New Zealand consumer confidence decrease in January, but the Asian region received a necessary positive fundamental boost out of China in the form of an upside surprise in its non-manufacturing PMI. Concerns are growing over the rising spread and death toll of the coronavirus, but the NZD/USD was able to stabilize inside of its support zone. New Zealand’s tourism industry will be hard-hit, but demand for soft commodities may counter this as China imposed internal restrictions on the movement of animal products to contain the virus. You can learn more about a support zone here.

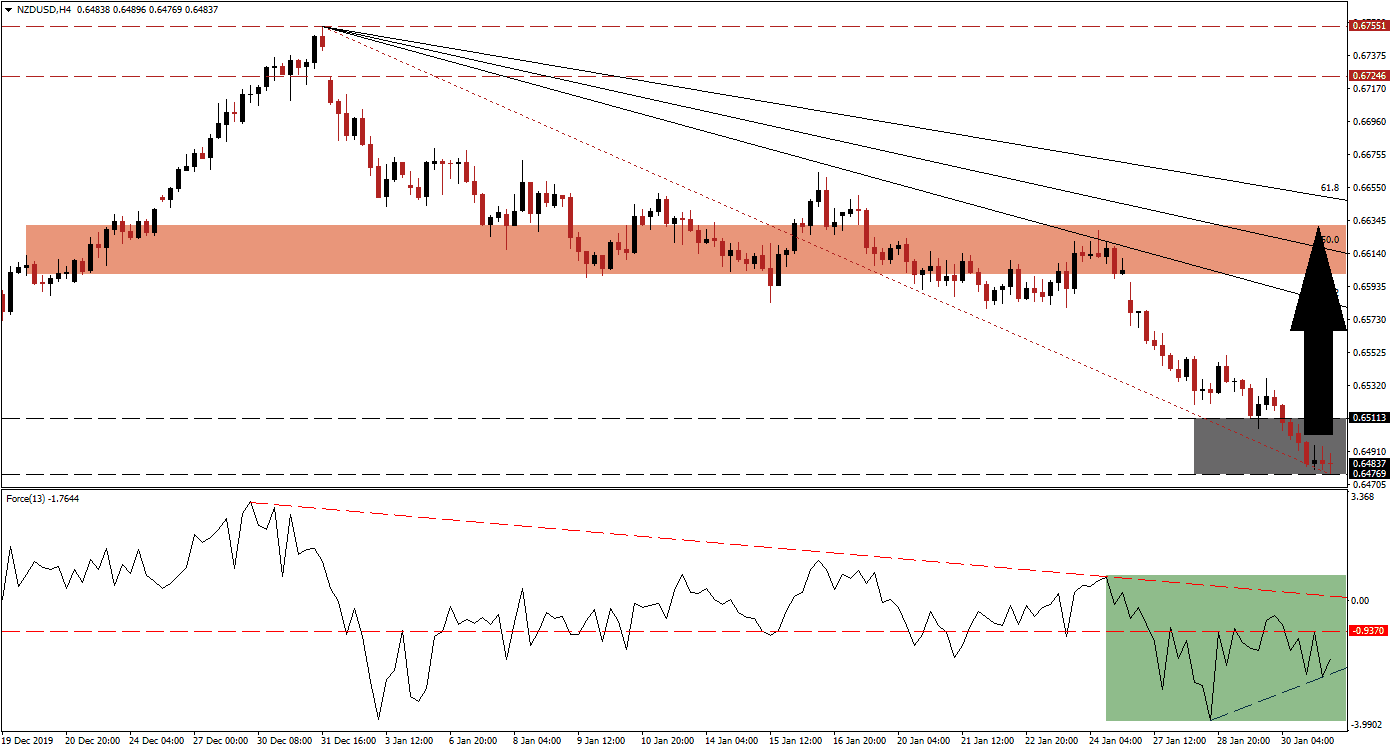

The Force Index, a next-generation technical indicator, suggests that the sell-off in this currency pair is exhausted and ready for a reversal. As the NZD/USD reached its support zone, followed by a fresh multi-week low, the Force Index advanced. A positive divergence formed, and this technical indicator is now being pressured to the upside by its ascending support level, as marked by the green rectangle. This is anticipated to lead to a push above its horizontal resistance level, convert it into support, and elevate the Force Index above its descending resistance level. Bulls will then take control of price action after a move above the 0 center-line.

Adding to bullish developments in the NZD/USD is a move above its Fibonacci Retracement Fan trendline inside of its support zone. This is assisting the momentum recovery and the previous three candlestick formation point towards the start of a bottoming-out process. The support zone is located between 0.64769 and 0.65113, as marked by the grey rectangle. A breakout is expected to initiate a short-covering rally, which will close the gap between this currency pair and its descending 38.2 Fibonacci Retracement Fan Resistance Level.

One key level to monitor after a sustained breakout is the intra-day high of 0.65509, the peak of a previous bounce off of the Fibonacci Retracement Fan trendline that was reversed into a lower low. A move above this mark is favored to initiate the next wave of net buy orders in the NZD/USD, fueling a recovery in this currency pair. Price action will then be clear to challenge its short-term resistance zone located between 0.66011 and 0.66316, as marked by the red rectangle. This will also close a previous price gap to the downside.

NZD/USD Technical Trading Set-Up - Short-Covering Scenario

Long Entry @ 0.64850

Take Profit @ 0.66300

Stop Loss @ 0.64500

Upside Potential: 145 pips

Downside Risk: 35 pips

Risk/Reward Ratio: 4.14

In case of a breakdown in the Force Index below its ascending support level, the NZD/USD is likely to follow suit. Given the long-term bullish outlook for this currency pair, any breakdown attempt is anticipated to be a short-term event, providing Forex traders a better buying opportunity. Price action will face its next support zone between 0.63242 and 0.63585.

NZD/USD Technical Trading Set-Up - Limited Breakdown Scenario

Short Entry @ 0.64300

Take Profit @ 0.63550

Stop Loss @ 0.64600

Downside Potential: 75 pips

Upside Risk: 30 pips

Risk/Reward Ratio: 2.50