Fourth-quarter consumer prices in New Zealand rose more than anticipated, with the annualized CPI clocking in at 1.9%. Dampening the tone was an unexpected contraction in credit card spending in December, but the NZD/USD was able to bounce off of the top range of its support zone. Bullish momentum continues to build, and negative US economic data is adding another fundamental driver for this currency pair. You can read more about a support zone here.

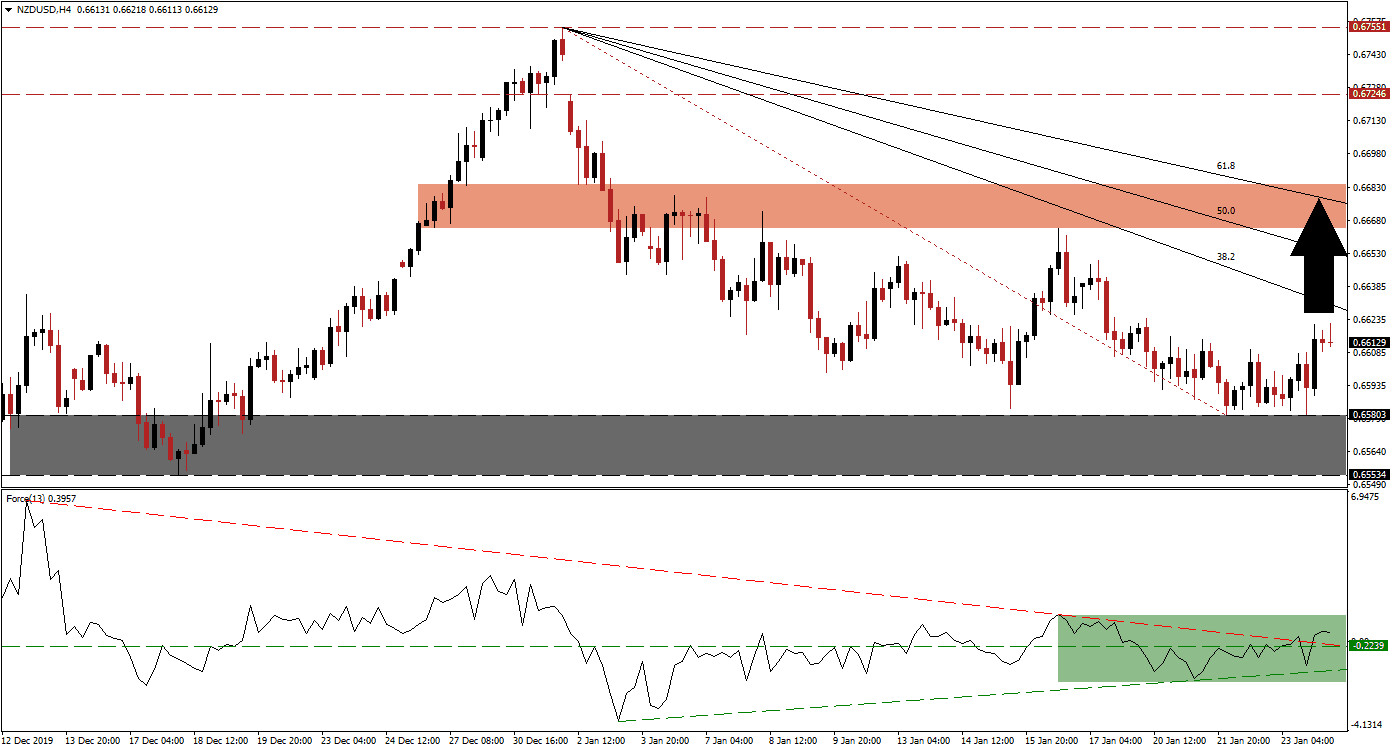

The Force Index, a next-generation technical indicator, points towards the increase in bullish pressures after recorded a higher lower as this currency pair grazed its support zone. An ascending support level emerged, pushing the Force Index above its horizontal resistance level, and converting it into support. This technical indicator additionally crossed above its descending resistance level, which placed it into positive territory, and bulls in charge of the NZD/USD, as marked by the green rectangle.

After price action ended its corrective phase, the Fibonacci Retracement Fan sequence was redrawn to reflect the change in direction. This currency pair moved above the Fibonacci Retracement Fan trendline, adding to bullish developments. It also created a higher low and remained above its support zone located between 0.65534 and 0.65803, as marked by the grey rectangle. The current drift higher is closing the gap between the NZD/USD and its descending 38.2 Fibonacci Retracement Fan Resistance Level.

Forex traders are advised to monitor the intra-day high of 0.66419, the peak before a minor price gap to the upside extended a previous rally. A breakout in this currency pair above this level is anticipated to result in the addition of new net buy orders. This should propel the NZD/USD into its short-term resistance zone located between 0.66646 and 0.66842, as marked by the red rectangle. Another breakout is possible, but a push through its 61.8 Fibonacci Retracement Fan Resistance Level will require a fresh catalyst. You can learn more about a breakout here.

NZD/USD Technical Trading Set-Up - Breakout Extension Scenario

- Long Entry @ 0.66100

- Take Profit @ 0.66800

- Stop Loss @ 0.65900

- Upside Potential: 70 pips

- Downside Risk: 20 pips

- Risk/Reward Ratio: 3.50

In the event of a breakdown in the Force Index below its ascending support level, the NZD/USD is favored to retrace into its support zone. The long-term fundamental outlook for this currency pair remains increasingly bullish with a supporting technical scenario. Any breakdown attempt should be considered a great buying opportunity. Price action will face its next support zone between 0.64652 and 0.65036.

NZD/USD Technical Trading Set-Up - Limited Breakdown Scenario

- Short Entry @ 0.65450

- Take Profit @ 0.64900

- Stop Loss @ 0.65650

- Downside Potential: 55 pips

- Upside Risk: 20 pips

- Risk/Reward Ratio: 2.75