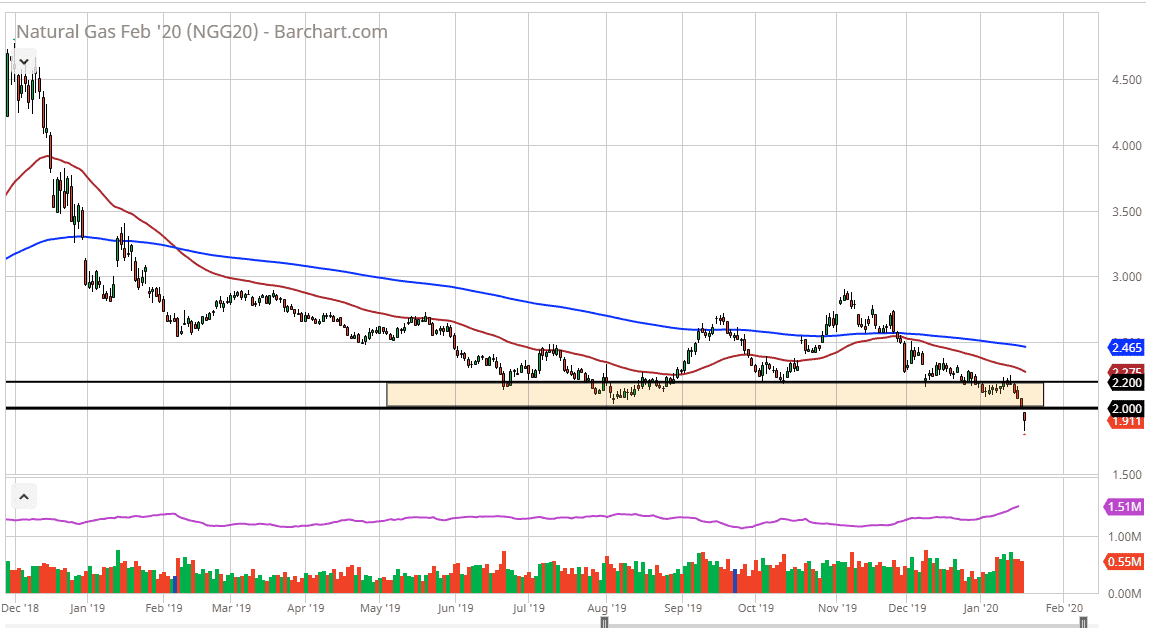

Natural gas markets gapped lower to kick off the trading week, but it should also be noted that the Americans were away for Martin Luther King Jr. holiday, so volume may have been part of the equation. That being the case, the market is likely to continue to look very bearish but based upon the reaction that we have gotten in this market later in the day, I anticipate that we may get a little bit of a “relief rally.”

This is not something to be bought, because quite frankly the one thing that this market has taught us over the last couple of months is that it can’t get up off the floor. In fact, this is a market that probably needs to see a handful of bankruptcies before it can recover. With over 300,000,000,000,000 m³ of known natural gas in the ground, the United States has enough to provide power to the world for several centuries. Canada has even more. As long as we are in the situation natural gas will continue to struggle as there was a huge rush into the marketplace by multiple companies over the last decade or so.

The real trade is going to be short natural gas related companies in the stock markets, but eventually things will calm down. There will be a lot of destruction in the markets as far as the players are concerned, which is probably the best thing that can happen to the commodity. 2020 is going to be a very difficult market to work with, because quite frankly if we cannot wipe out supply in the dead of winter, spring is going to be a nightmare.

Temperatures have snapped in the United States, and are extraordinarily cold in places like New York, Pittsburgh, Columbus, and Chicago. However, prices continue to fall. With the very low temperatures and quite frankly dangerous when chills, if natural gas can’t rally from here, it probably isn’t going to be able to for in any amount of time. I look at a bounce towards the two dollars level as an opportunity to short, and I would definitely be interested in shorting closer to the $2.20 level. With that being the case, the market is very likely to pay attention to the technicals more than anything else, because quite frankly the fundamentals are complete disaster. As someone who lives near a lot of natural gas production, I can tell you that we aren’t running out of it anytime soon.