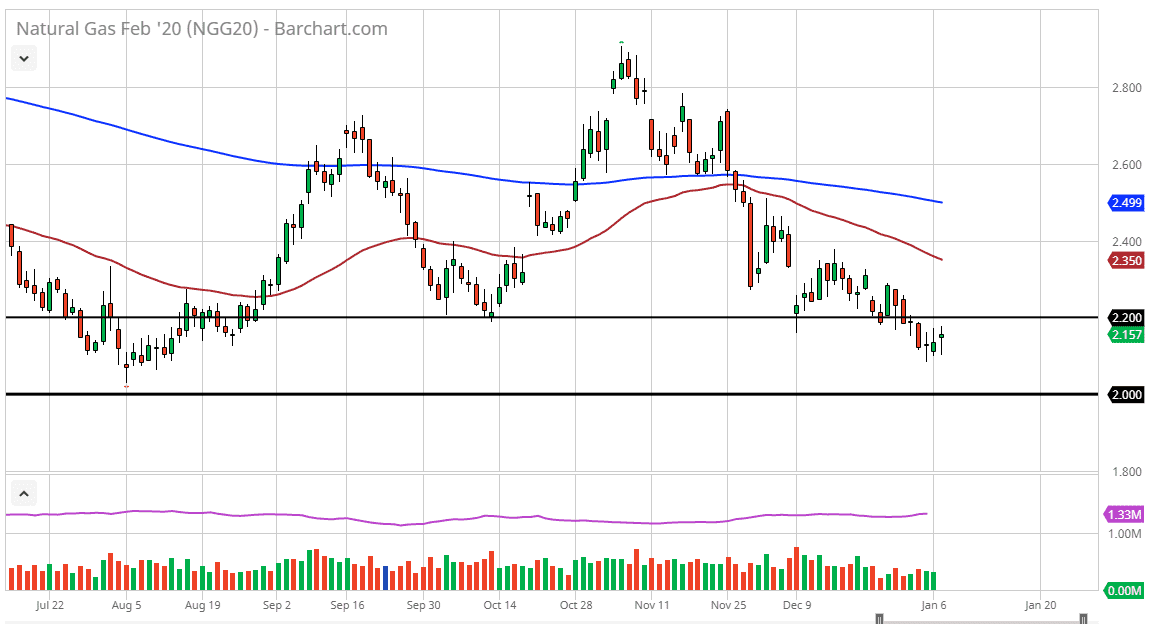

Natural gas markets gapped higher to kick off the trading session on Tuesday, but then fell rather hard to not only fill the gap at break down below it. By the time the day ended though, the market had seen a major turnaround in strength, as the buyers have formed a bit of a hammer during the day. That being said, there is still a significant amount of concern out there when it comes to oversupply as the Americans have drilled 17% more this past year than it did the year before. Ultimately, the market is likely to continue to see a lot of noise, and significant resistance near the $2.20 level. If we can break above that level, then it’s likely that the market goes looking towards the 50 day EMA, which is currently at the $2.35 level.

Keep in mind that if we do break out to the upside, it is a very short term type of opportunity. I think at this point it’s likely that the market will continue to see a lot of choppiness and erratic behavior, but at this point in time I think that it is easier to fade rallies more than anything else. We have not had a massive spike higher this winter, which of course is a cyclical and typically one of the best moneymakers for the year. This tells me that 2020 is going to be horrible for natural gas, as we will be starting from a very low base to begin with. With this in mind, if you are a short-term trader then you can take that little bit of a break to the upside above the $2.20 level, but you need to be out of it relatively quick.

At this point, the market looks likely to find plenty of resistance not only at the 50 day EMA above the $2.40 level again. What’s going to be interesting is to see how 2020 plays out, because quite frankly we have not burned off much in the way of supplies so natural gas will be extraordinarily oversupplied once the warmer temperatures hit the United States and Europe. With this, natural gas is going to continue to suffer, not only in the commodity markets but most certainly the equity markets. The real money might be shorting natural gas related companies in those very same stock markets. We are at extreme low, and certainly seem to be an area where the support zone is still intact extending from $2.20 down to the $2.00 level. Because of this, a bounce would make some sense.