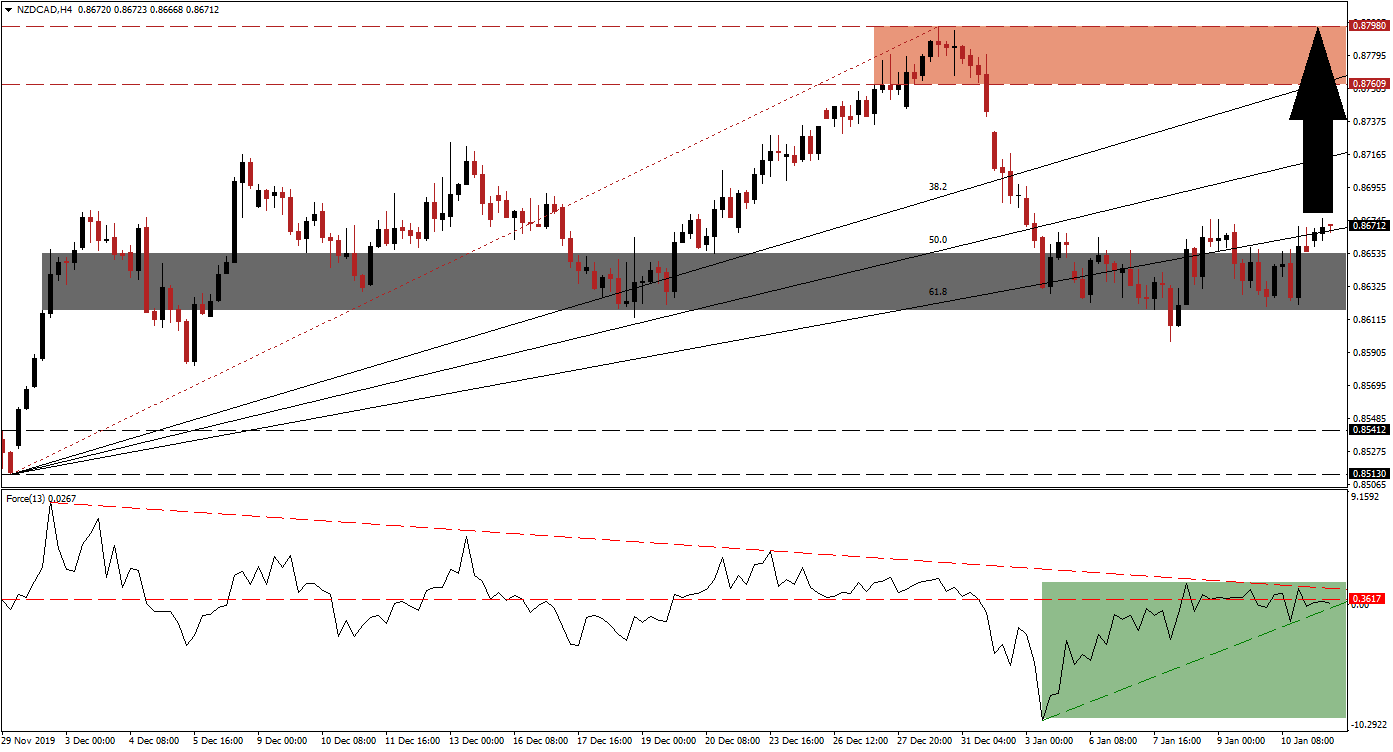

After this currency pair descended into its short-term support zone, the corrective phase ended. The NZD/CAD is now in the process of forming a bottom, from where a new breakout sequence is favored to emerge. As a result of the correction, price action temporarily moved below its ascending 61.8 Fibonacci Retracement Fan Support Level, which has now been reversed, adding to bullish momentum. You can learn more about the Fibonacci Retracement Fan here.

The Force Index, a next-generation technical indicator, confirms the rise in bullish momentum. While the NZD/CAD contracted, the Force Index started to recover. A positive divergence formed following the brief breakdown in price action below its short-term support zone. This technical indicator was able to recover into positive territory, but remains below its horizontal resistance level, as marked by the green rectangle. Its ascending support level is expected to push the Force Index above its descending resistance level, leading to a surge in this currency pair.

Price action completed a breakout above its short-term support zone located between 0.86175 and 0.86539, as marked by the grey rectangle. Adding to bullish developments was the move back above its 61.8 Fibonacci Retracement Fan Support Level. Canadian reports hint at a weaker economy than previously expected at the end of 2019, while the outlook for the New Zealand one remains cautiously bullish. The latest volatility in the NZD/CAD was caused by moves in the commodity market, in response to the spike in US-Iranian tensions. You can learn more about a support zone here.

A short-covering rally is anticipated to follow a breakout above the intra-day high of 0.86750, the peak of its current recovery. This should convert the 50.0 Fibonacci Retracement Fan Resistance Level back into support, clearing the path to the upside. The NZD/CAD is likely to challenge its next resistance zone located between 0.87609 and 0.87980, as marked by the red rectangle. More upside is favored with the 38.2 Fibonacci Retracement Fan Resistance Level crossing through the resistance zone.

NZD/CAD Technical Trading Set-Up - Breakout Extension Scenario

Long Entry @ 0.86700

Take Profit @ 0.87950

Stop Loss @ 0.86350

Upside Potential: 125 pips

Downside Risk: 35 pips

Risk/Reward Ratio: 3.57

Should the Force Index reverse below its ascending support level, the NZD/CAD is may attempt a breakdown below its short-term support zone. Forex traders should consider such a development as a good buying opportunity. The long-term fundamental scenario suggests more upside, enforced by technical developments. The next support zone awaits this currency pair between 0.85130 and 0.85412.

NZD/CAD Technical Trading Set-Up - Limited Breakdown Scenario

Short Entry @ 0.85900

Take Profit @ 0.85150

Stop Loss @ 0.86250

Downside Potential: 75 pips

Upside Risk: 35 pips

Risk/Reward Ratio: 2.14