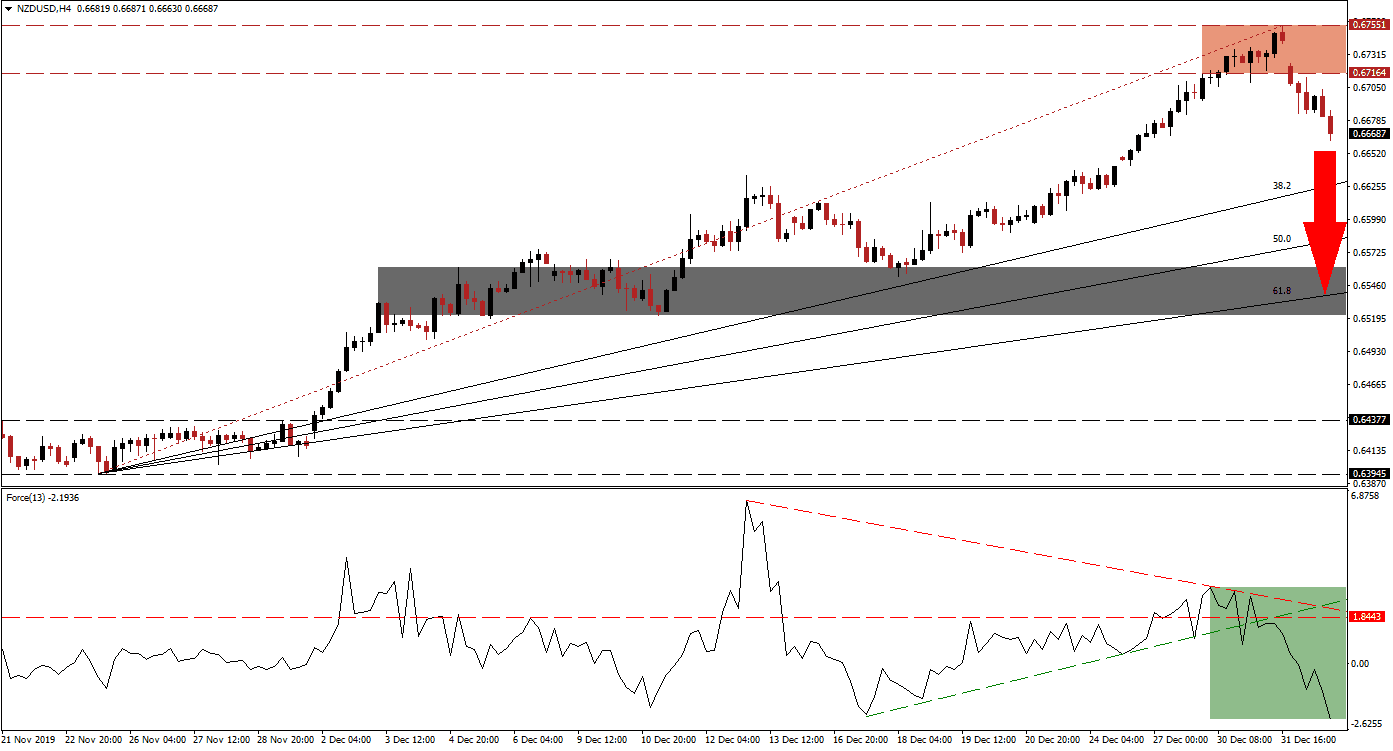

It has been less than 72 hours into the new year, and geopolitical tensions have already spiked. Oil prices surged after the US killed a top Iranian general in Iraq, the US Dollar soared from extreme oversold conditions, and volatility is expected to remain elevated. The NZD/USD completed a breakdown below its resistance zone with a price gap to the downside. Bearish momentum is expanding after the breakdown with more downside anticipated. You can learn more about a price gap here.

The Force Index, a next-generation technical indicator, was initially guided higher by its ascending support level. Following a move above its horizontal resistance level, bullish momentum faded while the NZD/USD entered its resistance zone. A descending resistance level formed and pressured the Force Index into a breakdown. This technical indicator reversed below its ascending support level, turning it into temporary resistance. It also accelerated deeper into negative territory, as marked by the green rectangle, with bears in control of price action.

An early warning sign that the uptrend is due for a minor counter-trend reversal emerged after price action moved below its Fibonacci Retracement Fan trendline, inside of its resistance zone. This zone is located between 0.67164 and 0.67551, as marked by the red rectangle. A profit-taking sell-off is adding downside pressure to the NZD/USD, which should extend its sell-off into its ascending 38.2 Fibonacci Retracement Fan Support Level. This level has supported the advance in this currency pair. You can learn more about a profit-taking sell-off here.

Given the magnitude of the preceding advance, an extension of the breakdown is favored. Price action is expected to descend into its next short-term support zone located between 0.65217 and 0.65610, as marked by the grey rectangle. The 61.8 Fibonacci Retracement Fan Support Level is enforcing this zone and anticipated to end the corrective phase in the NZD/USD. This will keep the long-term uptrend trend intact, and ensure the longevity of it. The fundamental outlook for this currency pair remains increasingly bullish.

NZD/USD Technical Trading Set-Up - Breakdown Extension Scenario

Short Entry @ 0.66650

Take Profit @ 0.65500

Stop Loss @ 0.67000

Downside Potential: 115 pips

Upside Risk: 35 pips

Risk/Reward Ratio: 3.29

In the event of a reversal in the Force Index, leading to a breakout above its descending resistance level, the NZD/USD is expected to push through its resistance zone. Forex traders are advised to monitor price action as it reaches its 38.2 Fibonacci Retracement Fan Support Level, from where a reversal remains a possibility, ending the correction, and extending the long-term bullish trend. A breakout should take this currency pair into its next resistance zone located between 0.68366 and 0.68735.

NZD/USD Technical Trading Set-Up - Breakout Scenario

Long Entry @ 0.67600

Take Profit @ 0.68700

Stop Loss @ 0.67150

Upside Potential: 110 pips

Downside Risk: 45 pips

Risk/Reward Ratio: 2.44