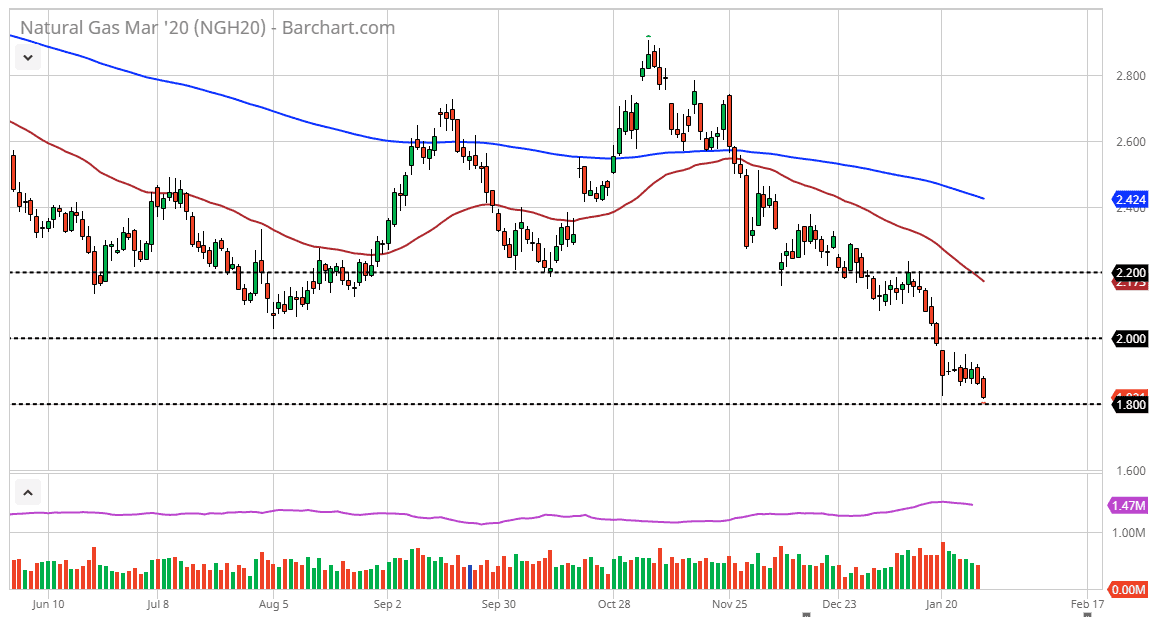

The natural gas markets broke down significantly during the trading session on Thursday as we continue to see a major downtrend. Quite frankly, the market cannot get off of its back at this point, which is a bit surprising considering the time year. However, the oversupply situation continues to be a major issue, so you can see that the sellers come back every time we try to rally. We haven't even really tried to rally lately. I believe that it’s only a matter of time before we try to break below this $1.80 level underneath. That was an area that had been supportive recently, but at this point the question isn’t so much as to what the direction is of the market but given enough time it looks like rallies will continue to be faded. The $2.00 level above is a large, round, psychologically significant figure that will attract a lot of attention as well, so signs of exhaustion near there would be a selling opportunity.

Furthermore, the 50 day EMA will also offer an opportunity to start selling on signs of exhaustion as well, but we obviously haven’t had a bounce to take advantage of. I am much more comfortable fading rallies as they occur, as opposed to trying to sell a breakdown below the $1.80 level, although that is obviously a weak signal as well.

Ultimately, the market continues to punish the natural gas market for the fact that the Americans drilled 17% more this past year than the year before, but bankruptcies are certainly coming. Down the road, natural gas could recover, perhaps later in the year and perhaps even during the “wrong time of the year”, depending on how the timeframe works out. Over the course of time, it still is a very soft market, and as a result the only thing you can do is start fading any signs of exhaustion as we will certainly get some type of bounce later in the winter as soon as we get some type of vicious cold snap in the northern hemisphere. That shot higher will be a nice selling opportunity as soon as we see signs of exhaustion. Unfortunately, even though the market continues to grind lower it’s difficult to get overly aggressive at these historically low levels. Sooner or later, companies are going to go out of business, thereby driving down the supply. We are light years away from that right now though.