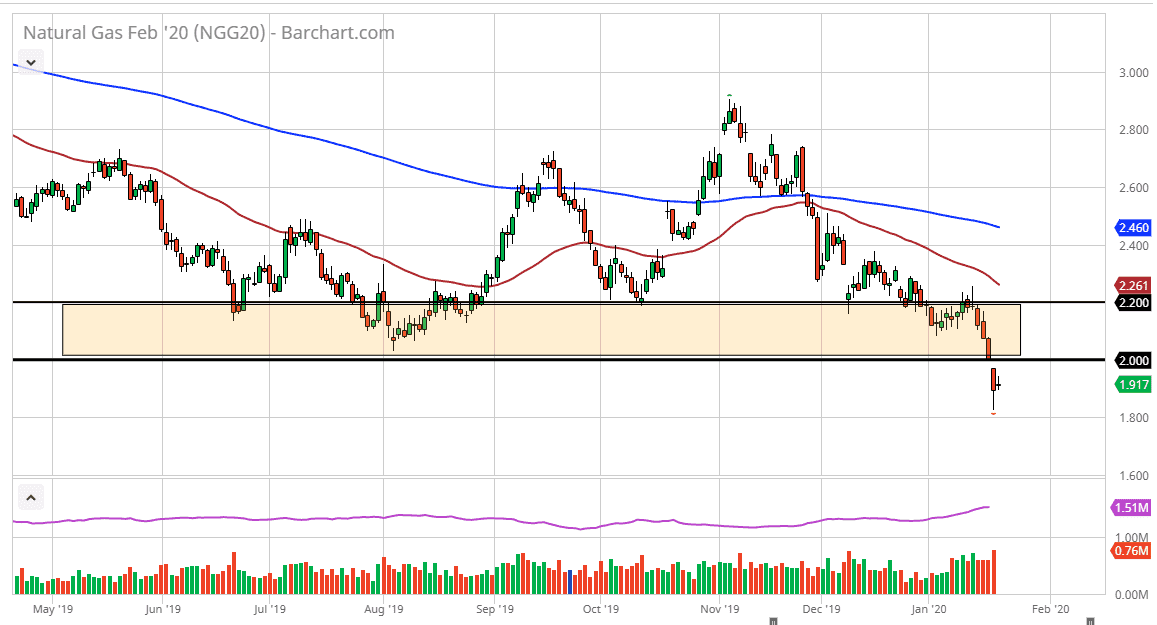

The natural gas markets have gone back and forth during very quiet trading on Wednesday, as we await the next move. We had gapped higher to kick off the session, but then turned around to show a lack of follow-through. The question now is whether or not we can continue that momentum, or will we simply go back and forth? At this point, it’s very interesting to see whether or not the market can really rally at this point, but I think at this point it’s likely that the market needs to at least do some short covering in the meantime in order to take profit in. That being said, I see a lot of trouble above.

A break above here would probably send this market looking towards the $2.00 level initially and test the massive amount of resistance that extends all the way to the $2.20 level. I think at this point it’s very likely that it’s only a matter of time before the sellers come in and push this market back down. It’s difficult to imagine that natural gas could suddenly turnaround considering how brutal this winter has been for the commodity. If it cannot gain at this point in the year, then it certainly cannot gain in spring or summer.

Alternately, if we do break down below the bottom of the candlestick for the trading session on Wednesday, then the market will break the $1.80 level and look towards the $1.75 level next. While it certainly can happen, it is very difficult to sell a breakdown at this point, rather than to sell into rallies as there has been a significant amount of bearish pressure to begin with. At this point, it’s likely that we will see signs of exhaustion as an opportunity, so at this point if it’s only a matter of time before we get one of those. I don’t like fresh selling at this point, because when you get this cheap in a market, eventually you get some type of massive turnaround. At this point, I’m going to step to the sidelines and wait for a nice opportunity to start selling. The 50 day EMA is starting to reach towards the $2.20 level, that should also offer a bit of resistance as well. The market simply cannot seem to pick up and go higher at this point, at least not for any significant amount of time and as the oversupply continues to be a major issue.