The US dollar has gapped lower to kick off the week as fears about the coronavirus in the Chinese mainland continue to have people running for cover. Quite frankly, this is a move that already started before the expansion of that disease, and it should be thought of more or less as an excuse to sell off. Keep in mind that this pair is highly sensitive to risk appetite, and therefore will rise and fall with stock markets on the whole.

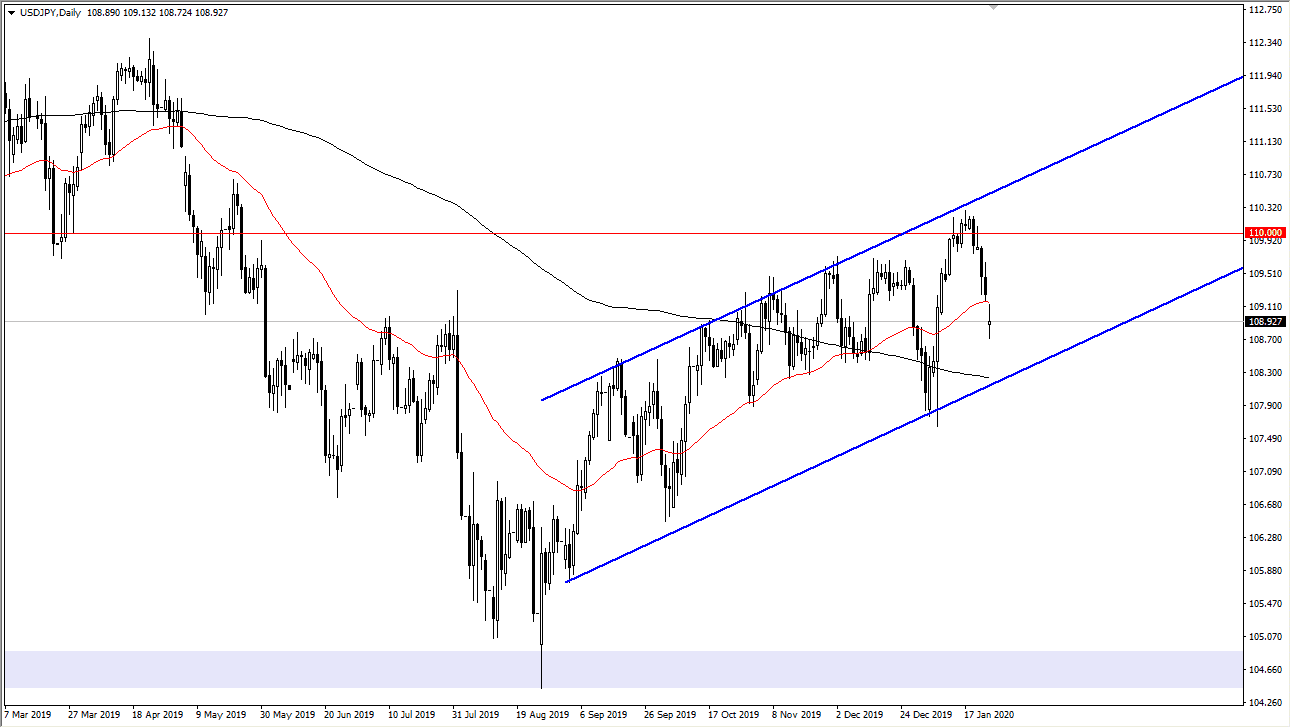

We are below the 50 day EMA, but it should be noted that there is still an uptrend line that needs to be tested at the ¥108.30 level, so if we do break down the downside is probably somewhat limited at this point. The 200 day EMA is in that area as well, so it’s very likely that should attract a lot of attention. The candlestick for the trading session is very interesting to say the least, as it has been all over the place and we have ended the day relatively flat, at least after the gap. Beyond that, the gap has also been filled for the most part, so the next day or two should be rather crucial.

If we can break above the top of the candlestick for the trading session on Monday, it’s very likely that we go looking towards the ¥110 level. Otherwise, the market was to break down below the bottom of the candlestick, then we will go looking towards that trendline that I have just mentioned as well as the ¥108.30 level. The 200 day EMA is in that area as well, so it’s very likely that the market will continue to pay attention to that general vicinity. We are still in an uptrend, so don’t forget that. However, pullbacks in this pair can be somewhat violent in general, and therefore pullbacks like this are nothing new. Ultimately, I'm looking for an opportunity to start buying but clearly, we don’t have that quite yet. With this, you will need to be very patient to look at that set up but in the short term it’s likely that the market may have further downside ahead of it. Pay attention to the stock markets, because it gives you an idea as to where this pair should go as the two seem to be relatively intermingled, especially in the case of the S&P 500.