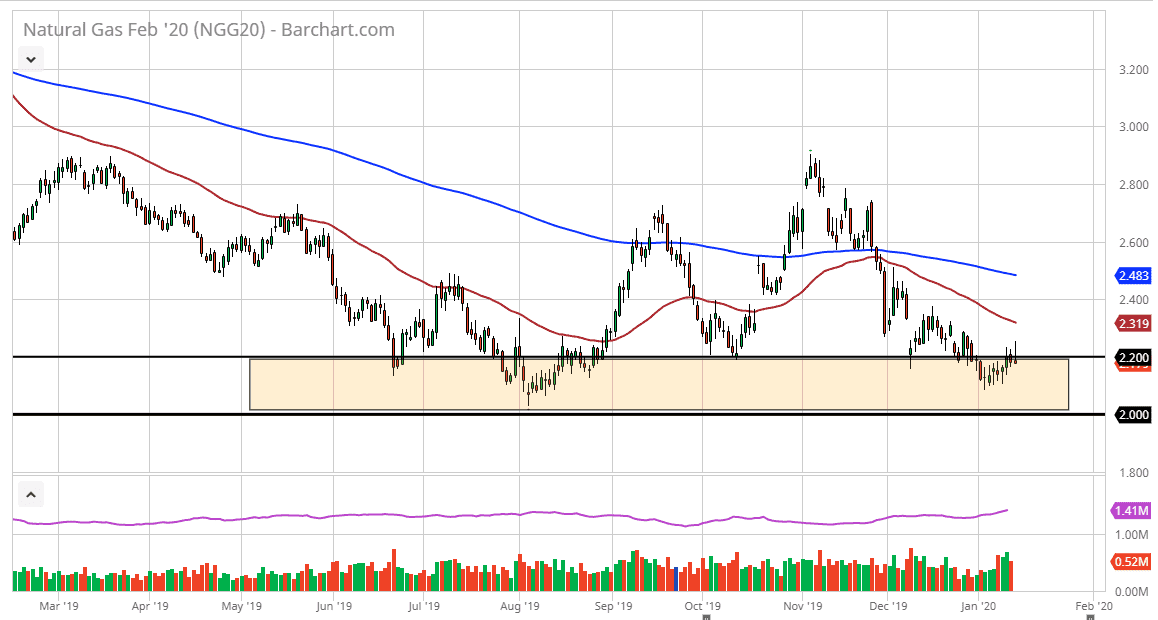

Natural gas markets initially tried to rally during the trading session on Tuesday, breaking above the $2.20 level. At this point, the market looks very likely to continue favor shorting rallies, and the fact that the market could even hang on to the gains for 24 hours tells you just how soft it is. Because of this, it’s difficult to get overly excited about buying this commodity, as there are a whole host of fundamental issues out there that could continue to be a problem.

Natural gas markets do have a significant amount of support extending between the $2.20 level and the $2.00 level, so I don’t think that we breakdown through there easily, but we look as if we are in fact trying to grind through that area. I don’t expect it to happen very soon, but I also recognize that every time this market rallies, sellers are willing to come in and crush it.

Ultimately, looking at the market you can see that the 50 day EMA is currently trading around the $2.32 level, and that’s an area that is rather important when it comes to longer-term charts. I don’t even know if we can break above it, but if we did in the $2.40 level would come into play. Granted, there is only a matter of time before we get some type of winter storm that spikes prices in the next few weeks, but that should end up being a nice selling opportunity. All things being equal, this is a market that I think you should simply wait for signs of strength to run out of momentum. When you get that sign, it’s time to start piling into the downside as the Americans have drilled 17% more in 2019 than they did in 2018, and then of course the temperatures have been warmer than usual. That is essentially a “one-two punch” to the face of the market.

In the meantime, short-term selling is possible but be aware the fact that we will eventually get a snap higher. Having said that, this is a market that is simply one that you cannot trust on rallies at all. Furthermore, it’s not that long before we start trading spring contracts, and it will start to price and even warmer temperatures, driving down demand even further, and then of course prices as a result. I have no interest in buying natural gas anytime soon.