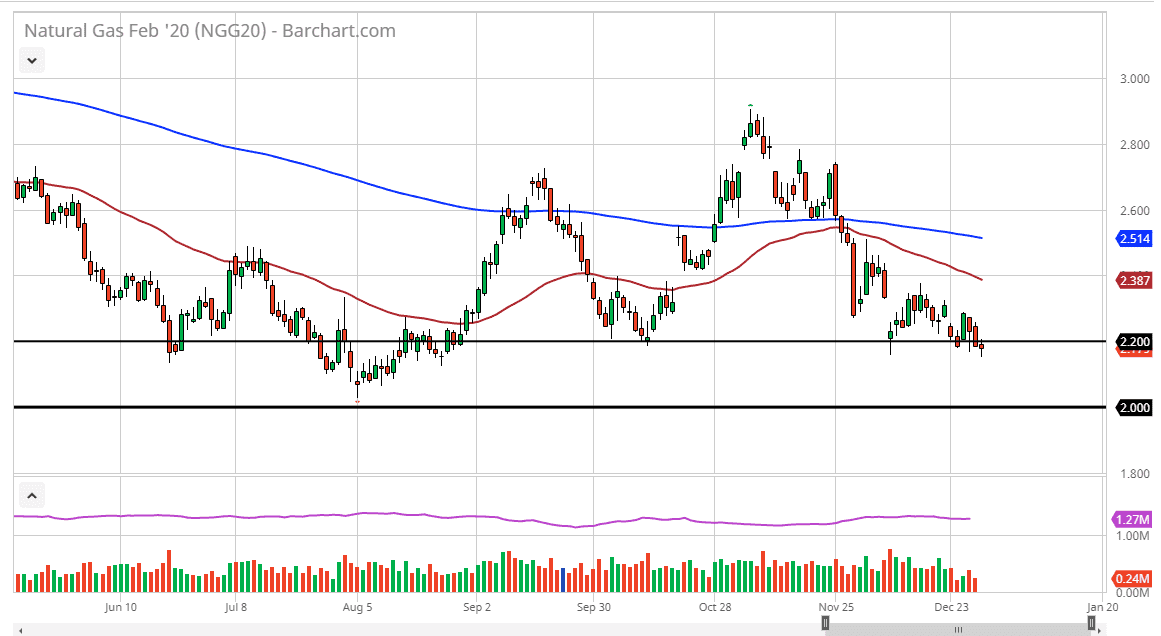

Natural gas markets have initially pulled back during the trading session on Tuesday but have shown quite a bit of resiliency by bouncing and forming a bit of a hammer. Ultimately, this is a market that finds a lot of support between the $2.00 level on the bottom and the $2.20 level on the top. There is a huge amount of support in that general “zone”, so having said that I think it’s likely that we will find buyers given enough time. If we can break above the top of the candlestick for the Tuesday session, I suspect that the short-term bounce is probably more likely than not. The $2.30 level will offer a certain amount of resistance, and for the shorter-term trader that may make a nice target.

To the downside, if we break down below the bottom of the hammer from the trading session on Tuesday, then we will grind towards the $2.00 level. Although I recognize that could very well find the market doing just that, the reality is that it’s going to be difficult to break through all of that noise so I would still be looking for a bounce at these extraordinarily low level. That being said, the easiest trade without a doubt has been fading rallies and I think that will continue to be the case. After all, the Americans have drilled 17% more natural gas this past year than they had the previous year, so it makes sense that supply will continue to be a major issue. Ultimately, the winter hasn’t been as cold as many previous years in the United States and that is not helping the situation.

At this point, I think that a rally would probably be resistance near the 50 day EMA and that could be a nice target be on the $2.30 level. The next moving average to pay attention to would be the 200 day EMA which is closer to the $2.50 level. With that in mind, I don’t have any interest in trying to get cute with this market, I just recognize there might be a short-term buying opportunity before we start selling off yet again. As things stand, 2020 could be a horrific year for natural gas as we simply cannot rally in the coldest months of the year, as supply has overwhelmed the market so drastically.