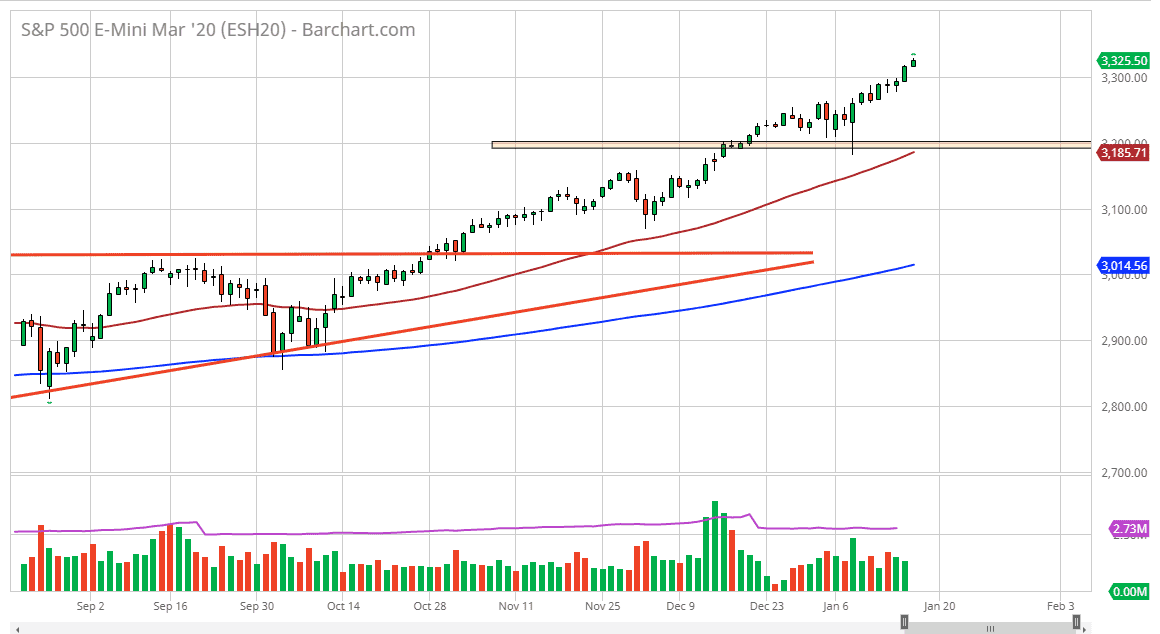

The S&P 500 has rallied a bit during the trading session on Friday, to close out the week on a positive foot. We are at an all-time high obviously, and that continues to be the case almost every day. The 3300 level has been broken significantly, as we have reached towards the 3325 handle. At this point, I believe it’s only a matter of time before the buyers come back into the market, especially on a pullback towards the 3300 level. Furthermore, I think there is a lot of support underneath at the 3200 level, an area where the 50 day EMA is crossing right now. If we were to break down below there it would be something rather negative, but I think there will be plenty of buyers in that general vicinity. Breaking through their probably opens up the door to the 3100 level, followed by the 3000 level which of course is going to be massive support.

The S&P 500 has been getting a lift with the Federal Reserve adding to its balance sheet, and as long as that’s going to be the case this market should continue to go higher. The Federal Reserve is firmly in the pocket of Wall Street so that should not be a huge surprise. However, things happen, and if we were to break down below the 3000 handle that could send this market much lower. In the meantime, I suspect that the market is probably destined to go looking towards the 3500 level, perhaps even higher than that. We will get the occasional pullback obviously, but those should end up being a nice buying opportunity. Ultimately, this is a market that should continue to see plenty of volatility, but obviously it has an upward proclivity and anybody who has sold for the most part of the last decade has been left in the dust.

With that in mind I look for value and have no interest in trying to fight this trend. I like the idea of buying pullbacks, on the signs of a short-term bounce near a large figure such as 3200, 3300, 3100, etc. With this, this is a market that is also going to earnings season, which has been relatively strong, of course adding more fuel to the fire so to speak. The uptrend continues to drive much higher in my estimation.