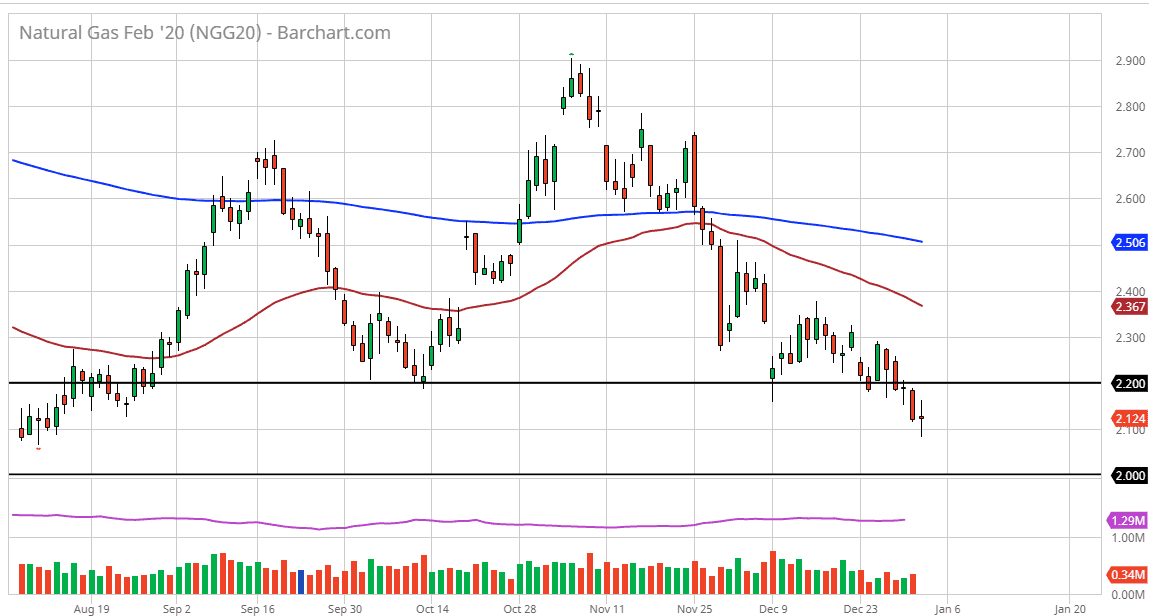

Natural gas markets went back and forth during the trading session on Friday, as we got inventory figure slightly better than anticipated. That being said, the market is in an oversold position and it is likely to get a little bit of a bounce from this general vicinity. We have recently seen the $2.00 level offer support all the way up to the $2.20 level, and as we formed a bit of a neutral candlestick for the trading session on Friday, it does suggest that perhaps the buyers are still here to be found. Nonetheless, that doesn’t mean that this is suddenly a bullish market, but it does perhaps offer short-term buying opportunity on a bounce.

To the upside, if the market was to break out above the $2.20 level, it could go looking towards the $2.30 level after that. This area should bring a lot of selling pressure in, especially if the 50 day EMA continues to slide lower. This is a market that I think will continue to struggle as warmer temperatures in the lower 48 certainly will be helping the scenario. The Americans drilled 17% more this past year than they did the previous year, and therefore it is a major oversupply issue that continues to weigh upon the market on top of the weather situation.

That being said, the market will probably continue to offer selling opportunities on these bounces, so the first time we show signs of exhaustion, there will certainly be sellers jump in and push market back down. This is a market that has no real hope of rallying for a significant amount of time so therefore it’s likely that we will see plenty of reasons to short this market, especially as we get closer to the springtime when the demand will drop off the face of the earth. Low demand, warmer temperatures, and a massive oversupply of natural gas leads to lower pricing. I don’t know that we break below the two dollars level anytime soon, but if we did that would be a horrific sign for the markets. Short-term bounces can be taken advantage of that you will need to be very cautious and nimble when it comes to trading this market if you try to go to the upside. If you are trying to short the market, and simply wait for signs of exhaustion and it will become more or less a waiting game.