. However, right now I think it is going to be very difficult to get a move like that due to the fact that there are so many things out there that could cause issues.

To the downside, if we were to break down, we could go looking towards the ¥106.50 level, in a bit of a “risk off” type of situation. Markets continue to be very noisy, but ultimately there are a lot of situations that could come into play here, and therefore being small with your trading position is probably the most important piece of advice that you can get. Ultimately, there are multiple moving pieces out there that can influence this pair so regardless of which direction the market moves, you should probably be trading about half the position that you normally do in order to ride out the volatility that almost certainly will be a major feature of this marketplace as the noise will be deafening at times, but eventually we will get some type of clarity that we can finally hang our hats on. Ultimately, given enough time we will get clarity but until that happens, caution is the better part of valor.