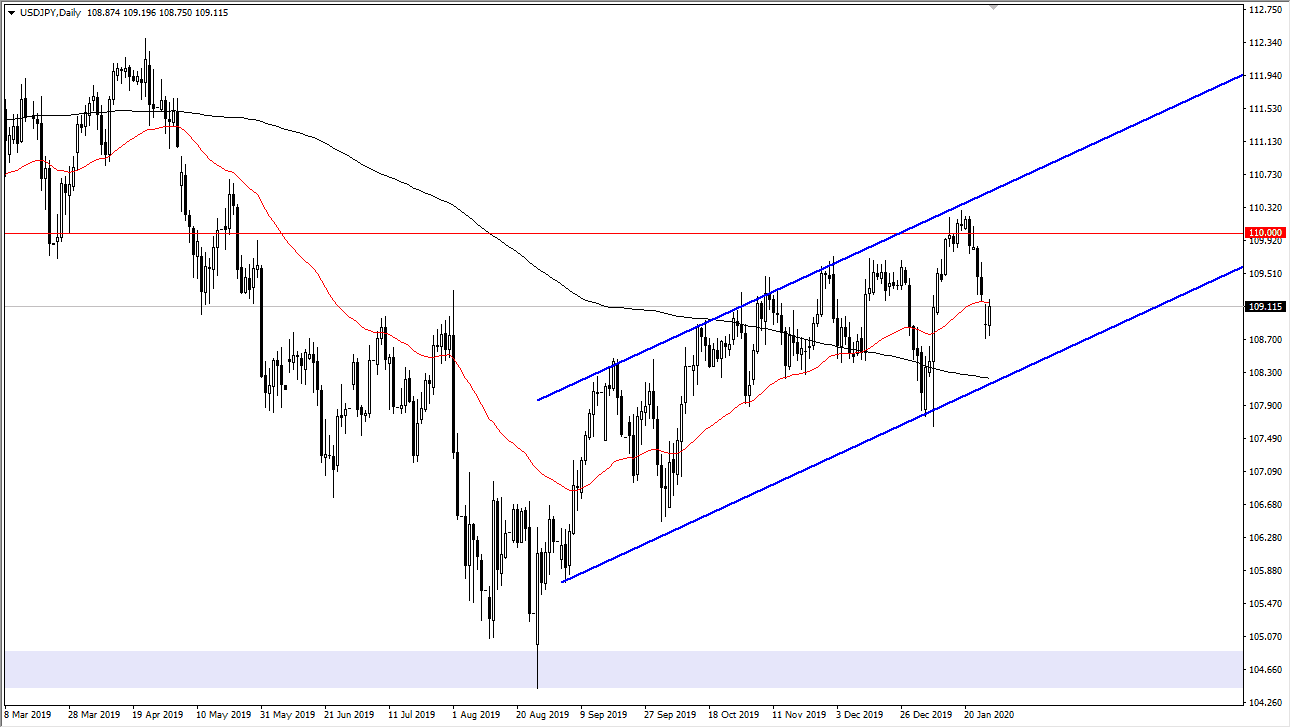

The US dollar has gone back and forth during the trading session on Wednesday, as we continue to dance around the 50 day EMA. Ultimately, this is a market that continues to see a lot of noise and of course it makes quite a bit of sense that the market was all over the place due to the fact that we had seen the Federal Reserve release a statement and at this point we have filled the gap but if we can break above the top of the range during the trading session on Wednesday, the market should then go to the ¥110 level. Pullbacks at this point should continue to find plenty of support, extending all the way down to the ¥108.30 level which is the bottom of the up trending channel. With truly interesting about this market is that it did almost nothing during the day when you would expect a huge move. In other words, it’s almost as if the markets are still confused.

If the market does break to the upside and go looking towards the ¥110 level, there is a significant amount of resistance in that area but if we can break above there it’s likely that we could go to the ¥110.30 level, and then the ¥111 level. That is a gap that needs to be filled, and if you can break above there then the market is likely to go looking towards the ¥112.30 level. To the downside, if the market was to break down below the ¥108.30 level, and of course the 200 day EMA underneath, then the market is ready to drop further, perhaps reaching towards the ¥105 level over the longer term. We have been in a channel for quite some time, but if we do break down then we test the major support level at the ¥105 level, an area that has been supportive for quite some time. Overall, this is a market that continues to move back and forth with global expectations, which of course are all over the place. I still favor the upside, but I also recognize that a bit of a pullback could be coming and therefore value hunting might be the way forward. At this point, I like the idea of looking for the stock market to lead the way, and it should be pointed out that the S&P 500 finished relatively flat just like this pair did.