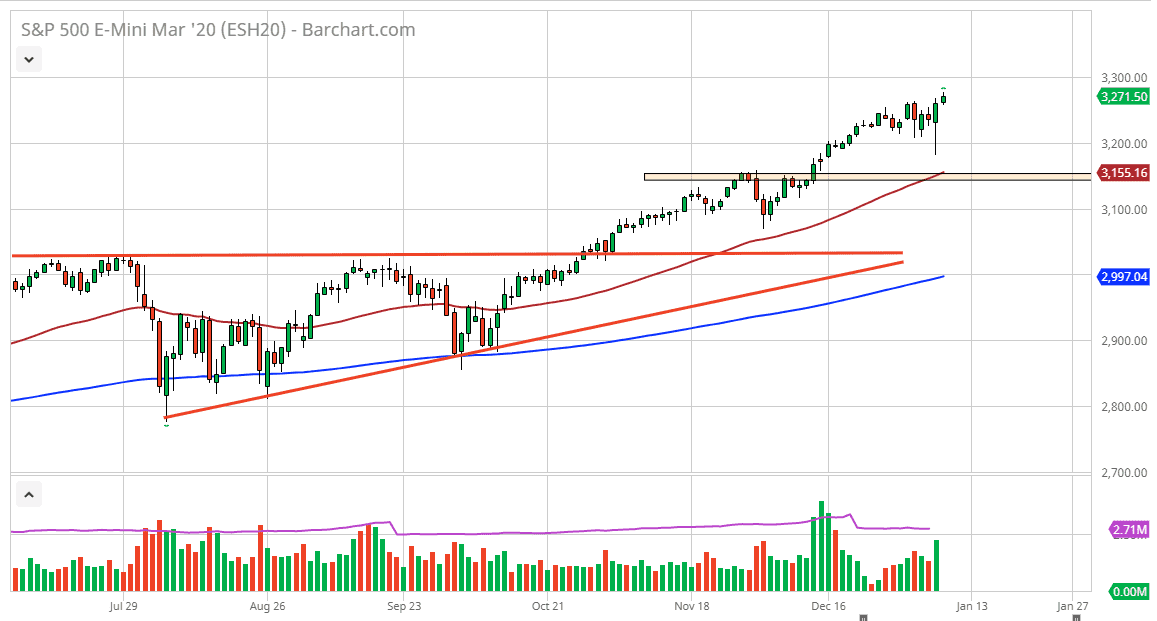

The S&P 500 has rallied a bit during the trading session on Thursday, breaking out to a fresh new high. With the jobs number coming out on Friday, we should see a continuation of this if we get a reasonably strong result for the December employment rolls. All things being equal, the market is likely to continue going higher one way or another, and even if we do pull back, I think it’s a nice buying opportunity. After all, the 3200 level has shown itself a significant amount of support, and most certainly the 3150 level will as well as we had previously in seen resistance in of course have the 50 day EMA in the same neighborhood.

The candlestick for the Wednesday session is very bullish, and it does suggest that there are plenty of buyers. That being the case, I think that it’s only a matter of time before we break towards the 3300 level and then eventually higher than that. I would prefer to buy pullbacks in this market because we are most certainly in a bullish trend, and it most certainly seems to be a scenario where there are plenty of value hunters willing to get involved.

Ultimately, I think that there is a strong argument that you should only be buying dips, just because the year probably won’t produce the type of returns that we are seeing in 2019, so therefore it will be especially important to pay attention to whether or not you are getting value. I have no scenario in which a willing to sell this market right now, as fighting a trend that has been so reliable is a great way to lose money. Candlestick analysis shows that 15 of the last 20 days have been grain, so that’s not the type of situation where you want to start trying to short. While I fully recognize that we could break down from here in the short term, I’m not interested in trying to sell, because it is just too difficult to time some type of major trend change in a market that is obviously being well supported not only by traders, but also the Federal Reserve. You don’t fight the Federal Reserve, so therefore simply look for opportunities to pick up this market on dips, even if you have to wait well beyond the Friday session to do so.