The S&P 500 has done very little in the electronic markets on Monday, which of course isn’t much of a surprise considering that the Americans were celebrating Martin Luther King Jr. Day. Ultimately, the 3300 level underneath is a potential scenario where buyers would step in based upon the large number, or at least value.

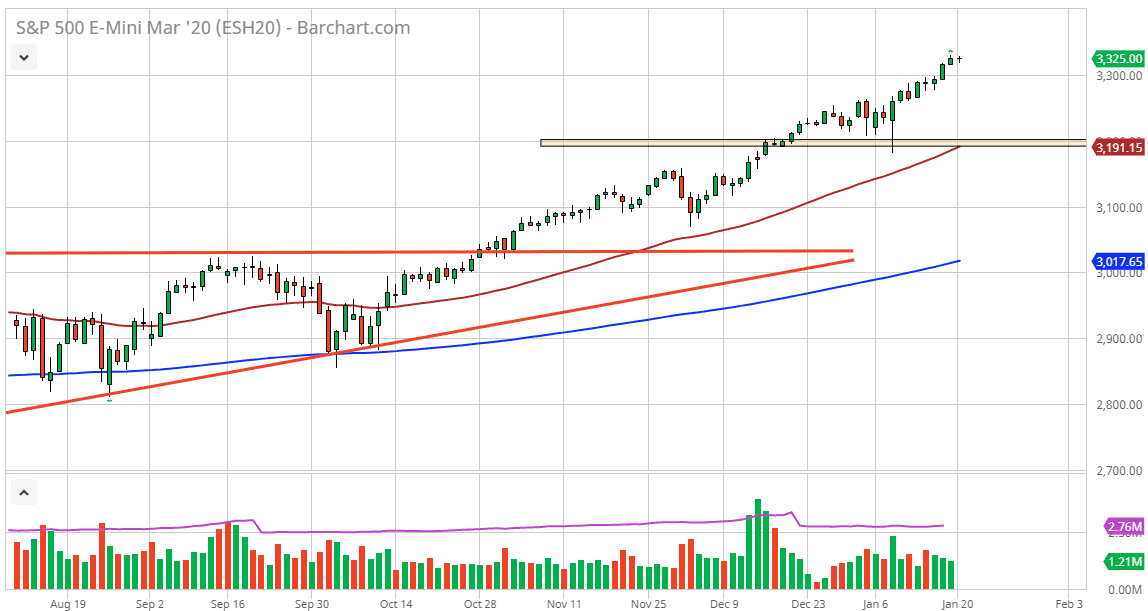

As long as the Federal Reserve is on the sidelines and willing to liquefy the markets, and the most certainly are, I believe that the stock markets will continue to rally. The S&P 500 has rallied right along with the increase in the Federal Reserve balance sheet, something that doesn’t seem to be changing anytime soon, unless of course they start buying more. With this, I like the 3300 level as a buying opportunity, but I also recognize that the 3250 level and the 3200 level as well. The 3200 level also features the 50 day EMA crossing it, so that of course will add more support.

You can’t read anything into the candlestick for the Monday session, but the last couple of days have been relatively positive. I think that will continue to be the case, and as earnings season has been reasonable, markets will focus on that as well. The banks have done quite well, so now the markets have something to hang their hat on so to speak.

On a pullback, I more than willing to jump into this market and take advantage of value, but I also recognize that you may wish to place a trade based upon the daily candlestick more than anything else. If we do continue higher without pulling back, then it’s very likely that the market goes looking towards the 3400 level, and now it appears that the longer-term target is probably the 3500 level.

All things being equal, this is a market that should continue to attract a lot of money, because quite frankly there isn’t much in the way of an alternative. Interest rates continue to be extraordinarily low, and therefore bonds simply don’t pay the type of returns in interest that they once did. Central banks around the world continue to liquefy monetary flow, which of course means that we should continue to see even more of this. Having said that, looking at pullbacks is probably the best way going forward simply because it offers value that the market doesn’t necessarily offer currently.