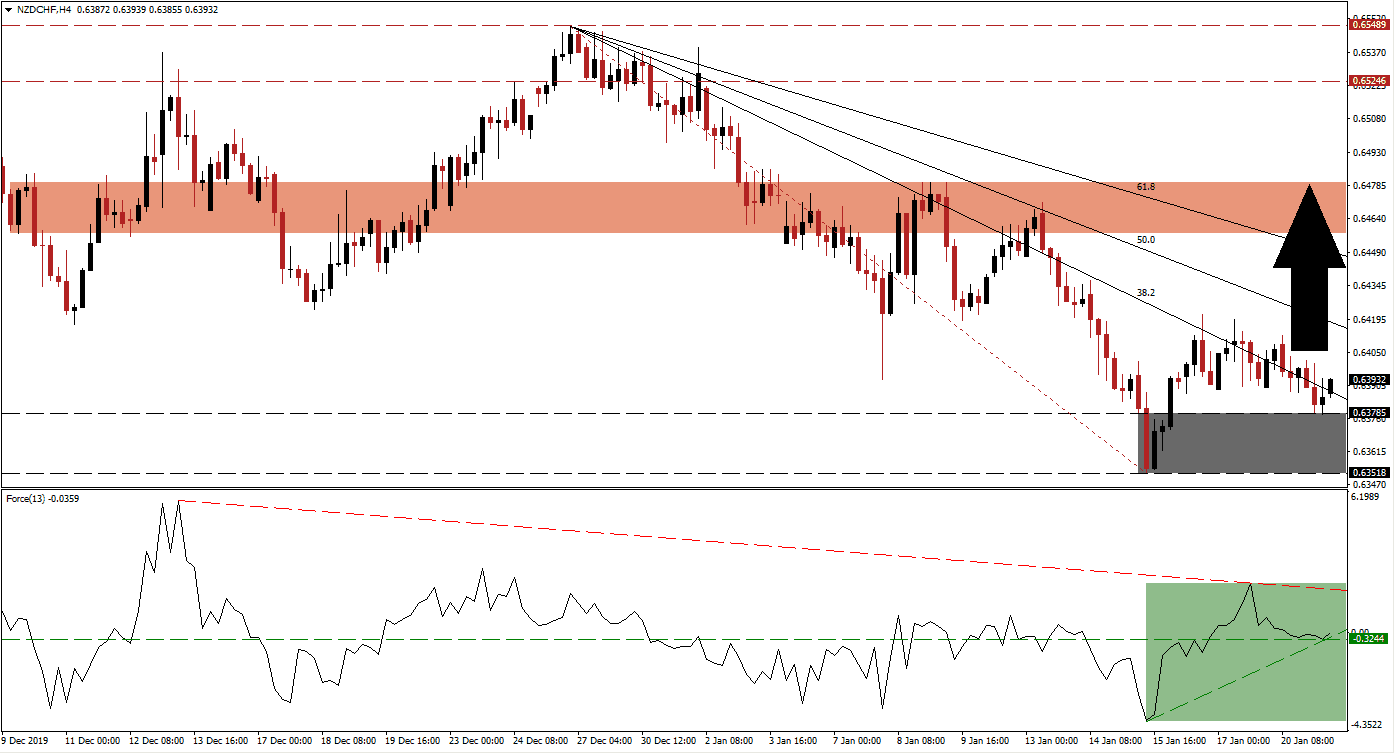

Despite a global economic downgrade for 2020 by the IMF, the Swiss Franc failed to advance on the back of safe-haven demand. This is largely due to the continued market interference by the Swiss National Bank, which landed it back on the US Treasury watch list and one step short of being labeled a currency manipulator. The SNB has manipulated the Swiss Franc more than any other central bank in the G-10. More upside is now expected in the NZD/CHF following the double breakout above its support zone and its descending 38.2 Fibonacci Retracement Fan Resistance Level. You can learn more about a breakout here.

The Force Index, a next-generation technical indicator, retreated from its high but stabilized as it reached its horizontal support level, as marked by the green rectangle. Its ascending support level is anticipated to push the Force Index above the 0 center-line and allow bulls to take charge of price action. A breakout in this technical indicator above its descending resistance level is favored to further advance the NZD/CHF through a breakout sequence into its short-term resistance zone.

Following the first breakout in this currency pair above its support zone located between 0.63518 and 0.63785, as marked by the grey rectangle, price action was rejected by its 38.2 Fibonacci Retracement Fan Resistance Level. This resulted in a higher low, a bullish development, and the second breakout in the NZD/CHF has converted it into support. Switzerland is dependent on its high-quality exports, which is why the SNB wants to keep the Swiss Franc depressed. You can learn more about the Fibonacci Retracement Fan here.

As the global economy continues to struggle, this task will become increasingly more expensive. Swiss bankers and economists who note the long-term negative impacts of the SNB’s monetary policy are growing in numbers. The NZD/CHF is favored to embark on a fresh breakout sequence above its entire Fibonacci Retracement Fan sequence and into its next short-term resistance zone. This zone awaits price action between 0.64575 and 0.64801, as marked by the red rectangle. An extension into its long-term resistance zone between 0.65246 and 0.65489 will require a fresh catalyst.

NZD/CHF Technical Trading Set-Up - Breakout Extension Scenario

Long Entry @ 0.63900

Take Profit @ 0.64800

Stop Loss @ 0.63600

Upside Potential: 90 pips

Downside Risk: 30 pips

Risk/Reward Ratio: 3.00

A breakdown in the Force Index below its ascending support level is anticipated to pressure the NZD/CHF to the downside. With the SNB active in the forex market, the downside potential remains limited to its next support zone. Forex traders should consider any breakdown attempt from current levels as a great buying opportunity. The next support zone is located between 0.62462 and 0.62785.

NZD/CHF Technical Trading Set-Up - Limited Breakdown Scenario

Short Entry @ 0.63350

Take Profit @ 0.62750

Stop Loss @ 0.63600

Downside Potential: 60 pips

Upside Risk: 25 pips

Risk/Reward Ratio: 2.40