Commodity demand is depressed as a result of constant new threats to the slowing global economy, like the spreading of a deadly string of coronavirus. This is more evident in mined or extracted hard assets, adding to downside pressure on the Canadian Dollar. Harvested soft commodities are expected to outperform, granting a boost to the New Zealand Dollar. Therefore, the NZD/CAD is anticipated to accelerate to the upside following an imminent breakout.

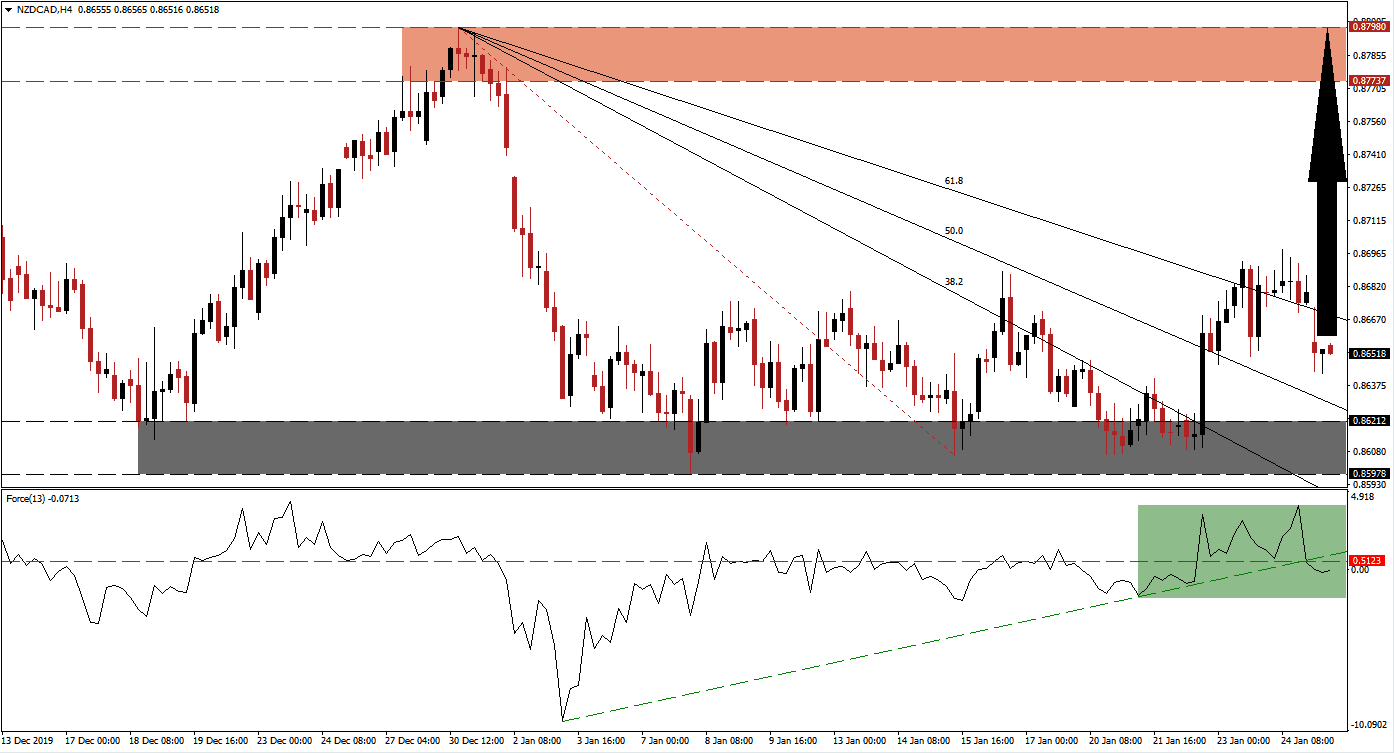

The Force Index, a next-generation technical indicator, shows the overall momentum recovery after price action first reached its support zone. After recording a new multi-week high, as the NZD/CAD pushed higher, the Force Index contracted below its horizontal support level, which turned it into resistance. Bearish momentum sufficed to pressure it below its ascending support level, as marked by the green rectangle. This technical indicator stabilized, and is now expected to complete a double breakout, leading it back above the 0 center-line, and placing bulls in charge of price action.

Following the dip in this currency pair into its support zone located between 0.85978 and 0.86212, as marked by the grey rectangle, a marginally higher low was created. A breakout sequence in the NZD/CAD above its entire Fibonacci Retracement Fan emerged, but price action was unable to maintain it. Another push to the upside is favored, as bullish momentum is recovering. Forex traders are advised to monitor the intra-day high of 0.86983, the peak of the breakout sequence. A move above it should result in the addition of new net buy orders.

A second breakout attempt in the NZD/CAD will close a minor price gap to the downside, before facing a small resistance level provided by its intra-day high of 0.87242. The momentum recovery is likely to result in a bigger advance into its resistance zone located between 0.87737 and 0.87980, as marked by the red rectangle. With the formation of a bullish chart pattern, resulting from a series of higher highs and higher lows, the long-term outlook remains favorable. You can learn more about a resistance zone here.

NZD/CAD Technical Trading Set-Up - Breakout Scenario

Long Entry @ 0.86500

Take Profit @ 0.87950

Stop Loss @ 0.86100

Upside Potential: 145 pips

Downside Risk: 40 pips

Risk/Reward Ratio: 3.63

Should the Force Index fail to recover to the upside, a reverse deeper into negative conditions, the NZD/CAD may attempt a breakdown. This will result in the Fibonacci Retracement Fan sequence guiding this currency pair to the downside. Price action will face its next support zone between 0.84255 and 0.84607. Forex traders are recommended to consider this a good buying opportunity.

NZD/CAD Technical Trading Set-Up - Limited Breakdown Scenario

Short Entry @ 0.85750

Take Profit @ 0.84600

Stop Loss @ 0.86200

Downside Potential: 115 pips

Upside Risk: 45 pips

Risk/Reward Ratio: 2.56