US Dollar weakness is expected to accelerate in 2020, and the Canadian Dollar was one of the best performers against the world’s top reserve currency. The most recent intra-day low in the USD/CAD marked a lower low, keeping the long-term downtrend intact. A recovery on the back of a short-covering rally was rejected by the bottom range of its short-term resistance zone. Global trade continues to contract, and the announcement by the US that tariffs on China will remain unchanged until after the November election will keep pressuring the supply chain.

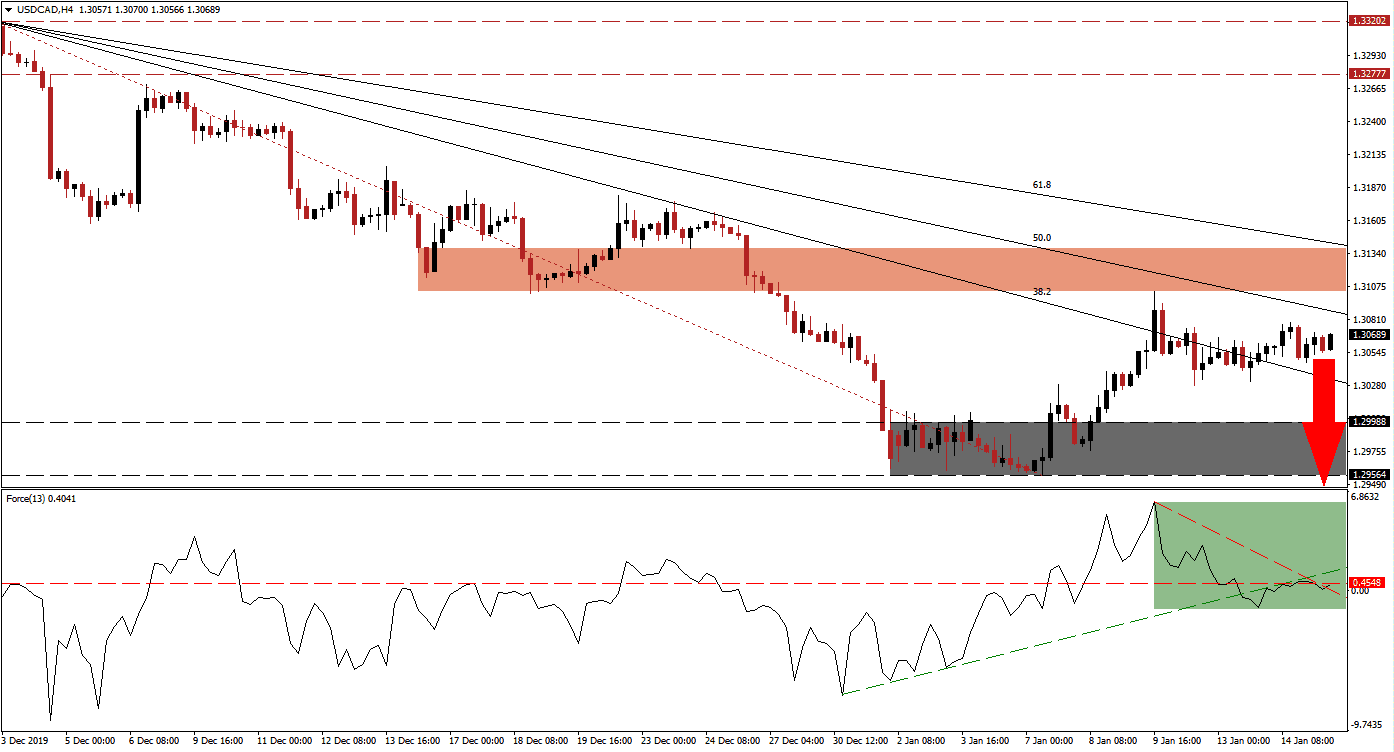

The Force Index, a next-generation technical indicator, peaked with price action before it was pressured to the downside by its short-term resistance zone. The Force Index quickly contracted below its horizontal support level, turning it back into resistance, and below its ascending support level. This technical indicator moved above its descending resistance level, as marked by the green rectangle, but a new push to the downside is favored to take it into negative conditions and bears in charge of the USD/CAD. You can learn more about the Force Index here.

This currency pair ended its uptrend after it reached the bottom range of its short-term resistance zone located between 1.31040 and 1.31382, as marked by the red rectangle. The counter-trend advance in the USD/CAD ensured the longevity of the long-term bearish chart pattern, which gathered strength for the next breakdown sequence. Price action is anticipated to be guided farther to the downside by its descending Fibonacci Retracement Fan sequence, with the 38.2 Fibonacci Retracement Fan Support Level approaching the top range of its support zone. You can learn more about the support and resistance zones here.

As the US economy continues to print economic reports suggesting a slowing economy, downside pressure on the USD/CAD will continue to increase. Forex traders are recommended to monitor the intra-day low of 1.30284, the low of a previous breakdown attempt. A move below this level is likely to result in the next wave of sell orders, adding to bearish momentum. Price action is expected to push through its support zone located between 1.29564 and 1.29988, as marked by the grey rectangle. The next support zone awaits this currency pair between 1.27818 and 1.28354, which will close two price gaps to the downside.

USD/CAD Technical Trading Set-Up - Breakdown Scenario

Short Entry @ 1.30700

Take Profit @ 1.28200

Stop Loss @ 1.31400

Downside Potential: 250 pips

Upside Risk: 70 pips

Risk/Reward Ratio: 3.57

In the event of a sustained breakout in the Force Index above its ascending support level, which acts as temporary resistance, the USD/CAD is anticipated to attempt a move above its short-term resistance zone. The upside potential is limited as the fundamental outlook for this currency pair remains bearish. Any breakout attempt will present forex traders a solid short selling opportunity. The next resistance zone is located between 1.32777 and 1.33202.

USD/CAD Technical Trading Set-Up - Limited Breakout Scenario

Long Entry @ 1.31850

Take Profit @ 1.33100

Stop Loss @ 1.31400

Upside Potential: 125 pips

Downside Risk: 45 pips

Risk/Reward Ratio: 2.78