Natural gas markets have gapped lower to kick off the first true trading session of the week, as volume came back into play. That being said, it has reached towards the $1.80 level, which is quite remarkable considering that it was just two months ago that the market was trading near the $2.83 level. There’s really no other way to put it, this winter has been an absolute disaster for the commodity. It is very tempting for traders to try to find a bottom here, and there is a likely bounce coming, but that isn’t something that you should risk being involved in. The inventory figures have not been bullish enough to slice through a significant amount of the oversupply, as the 17% more that has been drilled this past year than the previous year is still weighing upon the market.

We are starting to see credit ratings of some of the largest natural gas producers in the United States get slashed, some even into junk bond territory. That’s a sign that bankruptcies will probably be coming down the road. That’s something that needs to happen because there is so much in the way of supply and the ground that somebody needs to stop drilling. All things being equal, the market should continue to favor the downside even if we do rally. At this point, any massive spike in price should be a nice selling opportunity, because we aren’t that far away from trading spring contracts, as the forward contract right now is February. We are already too far into the wintertime to suspect that we will be able to get rid of the excess supply.

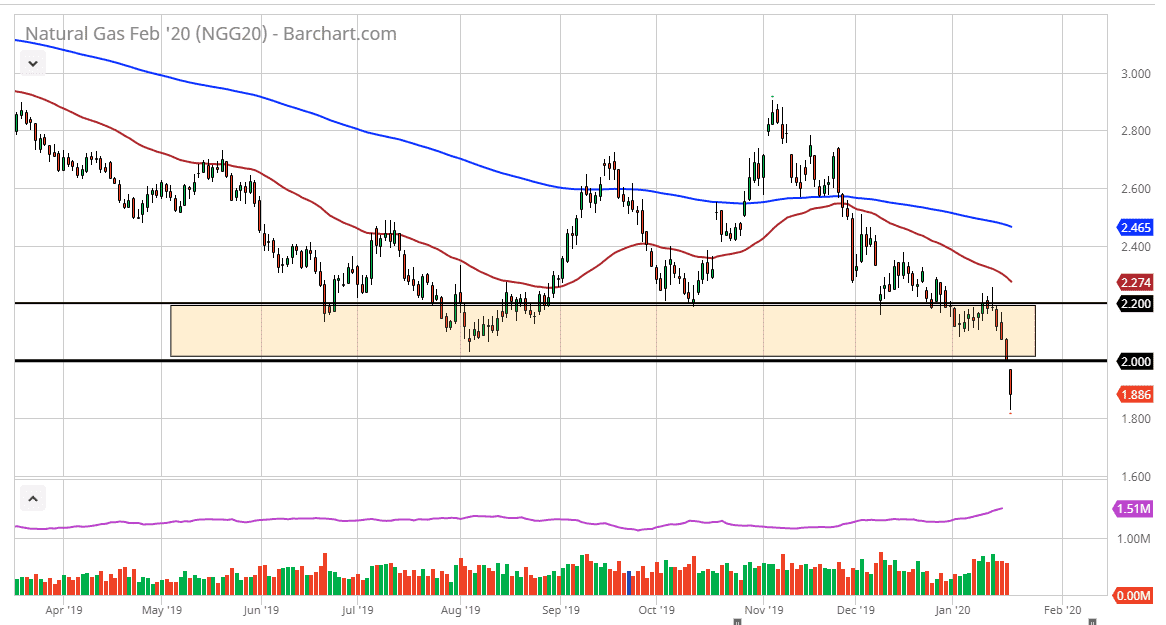

The 50 day EMA is at the top of the most recent attempt at a bounce, and it’s coming lower at this point. The $2.20 level will more than likely offer a bit of resistance due to the structure of the price action anyway, so as the EMA gets closer to that level, it’s likely that the sellers will return. There is a significant amount of noise between that level and the $2.00 level as well, so rallies of course will run out of steam unless something extraordinarily bullish happens in the near term. All things being equal, simply being patient enough to fade rallies that show signs of exhaustion is the best way to go. It has been for months.