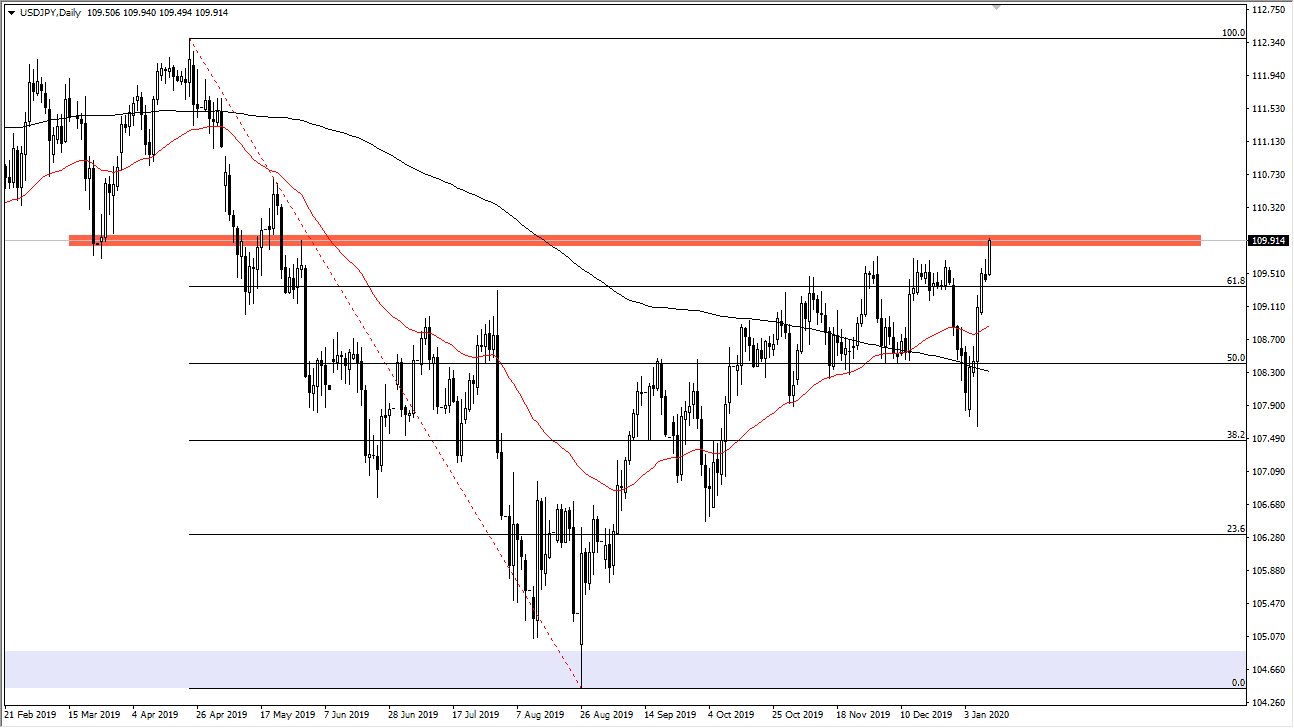

The US dollar has rallied quite significantly during the trading session on Monday to kick off the week, testing the major resistance barrier that I have been talking about for months. That of course is the ¥110 level, an area that features a shooting star if you go far enough to the left, and the scene of a major breakdown. There are a couple of things about the Monday session that suggests to me that we are in fact going to go higher, the first of which being the fact that we are closing at the very top of the range. Beyond that, we have broken above the top of a shooting star from the previous session, which is almost always a very bullish sign.

If we do pull back from here, I think that there are going to be plenty of buyers underneath anyway, so looking at this I think it’s only a matter of time before the buyers will get involved. I would be very interested in buying this market on a pullback to the red 50 day EMA, which is currently hanging around the ¥109 level. I think at this point we are either going to break out immediately, or we will pull back a bit only to find more buyers willing to jump in and pick this pair up.

What’s interesting is that I am seeing potential breakouts in all of the yen related pairs, so this is most certainly going to be reflected on fundamentals involving the Japanese yen more so than anything involving the US dollar. This pair does tend to move higher when times are good and risk appetite is fairly large, and pullback when people are concerned as the Japanese yen is considered to be a major “safety currency.” If the stock markets rally rather significantly and break out to the upside, that will probably push this market much higher as well. Ultimately, if we do break out to the upside it’s likely that we will go looking towards the ¥111 level, and then eventually the 112.30 level again. While a move lower is certainly possible, there has been a lot of structural damage to the resistance done during trading on Monday and therefore one would have to favor the upside anyway. There is a lot of work to do, but clearly major gains in momentum have been made during the trading session on Monday as volume comes back from the holiday season.