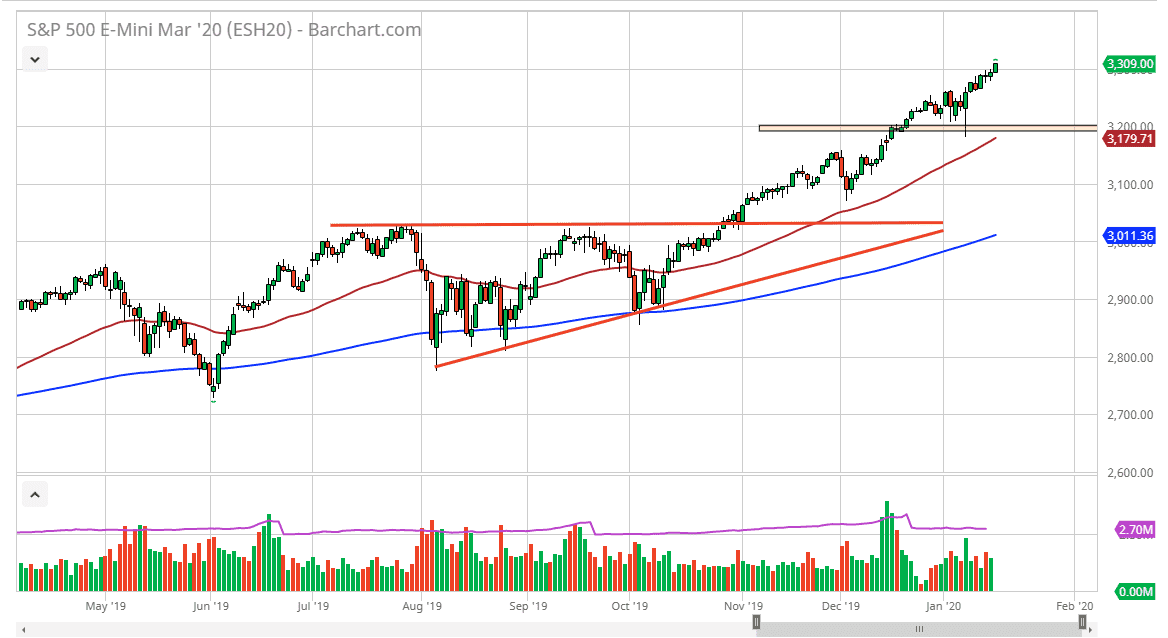

The S&P 500 has rallied quite nicely during the trading session on Thursday, breaking above the psychologically important 3300 level. This of course is a very strong sign and it looks as if the market is ready to continue going higher. We are closing towards the top of the range which is also a good sign, and it looks as if the market is very comfortable rallying from here. Keep in mind that this is the beginning of the year, so a lot of larger money managers will be trying to get involved again. They have to put positions on, and with the strong US economic data during the trading session on Thursday, there is more of an argument to be long of the US stock market in general. Retail sales and unemployment claims both performed very well during the session.

To the downside, I believe that the 3200 level should offer plenty of support as it has in the past, and now that we have the 50 day EMA reaching that level, I think it’s only a matter of time before the value hunters would come back in and get involved in this market. That being said, if we were to break down below there we will probably see a lot of support at the blue 200 day EMA, but I would be a bit surprised to see this market try to get down there.

Value hunters will continue to flood to this market just as they will the other indices in the United States, as there is plenty of strength out there with earnings, but at the same time we have the Federal Reserve more than willing to support the markets going forward as well. At the end of the day, it’s all about what the Federal Reserve does, or in this case doesn’t do, more than anything else when it comes to trading stocks. The advent of massive amounts of passive investing has also put a lot of upward pressure on the S&P 500. In fact, a lot can be said about the fact how these indices are built to go higher, not lower. It is because of this that all things being equal, pullbacks will be thought of as buying opportunities and quite frankly for the last 12 years that has for the most part always been correct. I believe that the market is now going to look towards the 3350 handle.