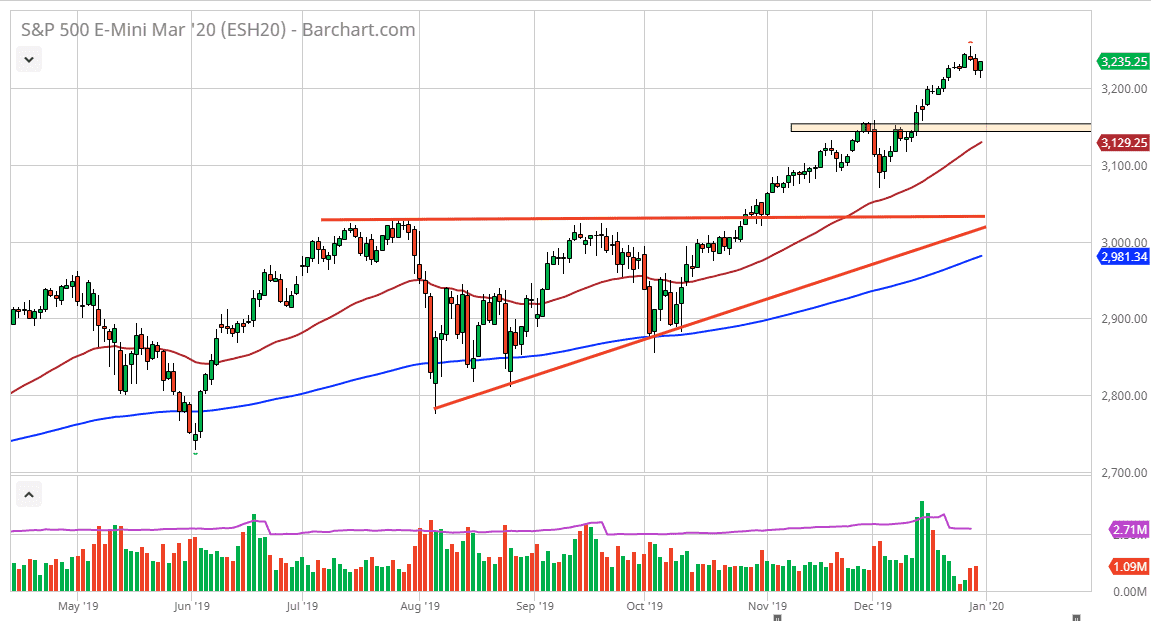

The S&P 500 has initially pulled back during the trading session on Tuesday only to turn around and show signs of life again. As we are rolling into a new year, it will be looking for direction in the short term, but longer-term it will almost certainly be positive due to the fact that we are in such a major uptrend. After all, not much has changed other than the idea that the United States and China are going to be signing some type of “phase 1 deal” on January 15. That of course is bullish, and as a result we have seen a little bit of a reaction to the upside. That being said, to the downside I think there are plenty of buying opportunities that we can take advantage of.

I anticipate that the 3150 level will be crucial, and that we will see a confluence of support there, not only due to the fact that there is previous resistance there, and that of course the 50 day EMA that is starting to crawl towards that area. That being the case, the market is very likely to see a lot of interest going forward as the Federal Reserve is very likely to liquefy the markets further, and of course the rest of the world central banks are doing the same. Quite frankly, the interest rate out there are low enough that it forces money into the stock market, and that is part of what has been driving the S&P 500 longer for some time.

If we were to break down below the 50 day EMA, then we could go as low as 3000, but at that point I think there would be a flood of money trying to come in and take advantage of what is obviously a very strong uptrend. Yes, we are a bit overextended at this point but ultimately this is a market that should eventually find plenty of buyers that could come into the market and push it much higher. I think at this point, looking for value is probably the best way going forward, but that something that I could have said about this market for several weeks, if not months. With this, I don’t have any interest in shorting this market, but I will of course let you know if the momentum shifts to the downside for anything more than a short-term pullback.