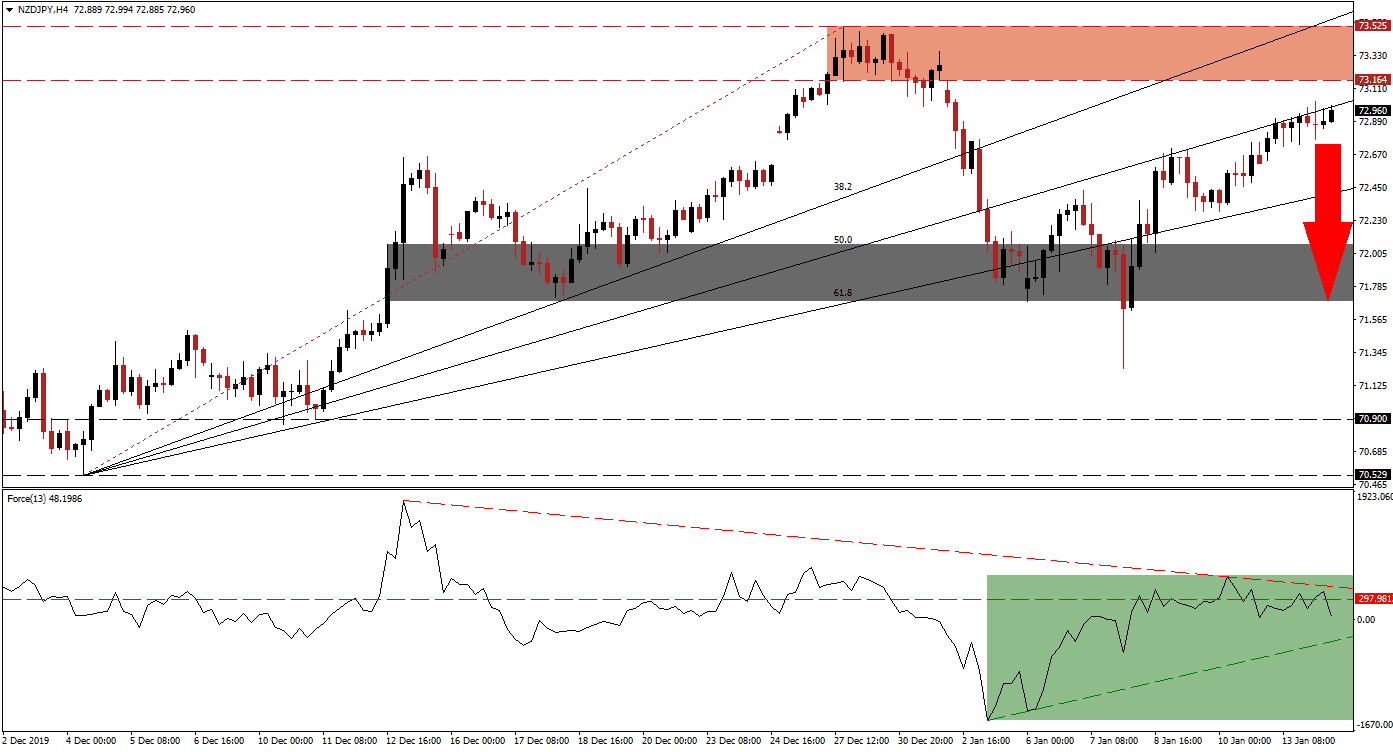

Japan reported a bigger-than-expected current account surplus but posted a surprise trade deficit for December. Bank lending slowed down while bankruptcies increased, and the Eco Watchers Survey came in below expectations in both sub-components. Despite the overall negative economic news flow, the Japanese Yen managed a moderately muted reaction. This safe-haven asset benefits from the elevated tensions and the NZD/JPY failed to push through its ascending 50.0 Fibonacci Retracement Fan Resistance Level.

The Force Index, a next-generation technical indicator, provided an early warning signal that the uptrend is exhausted and vulnerable to a breakdown. As bullish momentum faded, a negative divergence formed. This technical indicator has now converted its horizontal support level into resistance, as marked by the green rectangle. Adding to downside pressure is the descending resistance level. The Force Index is favored to accelerate to the downside, and into negative conditions, placing bears in control of the NZD/JPY. A breakdown below its ascending support level is additionally expected.

With the 38.2 Fibonacci Retracement Fan Resistance Level above the resistance zone located between 73.164 and 73.525, as marked by the red rectangle, breakdown pressures on this currency pair have expanded. Economic data released out of New Zealand showed business confidence contracting, building approvals plunging, and capacity utilization easing. While the long-term outlook remains bullish, a turbulent start to 2020 is likely to keep the pressure on the NZD/JPY. You can learn more about a resistance zone here.

Forex traders are recommended to monitor the intra-day low of 72.723, the low since the advance stalled off of its 50.0 Fibonacci Retracement Fan Resistance Level. A breakdown below this level is anticipated to result in a profit-taking sell-off. This should take price action below its 61.8 Fibonacci Retracement Fan Support Level, and downside pressure should suffice for a push into its next short-term support zone. The NZD/JPY will face this zone between 71.691 and 72.069, as marked by the grey rectangle. You can learn more about a breakdown here.

NZD/JPY Technical Trading Set-Up - Profit-Taking Scenario

Short Entry @ 72.950

Take Profit @ 71.700

Stop Loss @ 73.350

Downside Potential: 125 pips

Upside Risk: 40 pips

Risk/Reward Ratio: 3.13

A breakout in the Force Index above its descending resistance level is favored to pressure the NZD/JPY into a breakout attempt. Elevated geopolitical risks make a sustained breakout unlikely, and a weak Japanese economy fuels safe-haven demand on the back of global growth concerns. Short-term technical developments suggest a sell-off, which will keep the long-term uptrend intact. The next resistance zone is located between 74.245 and 74.584.

NZD/JPY Technical Trading Set-Up - Breakout Scenario

Long Entry @ 73.600

Take Profit @ 74.550

Stop Loss @ 73.250

Upside Potential: 95 pips

Downside Risk: 35 pips

Risk/Reward Ratio: 2.71