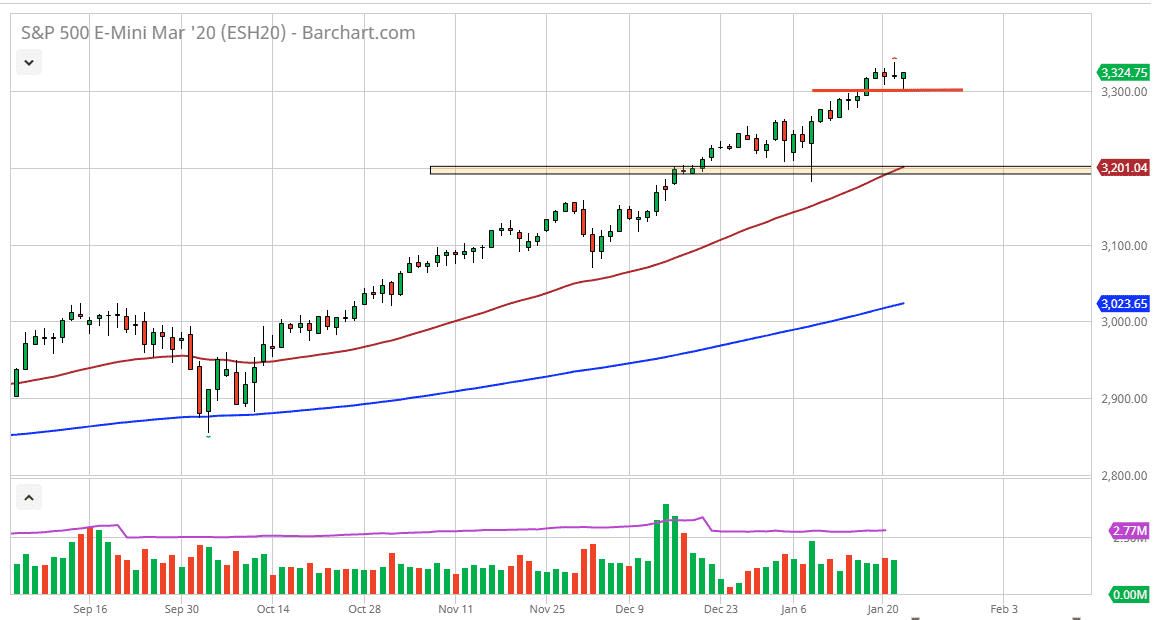

The S&P 500 has pulled back initially during the session on Thursday, as we are trying to form some kind of range for the market to build up the inertia to make fresh, new highs. The S&P 500 has been extraordinarily bullish for quite some time and has moved right along with the balance sheet of the Federal Reserve. The market has been very bullish, but longer-term it’s likely that we will continue to see one of two scenarios going forward: we will either go sideways to build up the inertia, or we will break down a bit in order to find value. The value will be found at the 3200 level as well, and possibly even the 3250 level. Ultimately, I don’t like the idea of trying to short this market as it is so bullish, and I think pullback should be looked at very patiently and with interest as it should give us an opportunity to get the S&P 500 “on the cheap.”

At this point, the market looks likely to continue to reach towards the 3500 level given enough time, which is my longer-term target. Ultimately though, this is a market that should target that, but quite frankly it may get there sooner than anticipated. Either way, I like the idea of buying dips and I don’t have any interest in shorting regardless of what happens unless there is some type of drastic fundamental change in the world.

We are in the midst of her earnings season, and that of course will have its influence on this market as well, but all things being equal it’s very likely that we will see the Federal Reserve be the biggest issue. The US dollar did rally a bit during the trading session but that probably had more to do with the ECB suggesting that they were going to stay loose for much longer, and that of course brings up the value of the greenback by default. Ultimately, this is a market that offers plenty of opportunities every time we pull back, so having said that I am approaching the markets as such. A strengthening US dollar does tend to work against the stock market, but even as it did do so during the trading session, we turn right back around and went higher anyway. This shows just how strong the market is at this moment in time.